Byron Capital analyst Douglas Loe says Cangene’s new management is successfully leveraging its core assets. On Tuesday, Cangene (TSX:CNJ) announced it had extended an existing contract related to U.S. government biodefence programs.

The company said it had entered into a modification of an existing agreement to expand the scope of work under its contract with the U.S. Department of Health and Human Services for the development and supply of anthrax immune globulin intravenous (AIGIV).

Cangene has worked with US government, supplying anthrax immune globulin (AIG) and vaccinia immune globulin (VIG), since 2002. In 2007, it announced a (US) $143 million contract which was slated to conclude midway through last year.

“We are very pleased to continue our work with the U.S. government on these important programs,” said Cangene CEO John Sedor, adding: “Cangene will continue to pursue opportunities to leverage our core competencies in biodefence while maintaining a focus on our commercial product business and expanding our pipeline.”

Byron Capital Healthcare analyst Douglas Loe says the order from the US government was a “pleasant surprise”. He thinks the company’s new management is leveraging its core assets: “…immune therapy manufacturing capacity and expertise, plasma collection facilities and underutilized U.S. marketing team – to positively impact growth prospects.” In a research update to clients Wednesday, Loe maintained his HOLD rating but raised his price target on Cangene to $1.90 from his previous target of $1.75.

__________________________

This story is brought to you by Agrimarine (TSXV:FSH). Not all salmon farms are the same. Click here to learn how Agrimarine is meeting consumer demand for sustainable aquaculture.

____________________________

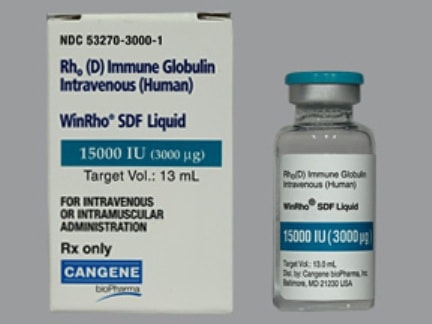

Winnipeg-based Cangene, which is 61% owned by pharma giant Apotex, was founded in 1984. The company is divided into has two divisions: biopharmaceutical operations and contract services. Cangene specializes in in hyperimmunes, contract manufacturing, biopharmaceuticals and biodefense. It operates eight locations across North America and employs more than 550 people in Winnipeg. In 2008, shares of the company spiked on a (US) $505-million (U.S.) contract to deliver botulism and anthrax immunoglobulins to the U.S. government, but have been sliding since.

Loe says this week’s news is not as transformational as the half-billion dollar Biodefense Hyperimmune Contract, but it does raise his top and bottom line estimates. The analyst is still using a 7x EV/F2013 multiple, but his target price is bumped because he now believes Cangene’s fiscal 2013 revenue and EBITDA numbers will of $102.7 million and $13.4 million, respectively, versus his previous estimates of $92.6 million and $10.8 million.

At press time, shares of Cangene were up 4.6% to $1.59.

__________________

____________________

Leave a Reply

You must be logged in to post a comment.

Share

Share Tweet

Tweet Share

Share

Comment