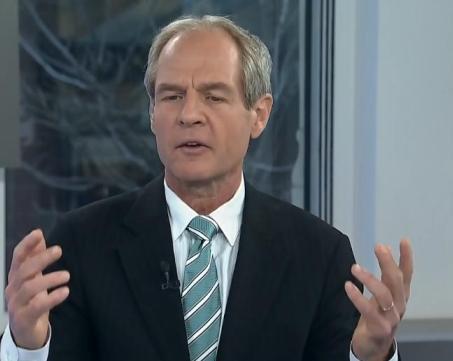

Catamaran is an outstanding long-term investment, says John Zechner

Portfolio manager John Zechner on BNN Tuesday. Catamaran (TSX:CCT) and Google couldn’t be further apart in terms of the corners of the technology space they occupy, but they have one thing in common, says one portfolio manager; they are both outstanding long-term investments.

John Zechner, Chief Investment Officer of J Zechner and Associates was on BNN’s “The Street” Tuesday to talk about his top picks. The portfolio manager says he prefers “stocks that you can buy, put away and hold for a long period of time.”

One such stock, he says, is the Canadian-born, now U.S.-based Catamaran.

Zechner, says he has no worries about the company’s long term viability, but did have some short term concerns because of the slow implementation of “Obamacare” in the U.S . But those were allayed, he says, when the company “blew through” the street’s expectation’s with its most recent quarterly report.

On May 1st, Catamaran reported its Q1, 2014. The company earned $77.34-million on revenue of $4.9-billion, a topline that was up 53% over the same period last year.

Zechner thinks investors should take advantage of the current price of Catamaran’s stock, which he consider to be low.

“The stock has stalled out,” he said. “You’re getting it at under twenty times earnings. This to me a buy and a put away.”

Catamaran, previously known as SXC Health, is the number three Pharmacy Benefits Manager, or PBM in the United States. PBMs are third party administrators of prescription drug programs, and are responsible for processing and paying prescription drug claims. The sector was shaken up early in 2012 when the merger of Express Scripts and Medco got the green light from US antitrust regulators and created a leader that boasted combined revenues of $116-billion, topping the space’s number two, CVS Caremark, which was the result of a merger between the large drugstore chain that was CVS and pharmacy benefits manager Caremark. CVS Caremark is now the second-largest competitor with $107 billion in revenues, and itself the subject of antitrust debate.

Founded in 1993, J Zechner Associates manages over $2 billion in assets.

At press time, shares of Catamaran on the TSX were down 1% to $45.90.

_____________________________________________________________________________________________________________

Nick Waddell

Founder of Cantech Letter

Cantech Letter founder and editor Nick Waddell has lived in five Canadian provinces and is proud of his country's often overlooked contributions to the world of science and technology. Waddell takes a regular shift on the Canadian media circuit, making appearances on CTV, CBC and BNN, and contributing to publications such as Canadian Business and Business Insider.