Cormark analyst Richard Tse said the long weekend provided him a little extra time to review BlackBerry’s Q4 and fiscal 2013 results, which were released last Thursday.

Tse says he came away from the extended review with more confidence in the Canadian smartphone maker, and this morning upgraded the stock to “Top Pick” rating. The Cormark analyst has a $20 one-year target price on BlackBerry.

Tse says BlackBerry’s Q4, in which it reported operating EPS of $0.22 on revenue of $2.7-billion, provided continued evidence that the company’s new management team is more than up to the task of successfully transitioning BlackBerry to its new platform.

“In our view, given the hyper competitive market and major internal product transition, we believe the results of the past two quarters have been nothing short of remarkable,” said Tse. “Operating improvements thus far under such extreme challenges give us reason to believe in BlackBerry’s ability to execute on BB10 as having better odds than we originally would have anticipated.”

Tse says BlackBerry has been able to achieve higher margins than most anyone expected from its BlackBerry 10 rollout, and its average-revenue-per-user numbers on its services revenue is also better than anticipated, with the company now predicting just a single-digit decline next quarter.

While Tse notes that BlackBerry saw a dip in the number of subscribers, he also says the company’s revenue model is changing, and it may not be for the worse, as many assume.

He says an increasing proportion of BlackBerry’s gross margin is coming from smartphones, instead of services. Tse thinks BlackBerry can make money this way, pointing to Apple’s high 40s/low 50s gross margins and Samsung’s mid-30s. What’s more, says the Cormark analyst, BlackBerry has an embedded subscription base it can use to leverage beyond its historical services model. He says the market is attributing no value to this advantage, which he thinks may become more relevant in the future.

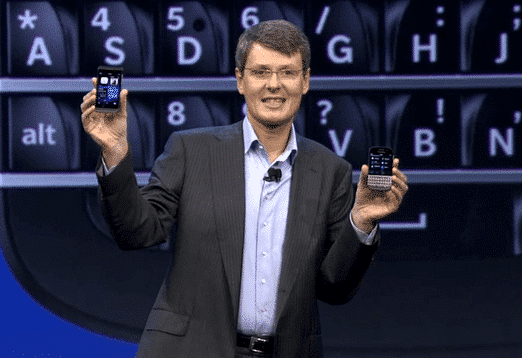

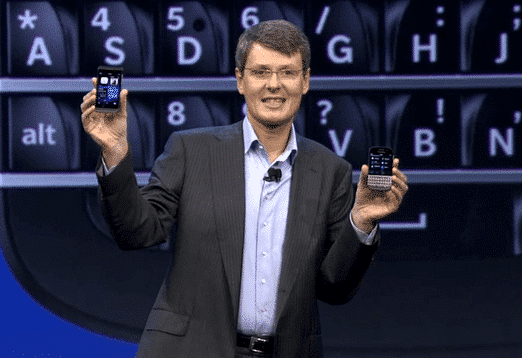

On the BlackBerry 10 rollout, which has many still wondering whether the company can assume the number three spot behind Apple and Samsung, Tse says he thinks the news flow will begin to turn positive as the Q10, the BlackBerry 10 device with the physical keyboard, rolls out in several markets, including the U.S. Noting that half of Z10 sales came from non-BlackBerry platforms, he says BlackBerry now has the best odds to occupy the number three spot in the global smartphone market.

Comment

Leave a Reply

You must be logged in to post a comment.

Share

Share Tweet

Tweet Share

Share

Only $20?

When are these analysts gonna get real? $30-$40 by Christmas! HO HO HO!

Duke, I think double from here is a reasonable TP

The actual share price are usualy the dobble of the analyst price target. Therefore a Christmas price of $40 is realistic.