Add another one to the list. It’s been a nightmare year for Research in Motion, but some believe the negativity on the stock is overdone.

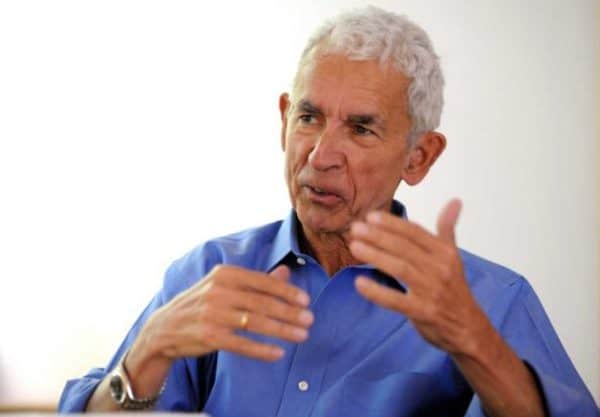

Joining noted value investor Donald Yacktman, who began picking up shares of RIM this past summer, is Laszlo Birinyi. Birinyi’s firm, Birinyi Associates, has returned nearly 18% so far this year.

On Tuesday, Birinyi appeared on CNBC’s Squawk Box to unveil his top five picks for 2012.

To the apparent surprise of the Squawk Box hosts, Birinyi is bullish on Research in Motion. He says the company has been beaten down, but has a brand and a loyal devotees.

_________________________________________________________________________________________________________

This story is brought to you by Cantech Letter sponsor Serenic (TSXV:SER). Serenic Corporation develops, markets and supports mission-critical fund accounting software solutions for not-for-profit organizations and government agencies. Click here for more information.

___________________________________________________________________________________________________________

Birinyi recalled that he appeared on the 1997 year-end special of the late Louis Rukheyser’s Wall St. Week, where he picked Apple Computer at $7.

Birinyi joins a growing chorus of analysts and fund-managers who believe the Waterloo-based device maker is undervalued. On Monday, Scotia Capital analyst Gus Papageorgiou reiterated his “outperform” rating on RIM, calling the stock “absurdly oversold”.

On November 3rd, shares of RIM fell below book value for the first time in nine years. Book value, of course, is what you get when you add up a company’s assets, such as cash, real estate and inventories, and subtract its liabilities. At the end of Q2, which ended ended Aug. 27, RIM had a book value of $18.92 a share. The stock fell as low as $16.98 on November 25th.

Shares of Research in Motion on the TSX closed today up 5.5% to $17.95.

______________________________________________________________________________________________________________

_______________________________________________________________________________________________________________

Leave a Reply

You must be logged in to post a comment.

Share

Share Tweet

Tweet Share

Share

Comment