Industry Insight: Medical Marijuana

Key Takeaways

-Patient enrollment at the current pace may surpass Health Canada projections within 18-24 months

-Near- to mid-term demand projected to be satisfied by current licensees supported by production capacity expansion programs

-Maintain our thesis that a fewer number of larger capacity producers is desired versus many small producers

-Early licensees have significant first mover advantage

Early enrollment data encouraging; 13% MOM from May to August

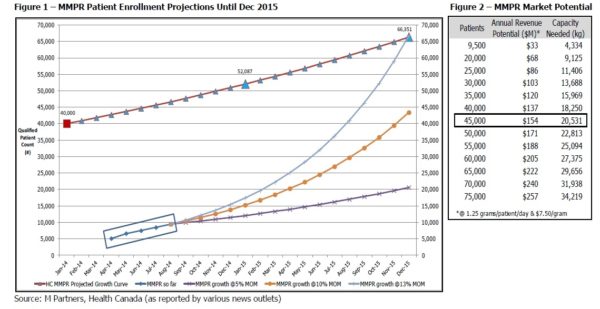

There were 6,600 patients enrolled in the MMPR program as at the end of May. Recent Health Canada data or reports, as reported by various news outlets, shows 9,448 patients enrolled as at the end of August implying a 12%-13% month over month (MOM) growth rate. Figure 1 shows that if MOM enrollment continues as it has since May, the patient population could meet Health Canada projections (interpolated from the Gazette published June 2013) in less than 18 months, by the end of 2015.

We have outlined three scenarios to project patient enrollment based on 5%, 10% and 13% MOM growth rates. If enrollment increases only 10% MOM and the MMPR patient population reaches almost 45,000 by the end of 2015, we estimate the industry could be generating revenue at an estimated annual run rate of $154 million (at 1.25 grams / patient / day and $7.50 / gram).

A ruling on the federal court injunction that delayed the ending of MMAR (the “old system”) is expected in Q1/15, and although this decision will represent a major development of the industry in Canada we should point out that it only applies to holders of the MMAR license. Today every new patient that wishes to obtain medical marijuana (MMJ) has to go through the MMPR program. Health Canada’s projection ( ) for the number of patients in the MMPR program included both MMAR patients switching over and new patients enrolled in the system. Using an admittedly small sample set, early enrollment data shows that the number of patients enrolled under MMPR at the end of 2015 could be greater than the entire number of patients that were enrolled under MMAR.

With ~9,500 patients as of August, we expected the industry to generate an annualized run rate of $33 million; we estimate that at a 10% MOM patient enrollment, the industry could generate 4.5x that amount, or $154 million, by the end of 2015 (Figure 2). With 45,000 patients, an estimated 20,500 kg MMJ (20,500,000 grams MMJ) is needed to satisfy that demand.

Applications continue to be submitted as industry grows

As of January 2014, 400 LP applications had been submitted to Health Canada. That number increased rapidly over the following months to 700 in April and then 900 in July. Over 1,000 applications have now been submitted as of September 2014, yet only 13 licensed producers (LPs) are listed on Health Canada’s website.

Proposed expansion plans of LPs may satisfy the demand

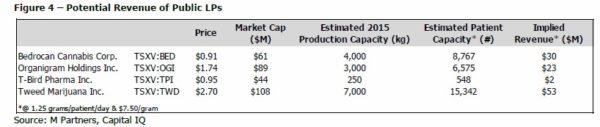

We have used a variety of public sources to outline proposed expansion plans by the following 13 LPs and our projections imply that Health Canada has licensed an adequate number of LPs for now and, as mentioned in previous reports, has slowed the granting process to focus on those already licensed. At first the application process was the main focus for Health Canada but we believe the regulator has now switched to focus on inspection and regulation of the LPs. Three of the four public LPs including Bedrocan (TSXV:BED), Organigram (TSXV:OGI) and Tweed (TSXV:TWD) have planned significant production capacity expansions in the next six months; we have approximated those numbers in Figure 3. If the market grows to 45,000 patients that require a combined total of 20,500 kg of MMJ per year, these three LPs alone could be capable of satisfying 70% of the market. Of the remaining nine LPs, eight of them are currently selling and four of those have expansion plans in place before the end of 2014. We acknowledge that these three big public LPs may not operate at full capacity right out of the gate but when combined with the anticipated expansions of other LPs, we believe that supply should be sufficient to stay ahead of demand.

