Where do Canadian Growth Stocks go From Here?

Growth and Operating Company share prices continued to move higher in the first quarter with the Euro Pacific Canada (EPC) Operating Company Index up almost 8% while the EPC Gross Margin Model (“GMM”) Index gained over 12%. This performance follows tremendous runs for our indexes in 2013 – 45% for the EPC Operating Company Index and 104% for the GMM Model Index. Since the beginning of 2012 there hasn’t been a bad time to get into growth stocks.

So, where do we go from here? Let’s take a look at what the numbers say and let’s focus on the broader EPC Operating Company Index. The EPC Operating Company Index is a 250-Company Canadian mid-cap index of operating companies (i.e. no resources, real estate or financials) with an average market capitalization of about $300 million.

Looking at the five year chart above we see that TEV/EBITDA multiples have expanded dramatically over the last five years. EBITDA multiples on the Russell 2000 and the EPC Operating Company Index nearly doubled by early 2013 and then continued to rise. Valuations for the TSX/S&P Composite Index have also expanded recently reaching the highs of the gold fever period of 2009-2011.

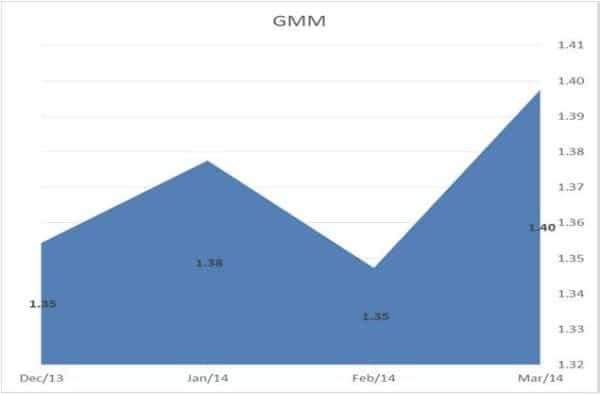

EPC Operating Company gross margin multiples – our proprietary valuation measure for operating growth companies – are also seeing new highs:

Since the end of 2013 we’ve seen an increase in the industry GMM from 1.35 to 1.40. A GMM of 1.40 is at the high end of the historical range – it implies average gross profit growth of 40% over the subsequent twelve month period vs. a very generous current run rate (not seasonally adjusted) of about 20%. Further declines in the USD/CAD exchange rate may very well strengthen CAD growth rates in 2014 – but our model tells us that this is priced in to present valuations and suggests little upside to that measure.

Guidance for 2014

Market performance was driven by a return to growth following the 2008-2010 downturn and an expansion of multiples. We believe that there is little room for multiple expansions left in the broader markets and investors should focus on high quality low gross margin multiple names with cash on the balance sheet.

For the full First Quarter Review Click Here.

_____________________________________________________________________________________

Adam Adamou

Writer