Don’t expect a big move from BlackBerry this week, says 5i’s Hodson

Even if BlackBerry (BlackBerry Stock Quote, Chart, News: TSX:BB) beats the street later this week, the resulting move from its stock probably won’t amount to much, says one analyst.

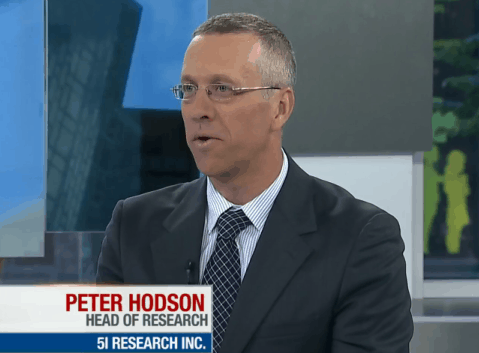

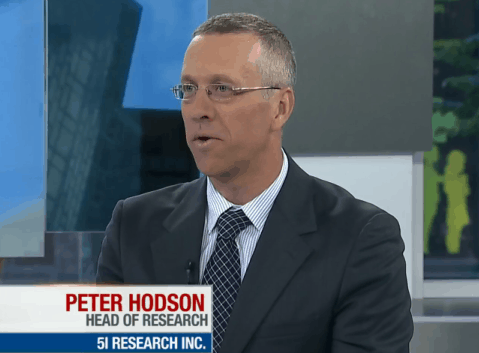

Peter Hodson, Head of Research at 5i Research Inc., was on BNN’s Market Call on Friday with with host Mark Bunting to talk about small and midcap stocks.

Hodson says there “won’t be a whole lot of excitement” around BlackBerry in the next three to six months. He says the company has come back from the dead, and investors have rewarded it for that, but that it now needs to prove itself for the next leg up, which will be more difficult.

He notes that BlackBerry has a good cash position and has returned to competitive form, but the business it has returned to has grown tougher, with more global players.

Hodson says good numbers in the company’s upcoming Q1 might might make BlackBerry’s stock react, but that pop will probably amount to no more than two dollars. The 5i research head says BlackBerry is an “emotional” stock that trades quarter-to-quarter, and that he prefers stocks that are more predictable and have less competition.

Bay Street veteran Hodson founded 5i Research, he says, because he found many firms have compromising conflicts of interest. He notes that because 5i holds no positions in any stocks, and does no business with any either. This, he says, frees the firm to follow any stock they wish purely on their own organic interest.

BlackBerry will report its Q1, 2014 results on Friday, June 28th, before market open. At press time, share of the company on the TSX were up 2.5% to $15.12.

Nick Waddell

Founder of Cantech Letter

Cantech Letter founder and editor Nick Waddell has lived in five Canadian provinces and is proud of his country's often overlooked contributions to the world of science and technology. Waddell takes a regular shift on the Canadian media circuit, making appearances on CTV, CBC and BNN, and contributing to publications such as Canadian Business and Business Insider.