Byron Capital analyst Douglas Loe says investors should not regard the numbers Cangene (Cangene Stock Quote, Chart, News: TSX:CNJ) posted this week as the new norm.

On Wednesday, Cangene reported its Q3, 2013 results. The company earned $3.79-million on revenue of $40.2-million, which compared favourably to the $27.5-million topline the company reported in last year’s Q3.

Loe says Cangene’s Q3 EBITDA was solid, but he expects that the lumpiness in the company’s numbers will continue. He notes that if you exclude the (U.S.) $18.6 million non-recurring milestone payment from the U.S. government on gaining FDA approval for the company’s Botulism Antitoxin (BAT) in March, revenue would have come in at just (U.S.) $21.8-million.

In a research update to clients this morning, Loe maintained his HOLD rating and $2.20 one-year price target on Cangene.

Winnipeg-based Cangene, which is 61% owned by pharma giant Apotex, was founded in 1984. The company is divided into has two divisions: biopharmaceutical operations and contract services. Cangene specializes in in hyperimmunes, contract manufacturing, biopharmaceuticals and biodefense. It operates eight locations across North America and employs more than 550 people in Winnipeg. In 2008, shares of the company spiked on a (US) $505-million (U.S.) contract to deliver botulism and anthrax immunoglobulins to the U.S. government, but have been sliding since.

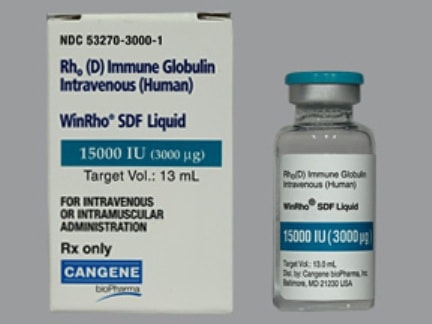

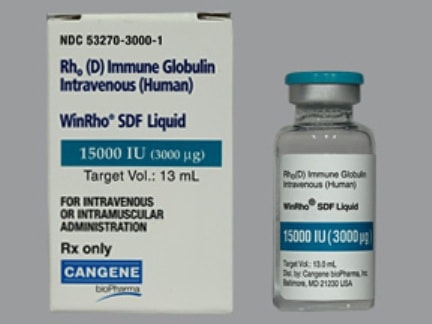

Loe says the visibility on future revenue growth drivers for cangene is still limited, especially in light of recent declines in the company’s flagship product WinRho and hepatitis B treatment HepaGAM B. He says the uncertainty of BAT revenue, which is meant to replace this, makes him cautious.

Shares of CNJ closed today up 1% to $3.

Leave a Reply

You must be logged in to post a comment.

Share

Share Tweet

Tweet Share

Share

Comment