2014 Cantech Letter Cleantech Stock of the Year: The Finalists

It was, to put it bluntly, a pretty bland year for cleantechs in Canada. The S&P/TSX Renewable Energy and Clean Technology Index ended pretty much where it began, and as of Friday, December 12th, the index contained just a single stock that had posted a triple digit gain, and that was just barely.

It was, to put it bluntly, a pretty bland year for cleantechs in Canada. The S&P/TSX Renewable Energy and Clean Technology Index ended pretty much where it began, and as of Friday, December 12th, the index contained just a single stock that had posted a triple digit gain, and that was just barely.

A quarter of the way through the year, the story was at least a little different. The global fuel cell stock rally may have been initiated by U.S.-based Plug Power, but the movement had a decidedly Canadian bent, with Vancouver’s Ballard Power and Mississagua’s Hydrogenics soaring on a bullish feeling about hydrogen, which had been essentially dormant since the 1990’s. Both stocks trickled off as the feeling dissipated.

Here, in alphabetical order according to company name, are the three executives our judges, an anonymous poll of sell-side analysts, thought were the three best candidates for 2014 Cantech Letter TSX Cleantech Stock of the Year. You can vote for your favourite at the bottom of the page. The winner will be presented the award at the Cantech Letter Awards Gala Dinner, (brought to you by Difference Capital and Wildeboer Dellelce) which follows the Cantech Investment Conference, January 15th at the Toronto Convention Centre.

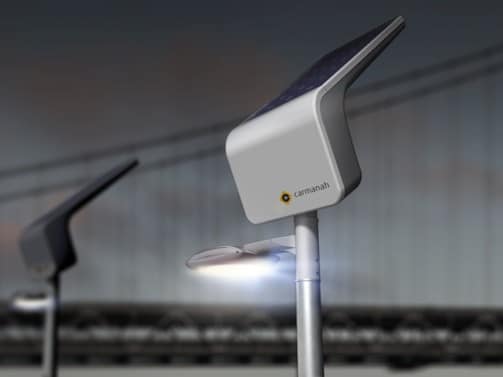

Carmanah Technologies (TSX:CMH)

Carmanah’s up and down history was punctuated by a 2014 that was decidedly up. In mid-November the company reported third quarter results that saw a jump in revenue to $12.2 million from just $4.9-million in the same period last year. “Our positive momentum continued in the third quarter with revenues up 149% compared to 2013’s third quarter,” said CEO John Simmons. “While some of the gain was attributed to the inclusion of revenues from our acquisition of Sol, Inc., our traditional Carmanah revenues were up 105% on a comparative basis. Naturally, we are delighted with the results.”

Catalyst Paper (TSX:CYT)

Richmond, B.C.-based Catalyst Paper posted gains early in 2014 and held on. The company, whose roots go back a century, lost $3.2-million on revenue of $272-million in its recently reported third quarter. Catalyst says that while it expects the specialty printing paper markets will remain challenging for the remainder of the year, declines in demand will be somewhat offset by recent capacity reduction in the market.

DIRTT Environmental Solutions (TSX:DRT)

DIRTT, a newer addition to the TSX Cleantech Index, is a disruptor in a market that has grown stale, says Paradigm Capital analyst Spencer Churchill, who launched coverage of the Calgary-based company in May. Founded in 2004, DIRTT, an acronym for ”Doing It Right This Time”, employs a 3D software platform to design and produce custom prefab interiors. The company compares its product to Lego in that its components connect using a repeated interface, but produce a unique result. DIRTT IPO’d in November of last year after raising $45-million through a syndicate of underwriters that was led by Raymond James and included Canaccord Genuity, National Bank Financial, TD and Cormark.

[polldaddy poll=8539409]

Nick Waddell

Founder of Cantech Letter

Cantech Letter founder and editor Nick Waddell has lived in five Canadian provinces and is proud of his country's often overlooked contributions to the world of science and technology. Waddell takes a regular shift on the Canadian media circuit, making appearances on CTV, CBC and BNN, and contributing to publications such as Canadian Business and Business Insider.