Play the word association game with the phrase Canadian Software and some are immediately reminded of the days when Corel’s WordPerfect looked like it was going to be the Pepsi to Microsoft’s Coke. While those days have gone the way of the leg warmer (what they’re back?), Canadian software companies have more than stepped up to fill the void. From Enterprise Resource Planning, to The Cloud, to SAAS, name any hot trend in software and there is a Canadian company that is making its mark globally. In this issue we talk to the some of the minds behind Canada’s 10 Most Interesting Software Stocks. We present these companies in no particular order.

1. OpenText (TSX:OTC)

Notice that the title Chief Information Officer seems to be popping up more often now? Get use to it. Throughout the world more companies are looking to monetize their intellectual assets.

Many of them are turning to Open Text, the Waterloo based company that has become a worldwide leader in Enterprise Content Management. Open Text grew out of a collaboration between the University of Waterloo and the New Oxford English Dictionary, a collaboration with the Oxford University Press to computerize the OED. This engineers on this project realized that it required developing search technologies that could be used to quickly index and retrieve information. The search technology developed for this project, which incorporated full-text indexing and string-search technology, was recognized as being useful for other electronic applications. In 1991, at about the same time the Internet was emerging, the results of this project were commercialized by a private spin-off called Open Text Corporation.

As the Internet expanded in usage OpenText grew, as organizations found they needed to index and search their existing and growing stores of electronic information. In 1994, the company began hosting its Open Text 4 search engine on the World Wide Web, competing directly with the AltaVista Web search engine. In 1995, OpenText provided the search technology used by Yahoo! as part of its Web index. Forward to fiscal 2010, when OpenText recorded over (US) $900 million in revenue.

Enterprise Content Management is used to organize the mountains of data that large companies have and walk them through the regulatory and security issues associated with making this data available to employees and the general public whether through internal means or through the cloud. Cantech Letter’s Nick Waddell recently talked to Open Text President and CEO John Shackleton.

2. Computer Modelling Group (TSX:CMG)

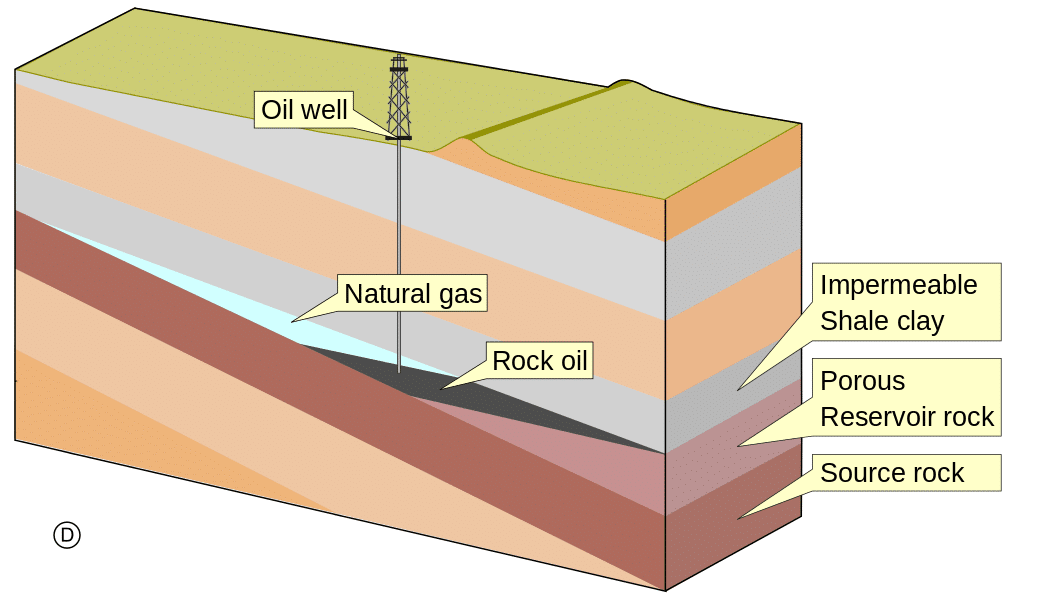

Calgary’s Computer Modelling Group is an Alberta technology success story. In 1978, the company was a small Calgary based research facility, and was actually a non-profit entity for the first seventeen years of its existence. When CMG decided to become a for profit entity they were pretty good at it and continue to be; the company has more than doubled its revenue from $23.7 million in fiscal 2007 to more than $45 million in 2010. Today, CMG has five offices around the world, and is more likely to make a sale of its leading edge reservoir simulation software outside of Canada than here at home. Reservoir simulation software has become an important tool for oil and gas companies. Computer models allow them to better predict the expected production, allowing for more better financial decisions.

