Toronto’s Constellation Software (TSX:CSU) today announced it has adopted a policy to pay a regular dividend, in an amount to be determined by the board of directors.

The company has declared an initial quarterly cash dividend of $1 (U.S.) per share payable on April 2, 2012, to all common shareholders and Class A non-voting shareholders of record at the close of business on March 12, 2012.

Versant Partners Tom Liston liked move enough to raise his target price on the stock from $92 from $82. And, for those who think this may signal a new era of conservatism for Constellation, Liston doubts whether the move will slow its torrid rate of acquisition. He points out that the company has a $160 million revolving credit facility, as well as the ability to increase free cash flow to well over $100 million a year.

_

This story is brought to you by Serenic (TSXV:SER). Serenic’s market cap of $3.63 million (as of December 20th, 2011) was less than its cash position of $4.03 million (as of Q2, 2012). The company has no debt. Click here for more information.

_______

In a research update today, Liston reiterated his “BUY” target on Constellation, basing his new price target on eleven times projected fiscal 2013 earnings, which he thinks will come in at $8.48 per share.

After returning 54% in 2011, Constellation Software was Liston’s best performer in 2011.

Formed in 1995, Constellation, which makes software for the public and private sector, is clear about its strategy. The company grows through acquisition, looking to acquire best of breed companies across different verticals. Constellation is involved in various niches on the public and private side from software for housing authorities, transportation agencies, and software for large home builders. On the strength of this strategy, the company has grown its revenue from just $243 million in fiscal 2007, to nearly $634 million in fiscal 2010.

The move to pay a regular dividend comes after a strategic review announced April 4th in which Constellation’s board hired Bank of America Merrill Lynch and BMO Capital Markets to “review strategic alternatives” for the company, which many investors recognize as capital markets shorthand for “try and find a buyer”.

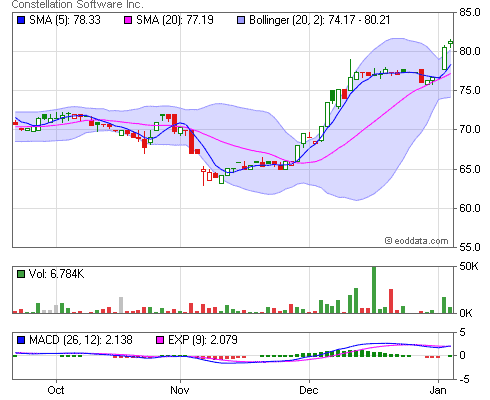

Share of Constellation Software closed today up 1% to $81.34.

____________

____________

Leave a Reply

You must be logged in to post a comment.

Share

Share Tweet

Tweet Share

Share

Comment