Figure 3 -Proposed Expansion Plans of Current LPs

Source: M Partners, Company filings, various news outlets

Look for LPs to grow into 2016 valuations as both production capacity and patient enrollment increase

There have been reports in the media around Health Canada not issuing new licenses that has in turn raised questions of potential supply shortages but our analysis shows that the expansion of production capacity by the LPs should be able to handle the expected patient growth. We maintain the view of a low likelihood of many new licenses being granted in the near term and that valuations of existing licenses are a fraction of what they could be in a regulatory environment that allows the introduction of edibles, a direction many of the LPs believe the industry is going. Currently LPs have to dispose and incinerate all plant material except the dried flower (or “bud”), but in an environment with edibles, some of the cannabinoid-containing product that is currently considered waste can be distilled down to an extract and be used in oils, creams, and food products providing potential revenue from starting material costs already built into the business.

Last month a BC court ruled to strike the word “dried” and definition of “dried marijuana” from the regulations to remedy an unconstitutional restriction on patients with the authority to possess MMJ but require other forms of cannabis to treat symptoms of serious illness. However, the lack of evidence-based studies and information on dosing schedules for MMJ has left medical governing bodies such as the Canadian Medical Association unconvinced. We believe that an environment that includes edibles in the form of cannabinoid-containing pills or capsules could provide a product to more accurately standardize, blind and measure for in clinical trials, as well as an alternative method of administering MMJ for physicians that would prescribe it but don’t feel comfortable having their patients smoke.

We estimate that over $100 million in investment dollars has flowed into the LPs in the last 12 months and investors are still anxiously watching the LPs jockey for position. We expect LPs to iron out the kinks of the physical growing segment of the business within 18-24 months (six to eight growing cycles) as they simultaneously navigate a highly regulated environment, manage a patient care business, and build relationships with the physician population and medical governing bodies. The expansion of production capacity coincides with the expected influx of patients as seen by the recently published enrollment data and we reiterate our recommendation that investors identify legitimate licensed producers when looking to play this space.

Disclosure

The particulars contained herein were obtained from sources which we believe to be reliable but are not guaranteed by us and may be incomplete. The opinions expressed are based upon our analysis and interpretation of these particulars and are not to be construed as a solicitation or offer to buy or sell the securities mentioned herein. Disclosure codes are used in accordance with Policy 3400 of IIROC.

Description of Possible Disclosure Codes

1. M Partners or its affiliates collectively beneficially own 1% or more of any class of equity securities of PharmaCan Capital which is the subject of the research report.

2. The analyst or any associate of the analyst responsible for the report or public comment does not hold shares in any of the companies.

3. M Partners or a director or officer of M Partners or any analyst have not provided services to company for remuneration other than normal investment advisory or trade execution services within the preceding 12 months, (may seek compensation for investment banking services from the company herein within the next 3 months).

4. The director, officer, employee or research analyst is an officer, director or employee of PharmaCan Capital, or serves in an advisory capacity to the PharmaCan Capital.

5. The analyst has viewed the material operations of the company. We define material operations as an issuer’s corporate head office and its main production facility or a satellite facility that is representative of the company’s operations.

a) MJN.P – The analyst has viewed the material operations of the company. The analyst visited PharmaCan Capital’s office in Toronto, Ontario in July 2014. No travel costs were covered by the company.

TWD – The analyst has viewed the material operations of the company. The analyst visited Tweed’s facility in Smiths Falls, Ontario in August 2014. No travel costs were covered by the company.

b) None

M Partners provided investment banking services for The Peace Naturals Project, PharmaCan Capital, and Whistler Medical Marijuana Company during the 12 months preceding the publication of the research report

7. The analyst preparing the report has not received compensation based upon M Partners investment banking revenues for this issuer

Daniel Pearlstein

Writer