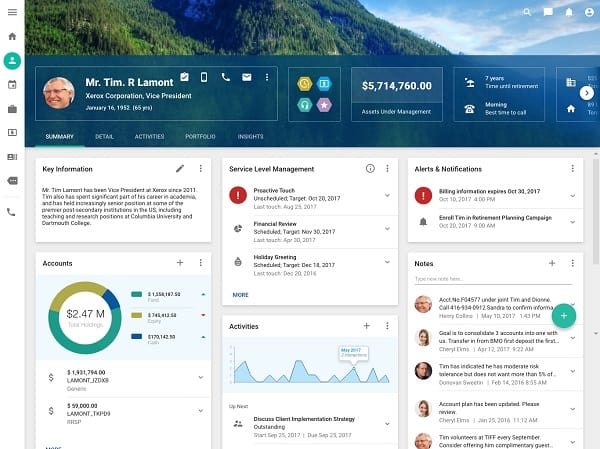

In fiscal 2011, the company’s revenue grew to $30.2 million, up 34% from the $22.5 million it reported in 2010. The bottom line was a tougher picture though, as NexJ lost $7.5 million, or $.42 cents a share, compared to last year’s loss of $1.9 million, or $.14 cents.

CEO Bill Tatham addressed both the losses and the topline growth in a press release today, commenting that: “In 2011, NexJ delivered on our growth objectives while also making the investments in people, programs and products that will allow us to continue our aggressive pursuit of the significant opportunity before us.”

NexJ’s employee count grew 25% to 323 in 2011, up from from 258 in 2010. The company also expanded its office space, professional services, product development, and its sales and marketing.

______________________________________________________________________________________________________________________

This story is brought to you by Zecotek Photonics (TSXV:ZMS). As of November 16, 2011, Zecotek owned title to or controlled more than 55 patents and applications. Click here to learn more.

______________________________________________________________________________________________________________________

Last May, the Toronto based CRM specialist IPO’d as one of the fastest growing companies in the country, having nearly tripled its revenue since fiscal 2008, from $7.86 million to $22.53 million in fiscal 2010. NexJ raised $43.65 million by selling 4.85 million shares at $9 each. The public financing came just thirteen months after it had raised $22 million in a pre-IPO.

Tatham founded NexJ, he told Cantech Letter earlier this year, “the Monday after the non-compete had expired” after selling Janna, the CRM company he founded in 1990 and sold to Siebel Systems (which was itself acquired by Oracle in 2005) ten years later.

NexJ’s specific verticals in CRM are finance, insurance and healthcare. The company uses applied analytics and intelligent modeling, believing these tools allow them to analyze greater amounts of data with more context and relevance. Though the company already counts three of the six largest global wealth managers as clients, Tatham believes it has an even greater opportunity in the healthcare vertical, where it plans to dedicate increasing resources.

Shares of NexJ closed today down 1% to $8.05.

______________________________________________________________________________________________________________________

_______________________________________________________________________________________________________________________

Leave a Reply

You must be logged in to post a comment.

Share

Share Tweet

Tweet Share

Share

Comment