Mitel Network’s Polycom acquisition gets thumbs up at Cormark

A massive acquisition by Mitel Networks (Mitel Stock Quote, Chart, News: TSX:MNW, Nasdaq:MITL) is getting a qualified thumbs up from Cormark analyst Richard Tse.

A massive acquisition by Mitel Networks (Mitel Stock Quote, Chart, News: TSX:MNW, Nasdaq:MITL) is getting a qualified thumbs up from Cormark analyst Richard Tse.

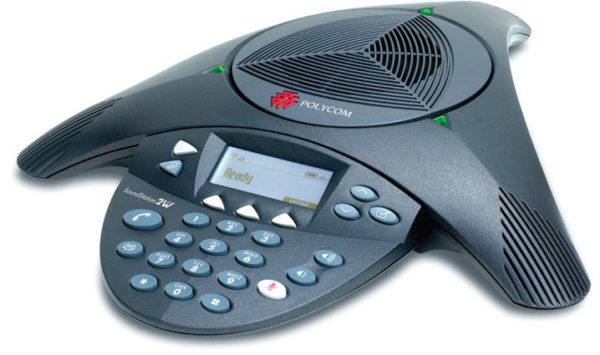

This morning, Mitel announced it had entered into a definitive merger agreement in which it will acquire all of the outstanding shares of San Jose-based video conferencing and workforce collaboration company Polycom for approximately $1.96-billion.

Mitel CEO Rich McBee commented on the deal, which will result in Polycom shareholders owning approximately 60 per cent of the combined company, post-closing.

“Mitel has a simple vision — to provide seamless communications and collaboration to customers,” said McBee. “To bring that vision to life we are methodically putting the puzzle pieces in place to provide a seamless customer experience across any device and any environment.” “Polycom is one of the most respected brands in the world and is synonymous with the high-quality and innovative conference and video capabilities that are now the norm of everyday collaboration. Together with industry-leading voice communications from Mitel, the combined company will have the talent and technology needed to truly deliver integrated solutions to businesses and service providers across enterprise, mobile and cloud environments.”

Tse says the deal is a good one for Mitel shareholders in the long run. He also suspects the Ottawa-based company might not be done on the M&A front.

“In our opinion, we believe the transaction is positive for Mitel,” says the analyst. “That said, the bulk of that initial benefit has gone to the Polycom shareholders. Strategically, the transaction puts Mitel back on the path to industry consolidation after acquiring Mavenir, a (stock) distracting revenue growth focused acquisition. But given what appears to be a course for fairly rapid cost synergies and aggressive de-levering, we think it also makes clear a path to more acquisitions sooner than later.”

In a research update to clients today, Tse maintained his “Buy” rating and one-year price target of (U.S.) $16.00 on MNW.

Nick Waddell

Founder of Cantech Letter

Cantech Letter founder and editor Nick Waddell has lived in five Canadian provinces and is proud of his country's often overlooked contributions to the world of science and technology. Waddell takes a regular shift on the Canadian media circuit, making appearances on CTV, CBC and BNN, and contributing to publications such as Canadian Business and Business Insider.