Espial Group falls after Q3 earnings report

Shares of Espial Group (Espial Group Stock Quote, Chart, News: TSX:ESP) are down today after the company released its Q3 earnings yesterday after market close.

Shares of Espial Group (Espial Group Stock Quote, Chart, News: TSX:ESP) are down today after the company released its Q3 earnings yesterday after market close.

The company earned $213,970 on revenue of $5.1-million, up 34% from the $3.8-million topline the company posted in last year’s third quarter. While investors may be expressing disappointment in the showing, the numbers did best at least one analyst’s expectations. Clarus Securities analyst Eyal Ofir expected the company would post adjusted EPS of $0.01 on a topline of $4.5-million. The company posted adjusted EPS of $0.03.

Those looking for a clear negative from the quarter will be hard pressed to find one. In a conference call following the report, the company did say that a previously announced “proof-of-concept” paid trial is no longer moving forward, but also announced that it had entered into another proof-of-concept that will take place through to through mid-2015.

CEO Jaison Dolvane was upbeat about the quarter.

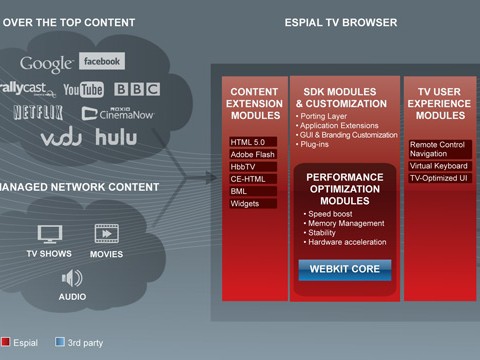

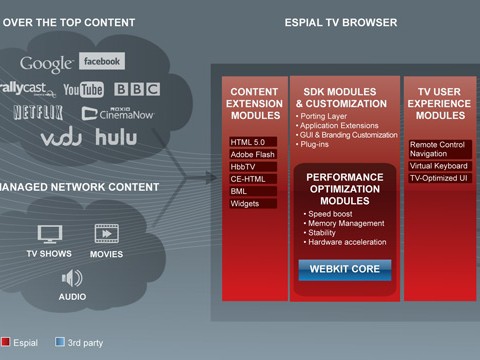

“We are pleased to report record revenue of $5.1-million in the third quarter and strong EBITDA performance. In the third quarter, we continued to innovate and demonstrate leadership around our RDK and HTML5 products. We made good progress this quarter, including showcasing European digital video broadcast (DVB) at IBC, which expands our ability to target European pay TV service providers,” he said. “In the third quarter, we also realized increased revenues from our Tier 1 North American cable customer and from ongoing proof-of-concept projects with service providers. We continue to see growing interest from pay TV service providers in open software solutions, like RDK and HTML5 solutions, for next-generation set-top boxes. We believe our focus and investments in these areas will position us to lead the industry.”

At press time, shares of Espial were down 12.3% to $1.85.

Nick Waddell

Founder of Cantech Letter

Cantech Letter founder and editor Nick Waddell has lived in five Canadian provinces and is proud of his country's often overlooked contributions to the world of science and technology. Waddell takes a regular shift on the Canadian media circuit, making appearances on CTV, CBC and BNN, and contributing to publications such as Canadian Business and Business Insider.