Click here for Cantech Letter’s recent interview with Ken Dedeluk, President and CEO of CMG

3. Serenic (TSXV:SER)

A little digging into the business of Edmonton’s Serenic Corp. reveals some interesting economic trends. Serenic, which makes software that helps international non-profits and NGO’s better manage their resources, appeared poised to benefit from a shift that many hadn’t noticed. As The New York Times reported at the time, the number of charities in the United States rose 60 percent, to 1.1 million, in the decade between 1999 and 2009. In the US, charities now collect nearly a trillion and a half dollars, which is more than the US government collects in income taxes. In Canada, philanthropic donations jumped 127% after a 1996 amendment by the Canada Revenue Agency that ditched the capital gains tax on gifts of securities.

The economic downturn that began in late 2008, however, hit charities especially hard. Midway through 2009, Boston based consulting firm The Bridgespan Group reported that 75% of charities had been hurt by the recession. Newer data suggests long-term trends in charitable giving are now resuming. A study by the Nonprofit Research Collaborative, a coalition of six organizations that study or represent nonprofits and fund raisers, showed that 43 per cent of charitable organizations increased the amount of money they raised in 2010, and 63 per cent of the more than 1,800 organizations studied said they expect private donations to rise in 2011.

Some believe the trend is a demographic one. The Financial Post, recently, described a “a baby boomer approach to philanthropy, with giving starting relatively early in life and being highly attuned to final outcomes.” This trend no doubt gained steam with the “Giving Pledge” an initiative by Bill Gates and Warren Buffett to convince the world’s billionaires to give most of their wealth to charity within their lifetimes. By 2010, half of the billionaires the pair had contacted agreed to pledge more than half of their wealth. The list of names includes George Lucas, Ted Turner, T Boone Pickens, Michael Bloomberg, Barry Diller and Barron Hilton.

Aside from demographics, another trend is helping charities rebound from the economic downturn; technology. The aforementioned report from the National Research Collaborative showed that online giving was experiencing the most growth of any fund raising method. And donations made by mobile phone are exploding; last month the BBC charity event Comic Relief made more than £7m from text message donations.

Fiscal 2009 was a bit of a misstep for Serenic, but the company rebounded in 2010 with record sales of $10.7 million. A concentration on expanding its partner network in the US, Europe and Africa has resulted in significant and recent sales to non-profits such as Human Rights Watch, The League of Women Voters, and to thirteen customers in seven African countries. With its stock now trading near fifty-two week lows, a little number crunching will tell you that Serenic is currently trading close to cash value – despite the recent additions of two new partners to its partner channel. Cantech Letter recently caught up with Randy Keith, Serenic’s President and CEO.

4. TECSYS (TSX:TCS)

Ever since the first raw material was delivered to the first customer, mankind has muddled through supply chains. The use of supply chain management systems has become a way for smaller manufacturers to gain an advantage over competitors, but has become an absolute necessity for multinationals looking to stay competitive. A window into the supply chain can improve customer satisfaction, reduce excess inventory and the time between the manufacture of a product and its sale. Montreal’s TECSYS counts some of the largest companies in the world as clients. The company is developing a reputation as an innovator in the maturing space. TECSYS’ visual oriented radio frequency device, for instance, uses simple, intuitive visual cues to prompt the end user where to find the product on the shelf, which bar code to scan and how to package an order. Recently, Cantech Letter talked to TECSYS’ President and CEO Peter Brereton.

5. Vendtek Systems (TSXV:VSI)

In 1988, four robotics students at Vancouver’s BC Institute of Technology settled on a class project. The result, a lottery ticket vending machine that would, ultimately, become Vendtek Systems, a software company that ballooned to over $121 million in revenue in fiscal 2010. Today, Vendtek’s e-Fresh software uses point-of-sale terminals to sell prepaid banking and telecom services. Vendtek’s journey however, was not without a stumble or two. In some ways company was a victim of its own success; when Vendtek grew from virtually nothing to $100 million in revenue from 2002 to 2007 the company’s administrative and accounting procedures were admittedly thin. The result was a self-imposed thirteen month halt on the stock while big boys KPMG and Price Waterhouse Cooper were brought in to sort through the books, on a transaction by transaction basis. When the company began trading again, with restated financials that weren’t very different from those previously reported, Vendtek found itself with a renewed sense of purpose, and, as CEO Doug Buchanan describes, a market opportunity in South America that dwarfs anything the company has addressed before. Cantech Letter caught up with Buchanan to talk about the journey from BCIT, the and his plan to improve Vendtek’s historically thin margins.

For Part Two of Canada’s 10 Most Interesting Software Stocks – CLICK HERE.

Disclaimer: At publication date, Cantech Editor Nick Waddell owns shares of Serenic and his company, Cantech Communications, is engaged to provide investor relations services to the company. Serenic is a sponsor of Cantech Letter.

_______________________________________________________________________________________

_______________________________________________________________________________________

Leave a Reply

You must be logged in to post a comment.

Share

Share Tweet

Tweet Share

Share

Comment