Canadian tech success story SXC Health today announced that following its merger with Catalyst Health, which was approved by shareholders July 3rd, it will be known as Catamaran Corp.SXC Health (TSX:SXC) today announced that following its merger with Catalyst Health, which was approved by shareholders July 3rd, it will be known as Catamaran Corp.

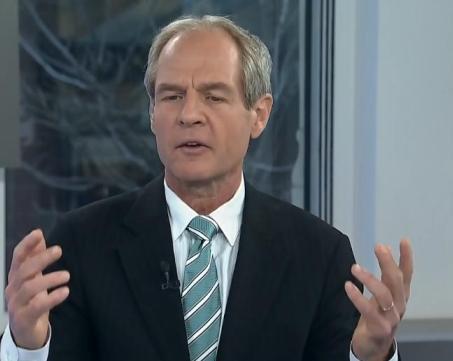

Mark Thierer, CEO of Catamaran said: “Catamaran is the most viable alternative for organizations who are struggling to solve the health care cost challenge, and we’re eager to put our enhanced resources to work for them,” adding: “We have the skill and scale to deliver compelling financial results and the clinical intelligence to deliver sustainable improvements in the health of members.”

Catamaran, when it begins trading tomorrow under the symbol CCT on the Toronto Stock Exchange (the stock will assume the ticker CTRX on the Nasdaq) will begin its life as Canada’s largest tech stock. Both CGI Group (TSX:GIB.A) and SXC recently passed struggling BlackBerry maker Research in Motion in terms of market capitalization. At press time, CGI Group had a market cap of $6.04-billion, while SXC had a market cap of $6.59-billion. RIM, meanwhile, has a market cap of just $3.88-billion.

____________________________________

This story is brought to you by Agrimarine (TSXV:FSH). Not all salmon farms are the same. Click here to learn how Agrimarine is meeting consumer demand for sustainable aquaculture.

_____________________________________

SXC Health’s trajectory is unparalleled in the recent history of Canadian tech. As late as 2004 the Milton, Ontario -based company was plodding along more than a decade after it was founded with just $33 million in revenue. There was no big, splashy Bay Street IPO; the company went public in a reverse takeover of a publicly listed shell, allowing it to raise a relatively meager $10 million in 1997. In February, however, SXC Health reported its fiscal 2011 results and the numbers surprised even its most ardent supporters. SXC’s revenue grew a whopping 155% to $5 billion, from $1.9 billion in 2010. Earnings were up too, increasing 45% to $166.4 million. Although it’s not a household name in a consumer market space like RIM, results like these mean SXC Health, which moved its head office to Chicago after listing on the NASDAQ in 2006, will continue to get noticed. The company has already taken home top spot in Fortune Magazine’s 2011 100 fastest-growing companies list, an honor RIM took home in 2009.

The newly formed Catamaran says its management team will be comprised of a mix of executives from both companies. Mark Thierer will lead the firm as Chairman and CEO, and Jeff Park will serve as Executive Vice President and CFO. Former Catalyst President and Chief Operating Officer Rick Bates will serve as Executive Vice President, Market Segments. Former Catalyst board member Steven B. Epstein will join the new Catamaran board. And the company says David Blair, the former Chairman and CEO of Catalyst, “has committed to provide ongoing support to the combined company to ensure a seamless and successful integration. ”

At press time, shares of SXC Health were down 2.1% to $94.95.

__________________________________

___________________________________

Leave a Reply

You must be logged in to post a comment.

Share

Share Tweet

Tweet Share

Share

Comment