After a tough few years, 2011 is shaping up quite nicely for shareholders of Quebec City’s Aeterna Zentaris (TSX:AEZ).

Today, nearly eight years after initially filing, the company’s cancer therapy candidate, Perifosine, was granted a patent by the European Patent Office.

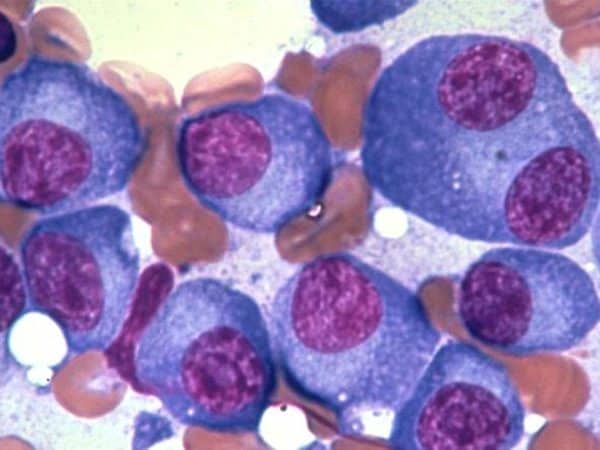

The patent, which is effective July 13th and will expire on July 28, 2023, actually covers the treatment of benign and malignant tumours, prior to and or during the treatment with approved anti-tumour anti-metabolites.

Juergen Engel, Aeterna Zentaris President and CEO, said “The patent protects the use of perifosine in combination with capecitabine, not only in metastatic colorectal cancer, but also in other cancer indications such as gastric and breast cancer where capecitabine is also approved. The patent comes also at a time when we are looking forward to the completion of the pivotal phase 3 trials with perifosine in colorectal cancer and multiple myeloma.”

Aeterna Zentaris has a lot riding on Perifosine. In 2010, the company managed to stem its losses to $23.2 million from the nearly $60 million it lost in 2008, but was clearly in a race against time. Much of its recent revenues are are non periodic milestone payments for Cetrotide, an in vitro fertilization drug. As of 2011’s Q1, a quarter that ended March 31st, Aeterna Zentaris had $41.1-million in the bank, a number that was whittled away by a loss of just over $10 million in that quarter.

AEterna Zentaris management is quick to point out that the company’s product pipeline is deep, but it’s clear that commercialization of Perifosine could be a single giant step in the right direction for a company that has had some recent notable disappointments, including the failure of cetrorelix, a prostate treatment that failed to meet its primary endpoint and led to the termination of its partnership with Paris based pharmaceutical giant Sanofi-Aventis.

Perifosine is a drug with multiple niche applications in cancer treatment. While the company has received encouraging news in the forms of FDA fast tracking and orphan status (for the treatment of neuroblastoma) some investors may have mistakenly believed the treatment itself only has niche potential, after all The FDA’s orphan drug status is reserved for new treatments that are being developed for diseases or conditions that affect fewer than 200,000 people in the United States. But the sum total of all opportunities for Perifosine is large enough to make AEterna Zentaris investors happy for some time. Some estimate the US market potential for multiple myeloma alone to “exceed $3 billion in the coming years.”

After bottoming at $1.05 last August, shares of Aeterna Zentaris have enjoyed a steady and sustained rise to more than twice that today. At press time, the company’s stock on the TSX was up 1.4% to $2.25.

_________________________

_________________________

Leave a Reply

You must be logged in to post a comment.

Share

Share Tweet

Tweet Share

Share

Comment