Why is Bay Street so negative on Celestica?

19% revenue growth. Improved earnings. A mountainous short position that continues to build.

To shareholders of Celestica (TSX:CLS), it must sound like one of these things doesn’t belong. On April 21st, the Toronto based contract manufacturer reported results from its Q1 2011. The numbers showed a company that is returning to growth. The $1.8 billion Celestica did bested last year’s $1.52 billion, and the $.14 cents a share earnings was better than last year’s $.12 cents, too.

So are there clouds on the horizon? Not according to the company. Celestica also guided higher for Q2. Management expects revenue for that quarter to come in somewhere between $1.75 billion and $1.9 billion, and for earnings to grow to between $.22 and $.28 cents.

Casual observers of the stock might be puzzled that Celestica trails only Manulife Financial as the most shorted stock on the TSX. Between May 15th and May 30th, short interest on Celestica grew from 35,265,236 shares to 38,242,628.

The growing short position has coincided with a slide in Celestica shares, which have fallen from a high of $11.75 on February 24th of this year to Friday’s close of $8.81. The company’s valuation has been pummeled to the point where a recent Cantech Letter survey showed that Celestica had nearly 30% of its market cap in cash. This is part of the reason Marketwatch’s Cody Willard recently called Celestica a “must own” tech stock. “Celestica is one of the single cheapest tech stocks I can find” says Willard, “especially when you consider the Company’s growing its nearly $4 in cash per share every year.”

So why the divide on Celestica? Some point to the Japanese earthquake of March 8th. The company has nearly five hundred employees at a plant in Miyagi, which is very near the epicentre of the quake, in Sendai. But as CEO Craig Muhlhauser told the Toronto Star recently, production has resumed, and none of Celestica’s employees were injured.

“Conditions were very difficult for our people during this period” said Muhlhauser “Not only were our employees dealing with the tragedy of this event, they also had to endure the very real and practical issues of not having the essential services for their families, such as food, gas, electricity and water. Despite continued aftershocks since the initial earthquake, our employees’ and their families’ lives have been slowly getting back to normal and the site has resumed production.”

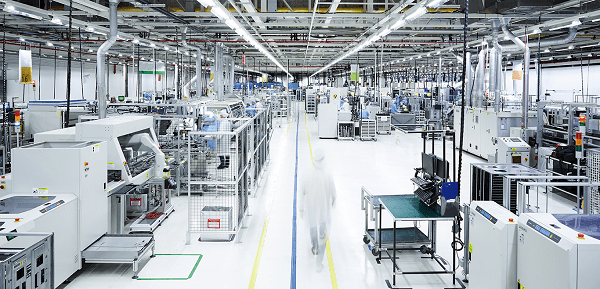

Perhaps a more persistent reason for Celestica’s valuation woes is the view of its business as a low margin one that is rife with competition. The company has, in the past, been accused of not being a technology stock at all, but a manufacturing concern. Celestica is in a business called electronics manufacturing services (EMS). The company’s bread and butter in the past was contracts such as assembling Xbox’s Blackberrys and iPhones. While management has perfected the art of squeezing out the maximum margin, some believe it’s inevitable that increased pressure from China will ultimately cripple Celestica’s business.

Muhlhauser, a former exec with Ford and GE, is more than familiar with this argument. But it’s clear he believes that critique is directed more to the Celestica he inherited, not the Celestica of today. According to Muhlhauser, Celstica has undergone a transition and is prepped to become a higher margin business.

Celstica’s recent acquisition of the semiconductor equipment contract manufacturing operations of Portland based Brooks Automation (NASD:BRKS), certainly seems to fit this ongoing narrative. While its still too early too see how the acquisition will affect Celestica’s bottom line, Brooks Automation as a whole has a profit margin near 14%, which would certainly be a bump to Celstica’s narrow margin of 1.67%.

Celestica shareholders no doubt hope this leads to analyst upgrades, such as the one Louis Miscioscia of Collins Stewart recently issued on the stock, becoming less and less rare. The analyst raised his target on Celestica to (US) $15, noting that the company trades at a significant discount to its peers.

_____________________________________________________________________________________

_____________________________________________________________________________________

Nick Waddell

Founder of Cantech Letter

Cantech Letter founder and editor Nick Waddell has lived in five Canadian provinces and is proud of his country's often overlooked contributions to the world of science and technology. Waddell takes a regular shift on the Canadian media circuit, making appearances on CTV, CBC and BNN, and contributing to publications such as Canadian Business and Business Insider.