Bombardier closes monster business jet sale to NetJets

The transaction for the firm portion of the aircraft order is valued at approximately (US) $2.6 billion based on 2012 list prices. If all the options are exercised, the total value of the order is approximately $7.3 billion. If exercised, the combined sale and aftermarket agreement are valued at approximately (US) $9.6 billion.

___________________________________

This story is brought to you by Cantech Letter sponsor BIOX (TSX:BX). The largest producer of biodiesel in Canada, BIOX’s proprietary production process has the capability to use a variety of feedstock, including recycled vegetable oils, agricultural seed oils, yellow greases and tallow. For more information CLICK HERE.

____________________________________

“We are very proud that, once again, NetJets has selected Bombardier aircraft to grow and support the expansion of its fleet worldwide,” said Steve Ridolfi, President, Bombardier Business Aircraft. “Our Challenger 300 Series and Challenger 605 Series jets are worldwide leaders in their respective segments. These aircraft are renowned for their reliability, performance and wide cabin comfort. We are convinced that the Challenger jets will complement NetJets’ existing fleet perfectly. After selecting our Global aircraft last year, this new order is a fantastic endorsement of Bombardier’s large cabin product portfolio.”

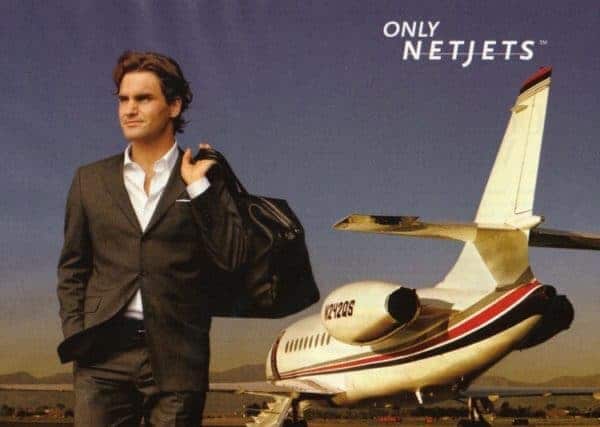

NetJets, which is owned by Warren Buffet’s Berkshire Hathaway, offers fractional ownership and rental of private business jets. The company, which traces its roots back to 1964, currently operates a fleet of more than 340 aircraft, including Cessnas Gulfstreams and Dassault Falcons.

Bombardier’s stock has been slumping near the lower end of its ten-year chart. But Byron Capital analyst Tom Astle says there is value in the Montreal-based company. In a recent report to clients, Astle estimated that the worst case scenario on Bombardier is that its rail business is worth “at least $2.50 a share”, its business jet segment is worth $1.40 a share and the commercial jets portion of its business is worth $.10 cents a share, bringing the low end valuation on the stock to $4.

Bombardier is divided into two segments that deliver roughly the same amount of revenue, Bombardier Aerospace, and Bombardier Transportation. Bombardier Transportation is more profitable, EBIT from the division was $172 million in Q3, compared to $129 million from the aerospace division. Bombardier CEO Pierre Beaudoin said lower deliveries of commercial aircraft were partly to blame for the company’s recent disappointing Q1, 2012 numbers which saw the company’s topline fall to $3.5-billion, from $4.7-billion the company reported in the same period last year.

Share of Bombardier closed today down 2.4% to $3.65.

_________________________

_________________________

Nick Waddell

Founder of Cantech Letter

Cantech Letter founder and editor Nick Waddell has lived in five Canadian provinces and is proud of his country's often overlooked contributions to the world of science and technology. Waddell takes a regular shift on the Canadian media circuit, making appearances on CTV, CBC and BNN, and contributing to publications such as Canadian Business and Business Insider.