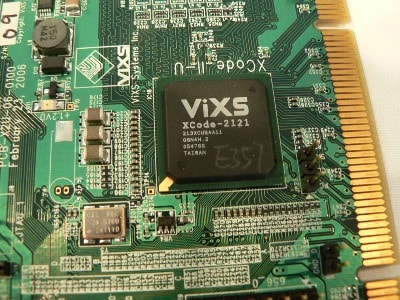

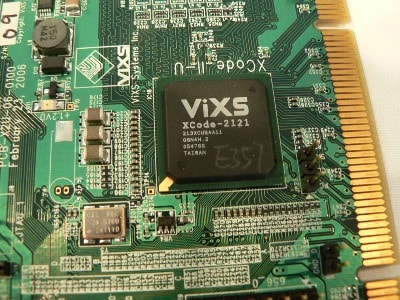

Market adoption of 4K video and HEVC will make for an exciting 2015 for ViXS Systems (TSX:VXS), says Clarus Securities analyst Eyal Ofir.

Market adoption of 4K video and HEVC will make for an exciting 2015 for ViXS Systems (TSX:VXS), says Clarus Securities analyst Eyal Ofir.

Yesterday, ViXS reported its Q2, 2015 results. The company lost (U.S.) $3.78-million on revenue of $9-million, up 11% from the $8.1-million topline the company posted in last year’s second quarter.

“ViXS continues to build momentum with our new XCode6000 family while maintaining robust sales throughout the rest of our product portfolio,” said CEO Sally Daub. “We are demonstrating solid growth sequentially and year over year while keeping our costs in line, clearly demonstrating our market leadership in media processing and monetizing our bet on ultra-HD and HEVC.”

Ofir says the quarter, which beat his expectations on both the top and bottom lines, could be a turning point in momentum for ViXS, which has seen its stock more than halved in 2014. The analyst thinks that major design wins and a key partnership with Intel that will see the pair tackle the cable set-top box market sets 2015 up nicely for the company. He thinks the adoption of 4K video and HEVC are in their infancy and revenue will ramp in 2015 as adoption soars.

Noting that ViXS is now entering a traditionally strong quarter, Ofir thinks the company will exhibit seasonal strength on top of revenue growth from design wins that have piled up over the past year.

In a research update to clients this morning, Ofir maintained his “Buy” recommendation and $3.30 one-year target on ViXS, implying a return of 114.3% at the time of publication.

Leave a Reply

You must be logged in to post a comment.

Share

Share Tweet

Tweet Share

Share

Comment