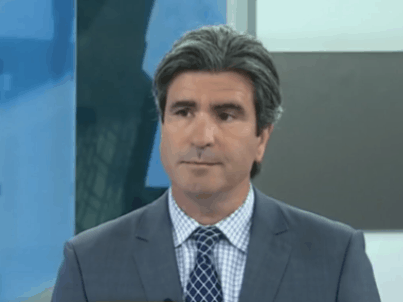

The recent run in small cap Canadian tech has been strong but it’s far from over, says M Partners tech analyst Ron Shuttleworth.

Shuttleworth today released his “Small Cap Tech Q3 2013 Review”, in which he summarized what has happened of late and looked forward to the trends and themes that will dominate the coming months.

Shuttleworth says he was more optimistic entering 2013 than he was the previous year because he felt there would a continuing recovery in U.S. employment that would drive performance for enterprise software because new employees need technology.

He also felt there would be a positive impact for tech because capital budgets are beginning to unfreeze as the influence of Euro crisis and U.S. Congressional brinkmanship were waning.

_____________

This article is brought to you by Virtutone Networks (TSXV:VFX). Click here to learn about one of Canada’s fastest growing telecommunications companies.

______________

Lastly, the M Partners analyst believed that technology procured as a service would become a more prevalent model, and is one that creates more earnings leverage for companies.

Going into 2013, Shuttleworth had six BUY recommendations, three HOLD recommendation and one SELL. Entering Q3, he had eight BUYS, one HOLD and no SELLS.

Buoyed by names such as Redknee, Solium Capital, Mitel and Descartes Systems Group, the M Partners coverage list has returned 29% in the past twelve months. Shuttleworth says a dominant theme is the maturation of the Software-as-a-Service business model, and many more companies in his coverage universe are operating recurring revenue models with success.

Going into Q4, Shuttleworth now has nine BUYS, one HOLD and zero SELLS. He says there continues to be more tailwinds around the companies he covers than headwinds. We are grateful to M Partners that we are able to share with you Shuttleworth’s full report, complete with his current top picks and updated info on the RES30, a broader small cap tech index he maintains that has returned 31% over the past year.

____________

_______________

Leave a Reply

You must be logged in to post a comment.

Share

Share Tweet

Tweet Share

Share

Comment