Baylin Technologies has triple-digit upside, says Paradigm

It’s stock has shown renewed signs of life in 2016, but Paradigm Capital analyst Daniel Kim thinks there is still a ton of upside left in Baylin Technologies (Baylin Technologies Stock Quote, Chart, News: TSX:BYL).

It’s stock has shown renewed signs of life in 2016, but Paradigm Capital analyst Daniel Kim thinks there is still a ton of upside left in Baylin Technologies (Baylin Technologies Stock Quote, Chart, News: TSX:BYL).

In a research update to clients today, Kim maintained his “Buy” rating and one-year price target of $5.00 on Baylin, implying a return of 139 per cent at the time of publication.

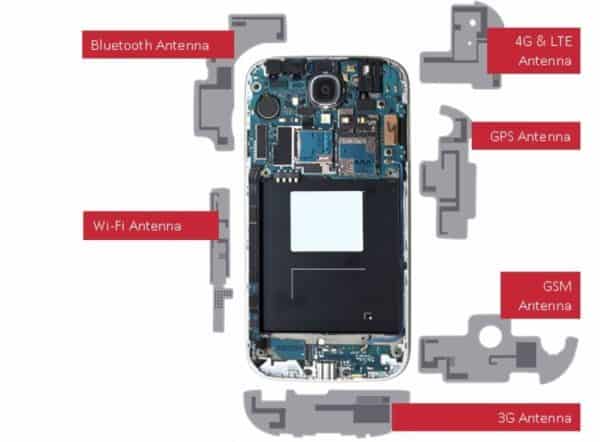

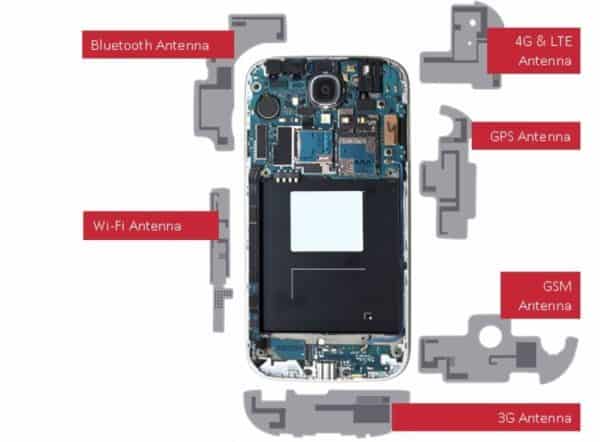

Kim says Baylin is sitting on a total addressable market of $13-billion for its DAS (distributed antenna systems) solutions, which are products designed to help boost cellular and data coverage.

“If we assume $1.00 in content per smartphone, BYL’s global Mobile TAM is ~$1.4B and mobile phone growth has stagnated but BYL’s mobile growth is coming through market share gains,” says the analyst. “In contrast, its Infrastructure division TAM is approximately 10-fold larger at $13B and this end market is growing rapidly between 15–30% CAGR.”

Kim says there are three drivers for Baylin, its DAS and public safety solutions products, the fact that it manufactures its DAS products in Wuxi, China which gives the company access to local players in that market, and the fact that it has already established a foothold with major carriers around the world, such as AT&T, Verizon and Sprint.

“If the company continues to deliver on its growth path, it will begin to generate meaningful EBITDA,” says Kim. “Once the market recognizes this growth strategy, we believe the shares will be meaningfully rerated toward our target price.”

Nick Waddell

Founder of Cantech Letter

Cantech Letter founder and editor Nick Waddell has lived in five Canadian provinces and is proud of his country's often overlooked contributions to the world of science and technology. Waddell takes a regular shift on the Canadian media circuit, making appearances on CTV, CBC and BNN, and contributing to publications such as Canadian Business and Business Insider.