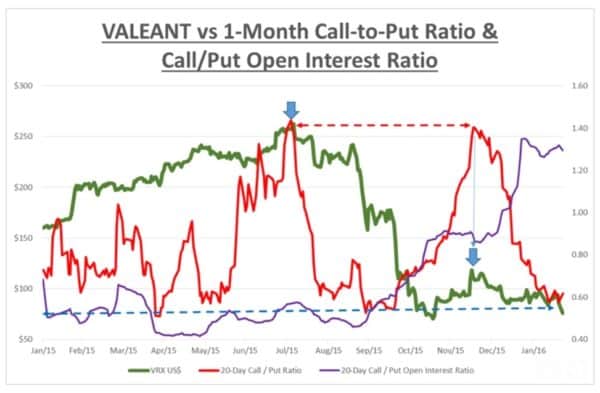

Valeant Pharmaceutical’s 20-day ratio of volume traded in Call options to Put options has fallen from a very optimistic 1.4X in mid-December to a more pessimistic 0.6X currently. Over the past year, similar readings around 0.6X or less has led to rallies in most cases: late April, May & October 2015 & short term stabilization in Sept 2015 before a failure.

Valeant Pharmaceutical’s 20-day ratio of volume traded in Call options to Put options has fallen from a very optimistic 1.4X in mid-December to a more pessimistic 0.6X currently. Over the past year, similar readings around 0.6X or less has led to rallies in most cases: late April, May & October 2015 & short term stabilization in Sept 2015 before a failure.

Paradoxically, since December when the ratio of Calls traded to Puts traded began to decline, the Open Interest in Calls expanded relative to Put open interest. It appears due to Put open interest declining from over 400,000 contracts to around 250,000 contracts, while Call option open interest remained stable around 300,000 contracts.

So while the Call/Put ratio has declined reflecting bearish sentiment, the amount of Put open interest, or supposedly bearish bets, has also declined. Perhaps hedges or short Put positions expired without being rolled into new positions.

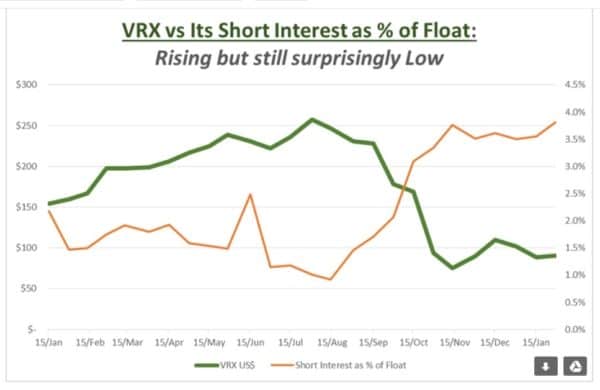

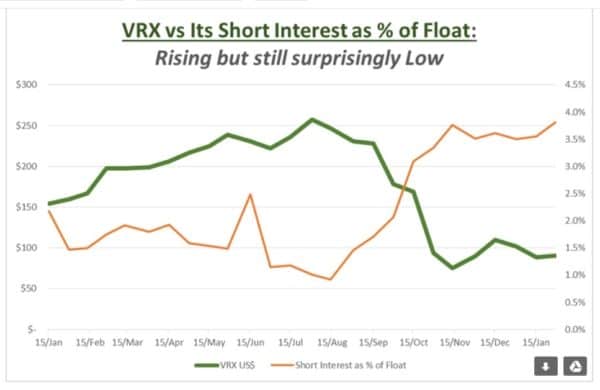

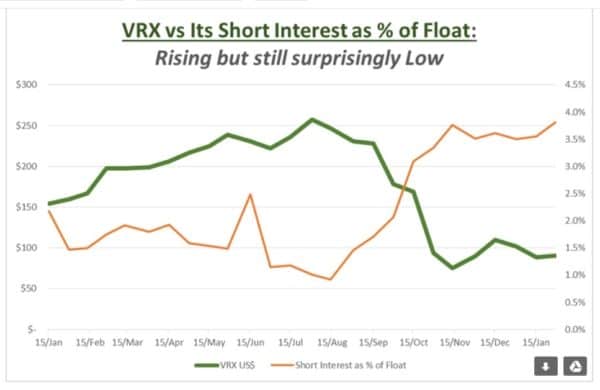

SHORT INTEREST: Since the collapse commenced in August, the short interest has tripled by ~4 million shares to 13 million currently. It seems like a lot. But expressed in terms of percent of float, it has risen from a sanguine 1% to a less sanguine almost 4% of float. A meaningful rise definitely but certainly no crowded short trade.

One would have expected Short Interest to be north of 10% given the headlines and leverage.

And short interest as a percentage of total float is still surprisingly low…

Disclaimer: Cantech Letter is an online magazine focusing on Canadian listed technology stocks on the TSX & TSX-V Exchanges (the “Service”). Cantech Letter is a publication of Cantech Media.

Cantech Media does not represent, warranty, or endorse the accuracy, reliability, completeness or timeliness of any of the information, content, views, opinions, or advertisements contained within or distributed by the Service.

THE SERVICE DOES NOT CONSTITUTE INVESTMENT ADVICE OR ADVOCATE THE PURCHASE OR SALE OF ANY OF THE SECURITIES MENTIONED AS PART OF THE SERVICE.

None of the information contained in the Service constitutes an offer to sell or a solicitation to buy any security of any kind of any issuer.

By using the Service you acknowledge that Cantech Media will not be liable for any direct, indirect, incidental, punitive, or consequential damages of any kind whatsoever which may result from the use of the Service.

Leave a Reply

You must be logged in to post a comment.

Share

Share Tweet

Tweet Share

Share

Comment