Paradigm’s Barry Richards says smallcap tech will drive the market in 2014

Richards spoke at the Cantech Investment Conference on January 16th at the Metro Toronto Convention Centre and talked about how last year was the year the beleaguered technology sector had been waiting more than a decade for.

“In my mind 2013 was the second best year in the last twenty years,” he said. He pointed out that technology was up nearly 20% in 2013, while the rest of the market was down 9%.

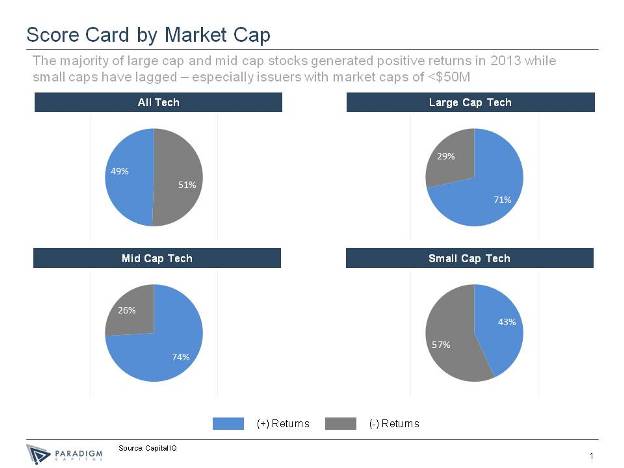

But a drill-down on the technology sector, noted the former analyst turned banker, reveals a surprising trend; more than half of all Canadian tech stocks were actually down last year. 2013, he says was the year of the large and midcap tech stock. 71% of large caps were up, bested by 74% of midcaps. Names like Sierra Wireless, Redknee, Mitel Networks and Avigilon delivered big returns for investors.

The culprit was small cap stocks; 57% of them were actually down last year. But Richards expects momentum will soon trickle down to this asset class in a big way.

“This, in 2014 and 2015, is where I see the best opportunity for some significant returns. This is a sector that has been unloved for some time and really deserves a little more attention,” he said.

Barry Richards full speech from the Cantech Investment Conference is below.

Nick Waddell

Founder of Cantech Letter

Cantech Letter founder and editor Nick Waddell has lived in five Canadian provinces and is proud of his country's often overlooked contributions to the world of science and technology. Waddell takes a regular shift on the Canadian media circuit, making appearances on CTV, CBC and BNN, and contributing to publications such as Canadian Business and Business Insider.