Burnaby’s Tekmira has become a world lead in RNA interference, a process that cells use to silence the activity of specific genes.In the U.S., biotech stocks partied like it was 1999 last year, delivering a spike that was second only to that year’s 102% gain. But Steve Silver, a biotech analyst at S&P Capital IQ, says the long overlooked sector isn’t overvalued.

“The extent to which these companies have gone up this year would suggest that a lot of positive news flow is priced in, but their valuations have not been stretched because the growth prospects have changed significantly with new drug approvals and acquisitions,” he recently said.

So how did the Canadian Life Sciences sector stack up? Turns out, we topped the Americans with a 111% gain, bringing the sector to $53-billion in value. But is there still upside? At least so far in 2014, a lot of investors think so. We count down the ten best performing TSX-listed Life Sciences stocks so far in 2014.

1. Microbix Biosystems (TSX:MBX) +194%

Closing Price December 31st, 2013: $0.165

Closing Price February 18th, 2014: $0.485

On Valentine’s Day, Mississauga-based Microbix, which has developed a range of virology products, reported its Q1 earnings, the company earned $116,161 on revenue of $1.92-million, more than double the meager topline the company posted in the same period last year. CEO Vaughn Embro Pantalony said the company could continue its strong showing. “Our strong first quarter operating results compared with last year, and our consistently strong financial performance in the last two quarters, highlight the significant profitable turnaround that our company has experienced in the past year,” he said. “I am confident that we have established a solid foundation for continued success in 2014.”

2. Tekmira (TSX:TKM) +136%

Closing Price December 31st, 2013: $8.45

Closing Price February 18th, 2014: $19.93

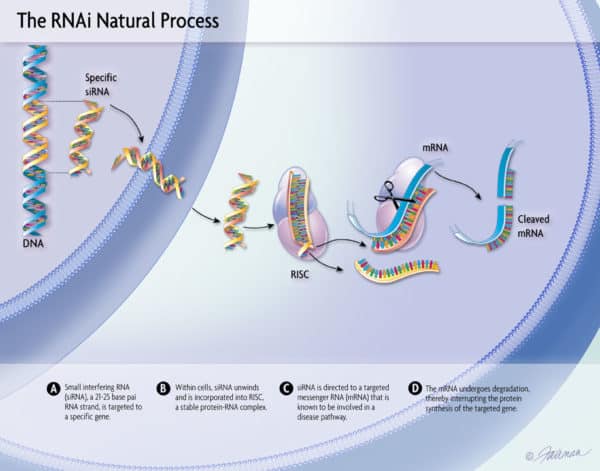

Burnaby based Tekmira, which was founded in 2005, is one of a handful of companies in the world developing therapies based on RNA interference, and the company is clearly an early leader in the space. RNA interference is a process that cells use to silence the activity of specific genes. The process works by blocking the molecular messengers of a a cell, rendering the cell useless. RNAi has already shown great potential with viruses such as HIV and Hepatitis C. Tekmira has three internal RNA interference product candidates; one to treat hypercholesterolemia, or elevated cholesterol, one for Ebola, and an anti-tumour drug in the treatment of cancer.

3. Concordia Healthcare (TSX:CXR) +83.3%

Closing Price December 31st, 2013: $8.00

Closing Price February 18th, 2014: $13.00

Recently public through a CPC transaction in December, Concordia Healthcare, a specialty healthcare player that focuses on orphaned drugs and medical devices, has already paid off early investors handsomely. Management says the recent acquisitions of Pinnacle Biologics, a U.S.-based biopharmaceutical company that specializes in the development of drugs to treat rare diseases, will be a key part of its growth strategy in 2014 an beyond.

4. Adherex Technologies (TSX:AHX) +83%

Closing Price December 31st, 2013: $0.36

Closing Price February 18th, 2014: $0.65

Adherex, which focuses primarily on Cancer therapeutics, shored up its balance sheet to a degree last November with a (U.S.) $1.6-million private placement. Still pre-revenue, the company hopes its lead product, Sodium Thiosulfate, will begin a march that will continue with the five other candidates in its pipeline. The treatment, which is a chemo-protectant against hearing loss associated with platinum-based chemotherapy, is already FDA-approved as an antidote for cyanide poisoning.

