Byron Capital’s Douglas Loe slashes target on Theratechnologies

Byron Capital Healthcare analyst Douglas Loe says the reason for Ferrer’s withdrawal in Europe, concerns about long-term cardiovascular safety concerns from elevating IGF-1 blood levels generated by Egrifta use, is particularly bad. Bad news for shareholders of Theratechnologies (TSX:TH) today.

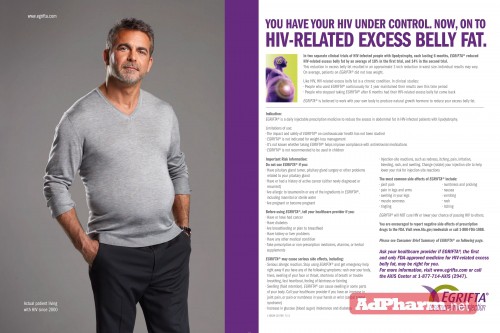

Shares of the Quebec-based biotech were slammed after the company reported it was informed by its European commercial partner Ferrer Internacional SA, that it would withdraw the marketing authorization application with the European Medicines Agency for Egrifta, Theratech’s tesamorelin treatment for excess abdominal fat in HIV-infected patients with lipodystrophy.

Theratechnologies said that as a result of today’s news, it is revising its guidance and and no longer expects to be EBITDA positive in fiscal 2013.

Byron Capital Healthcare analyst Douglas Loe says the reason for Ferrer’s withdrawal in Europe; concerns about long-term cardiovascular safety concerns from elevating IGF-1 blood levels generated by Egrifta use, is particularly bad. Loe says “…raising this as a safety concern at such a late stage of review is, at minimum, unusual, and irreconcilable with published data on Egrifta-HIV lipodystrophy we have reviewed before.” In a research update to clients today, Loe slashed his twelve-month target on Theratechnologies to $1 from his previous target of $6.50 and lowered his rating on the stock to Hold from Buy.

___________________________________

This story is brought to you by Agrimarine (TSXV:FSH). Not all salmon farms are the same. Click here to learn how Agrimarine is meeting consumer demand for sustainable aquaculture.

__________________________________

Montreal’s Theratechnologies, which was was founded in 1993 is, operationally, a much smaller company today than it was just last year. Last December, the company’s board decided to end a Phase 2 clinical program that was designed to evaluate tesamorelin for the treatment of chronic obstructive pulmonary disease. The company laid off 60% of its staff and said it would save an estimated $90-million over four years in an effort to be profitable by next year.

Today’s news ends momentum for Egrifta that began in November, 2010 when Theratechnologies received marketing approval for the treatment from the FDA. At the time, management noted that Theratech was one of the “one of the very few Canadian biotechnology companies to have successfully discovered, developed and brought a drug to the market on our own”.

Loe says there is a glimmer of hope in the United States, where he believes the regulatory setback in Europe is “not hugely material” to its growth there. The Byron analyst points out that the FDA has a favorable opinion of the treatment and prescription volume is growing, albeit in unremarkable fashion. He expects US sales will reach (US) $300 million by F2020.

Shares of Theratechnologies on the TSX closed today down 61.6% to $.73 cents.

________________________________

________________________________

Nick Waddell

Founder of Cantech Letter

Cantech Letter founder and editor Nick Waddell has lived in five Canadian provinces and is proud of his country's often overlooked contributions to the world of science and technology. Waddell takes a regular shift on the Canadian media circuit, making appearances on CTV, CBC and BNN, and contributing to publications such as Canadian Business and Business Insider.