2014 Cantech Letter TSX Technology Stock of the Year: The Finalists

2014 might remembered as a pause year in the nascent sector rotation from mining and metals to the innovation sectors here in Canada.

2014 might remembered as a pause year in the nascent sector rotation from mining and metals to the innovation sectors here in Canada.

Many expected at least one of Canada’s privco royalty, namely Hootsuite, Desire2Learn, Shopify, Vision Critical or BuildDirect would be public already, injecting new life into the scene. But it was not to be.

Canada did get new technology listings in 2014, but most were in the small to mid-cap range, and many went public through CPCs and RTOs, an increasingly common way to list.

Meanwhile, amongst those already listed, the rich got richer. Many of the top ten performers of 2014 household names to those who have more than a passing interest in Canadian tech stocks.

Below, in alphabetical order, are three stocks our anonymous poll of Canadian sell-side tech analysts revealed to be the best of the best. They are the finalists for 2014 Cantech Letter TSX Technology Stock of Year. You can vote for your favourite below. The winner will be presented the award at the Cantech Letter Awards Gala Dinner, (brought to you by Difference Capital and Wildeboer Dellelce) which follows the Cantech Investment Conference, January 15th at the Toronto Convention Centre.

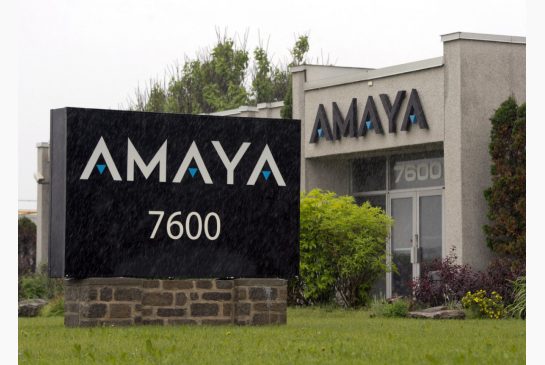

Amaya (Amaya Stock Quote, Chart, News: TSX:AYA)

It’s hard to imagine a more transformative acquisition than the one Amaya made in July, acquiring Oldford Group Ltd., the parent company of Rational Group Ltd., the world’s largest poker business and owner and operator of the PokerStars and Full Tilt Poker, for a whopping $4.9-billion. The deal instantly turned Amaya into the world’s largest publicly traded online gaming company.

BlackBerry (BlackBerry Stock Quote, Chart, News: TSX:BB)

Turns out, fixer John Chen’s autopsy of the BlackBerry corpse revealed that the patient was still breathing. Cormark analyst Richard Tse says Chen’s execution is making the company’s brand meaningful again, especially in enterprise. The analyst says BlackBerry’s “new” subscription-based revenue model has the potential to drive revenue in a way that is greater than one employing traditional system access fees. In a mid-November research update in which he upgraded BlackBerry to a “Buy”, Tse said the days of the market pricing in a risk that the device maker might go under could be in the past. “…we now believe there’s developing going-concern thesis based on a credible road map and momentum for BES12,” said Tse. “Obviously, that will not happen overnight but as far as the stock is concerned, we believe the market is looking to price in a 2-3 year outlook on the name.”

Sierra Wireless (Sierra Wireless Stock Quote, Chart, News: TSX:SW)

Sierra Wireless’s first full year as a M2M pure-play was simply stellar. It was, in fact, so impressive that one noted analyst changed his mind about the company’s prospects. Cormark analyst Richard Tse said Sierra Wireless was one of his favourite names of 2013, but explained that after a strong run in the stock he downgraded it to a “Hold” rating in January. That, said the analyst, was a mistake. Tse says he didn’t take into account the potential for the company’s operating leverage to grow considerably. In a update to clients in early November, Tse said acquisitions and accelerating revenue has the potential to make shares of Sierra Wireless go higher. “Way higher”, he said.

Update: Poll for Cantech Letter TSX Technology Stock of the Year now closed.

Nick Waddell

Founder of Cantech Letter

Cantech Letter founder and editor Nick Waddell has lived in five Canadian provinces and is proud of his country's often overlooked contributions to the world of science and technology. Waddell takes a regular shift on the Canadian media circuit, making appearances on CTV, CBC and BNN, and contributing to publications such as Canadian Business and Business Insider.