5. Trimel Pharmaceuticals (TSX:TRL) +67.5%

Closing Price December 31st, 2013: $.40

Closing Price February 18th, 2014: $.73

After spending the better part of two years in a downtrend, shares of Trimel have perked up in 2014. The Ontario-based company develops medications for male hypogonadism, female sexual dysfunction, and various respiratory disorders. Trimel’s most advanced offering is CompleoTRT, a gel formulation of testosterone that is currently working its way towards FDA approval.

6. Imris (TSX:IM) +62.6%

Closing Price December 31st, 2013: $1.66

Closing Price February 18th, 2014: $2.70

Magnetic resonance equipment manufacturer IMRIS IMRIS was founded in 1998 in order to commercialize research done by MRI pioneer Dr. Garnette Sutherland at the University of Calgary. The company, which now has more than forty patents either issued or pending, designs and manufactures Magnetic Resonance Imaging Systems for use in operating rooms. The company’s VISIUS Surgical Theatre can incorporate MR imaging, CT imaging and x-ray angiography in a number of configurations. While at cost of up to $12 million each, they’re not cheap, but the units do allow an MR or CT scanner to be shared by more than one clinical suite, meaning they can prove to be more economical than current solutions. Imris recently received FDA approval for the latest version of Visius.

7. Cardiome (TSX:COM) +58.9%

Closing Price December 31st, 2013: $6.70

Closing Price February 18th, 2014: $10.65

Vancouver-based cardiovascular therapy specialist Cardiome has been a roller coaster ride for investors, but the company’s stock recently spiked after an independent study showed that the BRINAVESS™ the fourth version of vernakalant, showed a conversion of atrial fibrillation to sinus rhythm in 74% of post cardiac surgery patients with atrial fibrillation.

8. Resverlogix (TSX:RVX) +54.6%

Closing Price December 31st, 2013: $.485

Closing Price February 18th, 2014: $.75

Resverlogix’s name is derived from resveratrol, an antioxidant that is commonly found in plants. In 1997, researchers found that the substance may have cancer chemopreventive activity. A few years later, Donald McCaffrey and Dr. Norman Wong founded Resverlogix around the idea that a paradigm shift was about to happen in the treatment of atherosclerosis that would move thinking away from the reduction of LDL cholesterol to raising HDL cholesterol. Today, the company’s lead offering RVX-208, is getting attention because research in showing that it can create new high density HDL particles which can efficiently remove arterial plaque.

9. Prometic Life Sciences (TSX:PLI) +46.2%

Closing Price December 31st, 2013: $.93

Closing Price February 18th, 2014: $1.36

Investors are increasingly optimistic that PBI-4050, Prometic’s new therapeutic aimed at idiopathic pulmonary fibrosis, is the real deal. Prometic, which is now entering clinical trial stages with the treatment, released new preclinical data at the 2013 European Respiratory Society Annual Congress held in Barcelona late last year that showed it significantly reduced the tissue scarring in the lungs of its animal trial subjects. Founded in 1992, Laval-based ProMetic designs technology that is used to remove pathogens from blood, and extract and recover proteins from plasma. The company has a number of therapeutics and protein technologies that target everything from Chemotherapy-induced anemia, to Cancer related anemia, to its Prion Capture Technology, which enhances detection of “mad cow disease” in cattle.

10. Nuvo Research (TSX:NRI) +41.8%

Closing Price December 31st, 2013: $2.15

Closing Price February 18th, 2014: $3.05

Shares of Nuvo Research caught fire early in January and haven’t looked back. Shareholders of the Mississauga-based company, which has built a portfolio of products for pain treatment, got the news they wanted on January 17th, when PENNSAID 2%, a treatment for osteoarthritis knee pain, received FDA approval.

________________________________________________________________________________________________________________

Comment

One thought on “Canadian Biotech Stocks: The Ten Best Performers So Far in 2014”

Leave a Reply

You must be logged in to post a comment.

Share

Share Tweet

Tweet Share

Share

Resverlogix hot?????