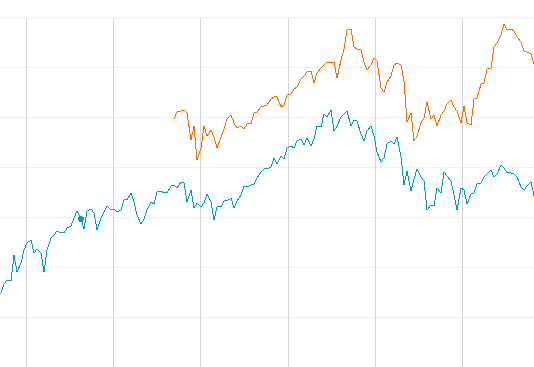

Late in 2011, Versant Partners analyst Massimo Fiore made NewAlta (TSX:NAL) his top pick for 2012. Early in the year, the company has already posted a 9% gain, and Fiore says there could be more good news on the way.

Fiore thinks NewAlta will reward investors by increasing its dividend later this year. The Versant analyst believes the company will increase the kicker from $.08 cents a share per quarter to $.10 cents. He says the company’s debt ratio covenants, (loan agreements that peg maximum leverage) are near the levels they were prior to previous dividend increases.

NewAlta is a one stop industrial waste shop, offering best of breed solutions in everything from soil remediation, hazardous waste management and water well assessments. The company, which is based in Calgary, has a network of 85 facilities from coast to coast. Management says it has a 35% market share in Canada. Consistently profitable, the company has increased its topline revenue from $499 million in 2007 to $576 million in fiscal 2010.

_____________________________________________________________________________________________________________________

This story is brought to you by Cantech Letter sponsor BIOX (TSX:BX). The largest producer of biodiesel in Canada, BIOX’s proprietary production process has the capability to use a variety of feedstock, including recycled vegetable oils, agricultural seed oils, yellow greases and tallow. For more information CLICK HERE.

____________________________________________________________________________________________________________________

Fiore thinks NewAlta will benefit from strong activity in the oil patch and continued strong commodity prices in the coming year. He says the company’s outlook has never been better, with an aggressive capital plan and several high return projects on the go. NewAlta will release its fiscal 2011 results early in March.

The bigger picture looks good for NewAlta, too. Market research firm BCC Research estimates the global market for hazardous waste treatment is more than $11 billion dollars and will continue to grow at nearly 8% per year.

Fiore today maintained his BUY recommendation and $16.50 target price on Newalta, which he derives by applying six times his estimate of 2013’s EBITDA.

Shares of NewAlta today closed at $13.57.

_______________________________________________________________________________________________________________________

_______________________________________________________________________________________________________________________

Leave a Reply

You must be logged in to post a comment.

Share

Share Tweet

Tweet Share

Share

Comment