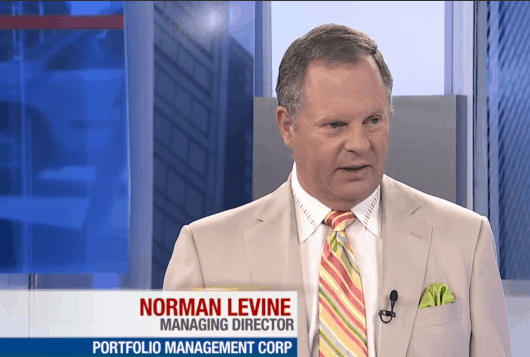

BCE is a top notch defensive play, says Portfolio Management’s Norman Levine

On Friday, Norman Levine, Managing Director, Portfolio Management Corp. was on BNN’s Market Call with host Michael Hainsworth to talk about North American large cap stocks.

Levine says he is ambivalent about the markets right now. He thinks investors should be wary of reading too much into its movements now because it is summer and volume is quite low. “We are concerned, but we’re not hugely worried” says Levine of the overall market, noting that in 2007 and 2008 his fund kept as much as 35% of its value in cash, today that number is around 10-12%, says the Portfolio Management Corp director.

One Canadian large cap Levine likes is BCE (TSX:BCE). Levine says that even though it is a large company, CEO George Cope is running it like an entrepreneur. BCE is gaining market share in wireless, and gaining share in television, he notes. And with a 5.1% dividend yield and very low volatility, BCE is a safe play that is suited for the times. Levine says there may be a time when a protected, defensive stock like BCE isn’t the right place to be, but this isn’t it.

BCE operates Bell Media, one of Canada’s largest media companies, which owns the Canadian television networks, CTV and CTV Two, plus thirty other specialty television channels, Bell Media Radio, and a chain of retail stores. BCE owns 18% of the Montreal Canadiens and, along with its competitor Rogers, now owns a majority stake in Maple Leaf Sports & Entertainment, which owns several Toronto professional sports franchises, including the Toronto Maple Leafs. BCE ranked number 262 on the 2011 edition of the Forbes Global 2000 list.

Shares of BCE on the TSX closed Friday up 1% to $42.39.

Nick Waddell

Founder of Cantech Letter

Cantech Letter founder and editor Nick Waddell has lived in five Canadian provinces and is proud of his country's often overlooked contributions to the world of science and technology. Waddell takes a regular shift on the Canadian media circuit, making appearances on CTV, CBC and BNN, and contributing to publications such as Canadian Business and Business Insider.