Euro Pacific lowers price target on Cipher Pharmaceuticals, maintains buy rating

Euro Pacific Canada analyst Doug Loe says worries about EBITDA compression have him feeling a little less bullish about Cipher Pharmaceuticals (Cipher Pharmaceuticals Stock Quote, Chart, News: TSX:CPH, Nasdaq:CPHR).

Euro Pacific Canada analyst Doug Loe says worries about EBITDA compression have him feeling a little less bullish about Cipher Pharmaceuticals (Cipher Pharmaceuticals Stock Quote, Chart, News: TSX:CPH, Nasdaq:CPHR).

Yesterday, Cipher reported its fourth quarter and fiscal 2015 results. In the fourth quarter, the company earned $2.0-million on revenue of $9.7-million, up 30 per cent over the $7.5-million topline the company posted in the same period last year.

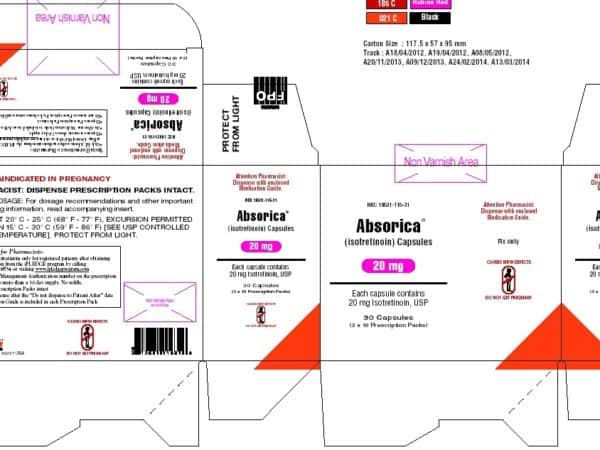

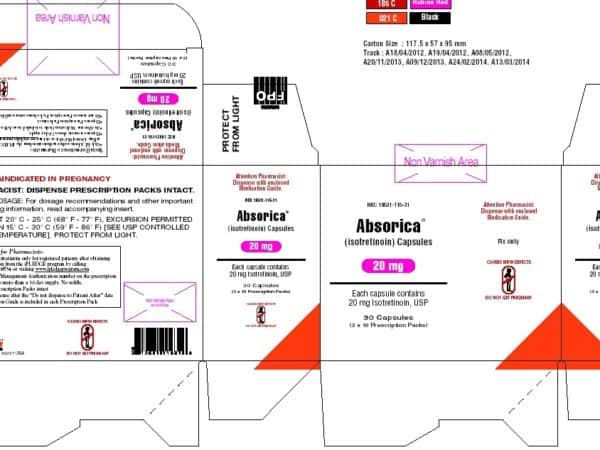

“In 2015 we made major strides to transform Cipher from a royalty business into an integrated dermatology growth company with a solid commercial foundation in the United States and Canada, a portfolio of currently marketed products, and a robust pipeline of late-stage assets to drive organic growth,” said CEO Shawn Patrick O’Brien. “We started 2015 with five revenue streams and entered 2016 with 15 revenue streams and growing. The favourable resolution of the Absorica patent litigation in the fourth quarter provides excellent revenue visibility on this product through 2020. While maintaining positive cash flow from operations, we’re using our strong earnings base and balance sheet to invest significantly in our U.S. products and capabilities to accelerate revenue and drive long-term profitability. As anticipated, this investment affected profitability levels in 2015.”

Loe says that while Cipher’s topline slightly exceeded his expectations, he notes that EBITDA and margin compression continued in the fourth quarter, driven by higher SG&A expenses that he expects will continue for the next few quarters to come. He says he doesn’t anticipate a material lift in EBITDA until sales of the company’s Innocutis product ramps, the company makes an acquisition, or regional licensing deals are infused into its new North America-wide marketing infrastructure.

The analyst says the EBITDA lag isn’t surprising, but he has some suggestions about how the company might achieve a better margin profile quicker.

“Now, there is nothing fundamentally unusual about a firm, even in specialty pharma, that makes investments in sales & marketing infrastructure that lag downstream revenue growth and we were always aware of the investments in Innocutis pipeline promotion that were put in place in FH215 to drive future Sitavig-NuvailBionect sales,” says Loe. “What we would like to see, though, is for Cipher to leverage US sales infrastructure now in place, just as it is (or rather, is about to) in Canada, by adding new commercial dermatology pipeline to its US portfolio at a more aggressive pace than achieved to present day, and our expectation is that the firm can deploy resources in FH116 to pipeline augmentation while product promotion activities are well underway, and well Price funded….Cipher’s existing pipeline, while perhaps excessively well-populated by clinical-stage assets, is already substantial if not expected to be overly impactful on F2016/17 EBITDA, and the stock looks attractively valued to us for its downstream revenue/EBITDA growth prospects just based on its existing portfolio even before considering future dermatology assets that could be acquired with available cash.”

In a research update to clients yesterday, Loe maintained his “Buy” rating on Cipher Pharmaceuticals, but lowered his one-year target price on the stock from (U.S) $13.25 to $10.50, implying a return of 127 per cent at the time of publication.

Nick Waddell

Founder of Cantech Letter

Cantech Letter founder and editor Nick Waddell has lived in five Canadian provinces and is proud of his country's often overlooked contributions to the world of science and technology. Waddell takes a regular shift on the Canadian media circuit, making appearances on CTV, CBC and BNN, and contributing to publications such as Canadian Business and Business Insider.