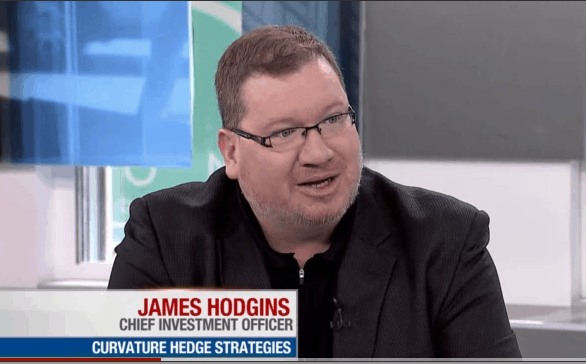

James Hodgins, Chief Investment Officer of Curvature Hedge Strategies, says DHX is in a sweet spot because of escalating battle for original content that is happening now in the US.On Thursday, James Hodgins, Chief Investment Officer of Curvature Hedge Strategies appeared on Market Call with host Michael Hainsworth.

The topics of the day were small and midcap stocks, which are a specialty for Hodgins, and market neutral investing. Why market neutral? Because Hodgins says he expects the European debt crisis, which have caused the overall markets to be choppy, will continue to weigh on equities.

One stock Hodgins predicts will rise above the chop is DHX Media (TSX:DHX), a Halifax-based based company that is the co-producer of more than forty original television series.

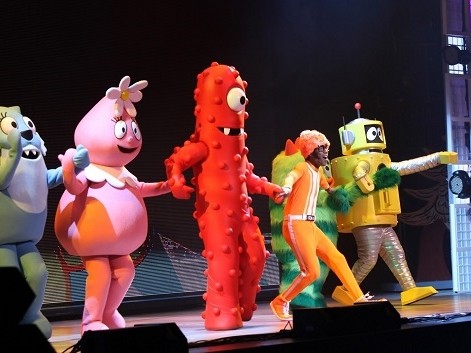

Hodgins says DHX is in a sweet spot because of an escalating battle for original content that is happening now in the US. He believes the launch of Apple’s ‘iTV’, paired with existing demands from providers like Netflix and Hulu, may be a catalyst for DHX. Hodgins points out that DHX’s catalogue is strong, led by Yo Gabba Gabba!, which is the number two rated preschool program in the United States. The Curvature Fund Manager, who is impressed with DHX Media’s rapidly improving numbers, says the stock is one of his top picks.

__________________________________

This story is brought to you by Agrimarine (TSXV:FSH). Not all salmon farms are the same. Click here to learn how Agrimarine is meeting consumer demand for sustainable aquaculture.

______________________________________

Founded in 2006, DHX Media boasts a library of over 2,525 half-hours of film and television, including Animal Mechanicals, Rastamouse, Angela Anaconda and the hit Yo Gabba Gabba! The company has quietly become a leader in kids TV. DHX has signed more than 1,200 license deals with over 150 children’s networks worldwide, including the BBC, Cartoon Network, PBS, The Disney Channel and Nickelodeon. On May 14th, DHX reported its Q3, 2012 results. Revenue was up 35% to $16.6-million from $12.3-million in the same period in 2011.

Hodgins points out that DHX founder Michael Hirsh was the founder of Nelvana, an entertainment company that was known for its work in children’s animation. Nelvana was sold to Corus Entertainment in September, 2000. Hodgins says that while he believes DHX media could double from its present level, that number could be much higher if Hirsh can pull off another strategic sale.

Shares of DHX Media closed Friday up 7.8% to $1.10.

__________________________

__________________________

Leave a Reply

You must be logged in to post a comment.

Share

Share Tweet

Tweet Share

Share

Comment