A close-up of APXS’s sensor head as it undergoes vibration tests at Macdonald Dettwiler in Brampton, Ontario. The sensor head is the part of the instrument that will be placed into contact with Martian samples for analysis on the Mars Curiosity rover. (Credit: MDA) Yesterday, Macdonald Dettwiler (TSX:MDA) announced it had received a request for information from the U.S. Department of Justice in connection with the company’s proposed acquisition of Space Systems/Loral Inc.

The company says the request may be part of the review process under the Hart-Scott-Rodino Antitrust Improvements Act of 1976, and will extend the waiting period imposed by that legislation until thirty days after the company has complied with the second request.

Cormark Securities analyst Richard Tse says yesterday’s announcement clearly adds risk to the pending transaction. While Tse says he viewed the deal as “strategically and financially positive” he says the stock had already reflected that value in the lift it received after the announcement. On June 27th, the day of the press release announcing the deal, shares of Macdonald Dettwiler on the TSX spiked $12.61 to close at $57.25. Since the stock has only fallen slightly in the meantime, and MDA’s other business is facing what Tse calls “sunsetting” contracts, the Cormark analyst’s take on the situation as a whole is essentially neutral. In a research update to clients today, Tse maintained his Market Perform rating and $56 target on Macdonald Dettwiler.

_________________________

This article is brought to you by Zecotek (TSXV:ZMS). Zecotek holds over 50 patents and launched a major U.S. patent infringement lawsuit earlier this year. Click here to learn more.

__________________________

On June 27th, MDA said it would pay (US) $875-million plus cash dividends and other payments from Space Systems/Loral, which the company expected to be in excess of (US) $135-million. Dan Friedmann, MDA’s president and CEO said the transaction, which essentially doubled the size of his company, was “game changing”.

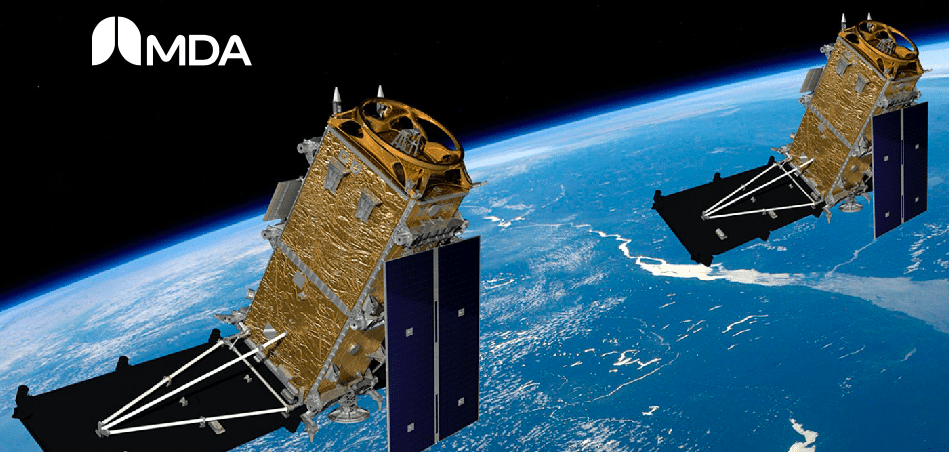

Richmond, BC’s Macdonald Dettwiler was formed in 1969, a pairing of the efforts of John MacDonald and Werner Dettwiler. Since then, MDA has been a part of the fabric of Canadian technology. The Richmond, BC based aerospace giant’s contribution to the Canadarm, a robotic space arm developed in the 1970′s to repair and service NASA space shuttles, is iconic. But the company has, in more recent times, been forced on the rocky road of reinvention. 2010′s revenue of $688 million was barely half of 2007′s. In 2011, however, MDA began to get back to its aerospace roots, which it had briefly been sidetracked from.

The company sold its real-estate information business, which provided property information to insurance companies, lenders, and legal professionals, to US private equity firm TGP Capital. The sale of the unit, which was once thought to be a key to the company’s growth, gave MDA an $819 million shot in the arm, making a large acquisition such as the one announced this past summer, possible.

MDA’s recent activities will be more familiar for those who had followed the company in its halcyon days. The company is the prime contractor for a spectrometer geology instrument called APXS, which allows NASA’s Curiosity rover to calculate the chemical composition of the rocks and soil on Mars.

Tse says MDA is a much cleaner story since the sale of its Information Products division. However, he says, the company faces the risk of a funding gap for RADARSAT, even with a growing commercial pipeline. The Cormark analyst says how well Macdonald Dettwiler converts its backlog will go a long way towards determining its value.

Shares of Macdonald Dettwiler closed today down 5.89% to $50.65.

_________________

__________________

Leave a Reply

You must be logged in to post a comment.

Share

Share Tweet

Tweet Share

Share

Comment