Byron Capital’s Berry says Clearford Industries is a Speculative Buy

CIBC World Markets analyst Paul Lechem estimates we’re only about part of the way though an “infrastructure super-cycle” that is fueled by both private and public spending.

This storyline should have been a real boon to Kanata’s Clearford Industries (TSXV:CLI), which has developed a sewer system that is a vast improvement over traditional gravity sewers, but it wasn’t. Instead, Canada has served a more of a demonstration market for the company’s small bore sewer systems. Clearford’s technology, it turns out, is ideally suited to addressing problems in the developing world, where water can be scarce and literally billions of people still don’t have access to proper sanitation.

________

This story is brought to you by Cantech Letter sponsor BIOX (TSX:BX). The largest producer of biodiesel in Canada, BIOX’s proprietary production process has the capability to use a variety of feedstock, including recycled vegetable oils, agricultural seed oils, yellow greases and tallow. For more information CLICK HERE.

________

The small bore sewer system use a tidy bit of technology called Distributed Anaerobic Digestion. Solid mass is digested using naturally occurring bacteria, producing water and biogas. Historic gravity sewers move waste through large pipes with seams that separate over time, manholes that are required at each change in direction of the pipe, and treatment plants that can be inefficient because they need to be large enough to operate at maximum capacity, which occurs very infrequently. Because Clearford’s solution moves no solids it can use flexible piping. And the distributed architecture of Clearford’s solution means less maintenance, less water usage and has the upside of producing usable biogas.

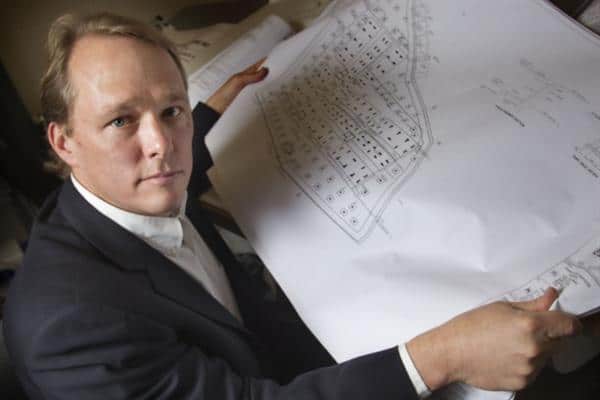

Clearford CEO Bruce Linton has racked up air miles traveling to places like India, Sri Lanka and Peru. Linton thinks the company’s small bore sewer, which has 26 patents issued, filed or pending, could be nothing less than “the answer the developing world needed to solve the huge and growing sanitary sewage challenge.”

Byron Capital analyst Byron Berry thinks Clearford Industries is still in a typical venture capital “go-to-market stage” and is riskier than more mature companies. But Berry also thinks the company could see “very strong price appreciation”. On January 6th, Berry initiated coverage on Clearford with a Speculative Buy rating, although he declined to place a target price on Clearford at this time.

Berry says the immediately addressable market for Clearford’s technology means the company could win ten municipal and ten private developer contracts each year for the next three years, and that those contracts could deliver annual revenue of more than $46 million at a 25% profit margin. In the nine months ended September 30th, 2011 the company reported revenues of $7.1 million.

Clearford closed Friday at $.16 cents. The company has 60.53 million shares outstanding, giving it a market cap of $9.7 million.

___

____

Nick Waddell

Founder of Cantech Letter

Cantech Letter founder and editor Nick Waddell has lived in five Canadian provinces and is proud of his country's often overlooked contributions to the world of science and technology. Waddell takes a regular shift on the Canadian media circuit, making appearances on CTV, CBC and BNN, and contributing to publications such as Canadian Business and Business Insider.