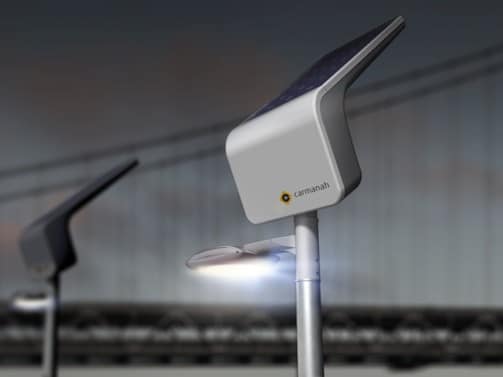

Carmanah Technologies 2010: solar powered light at the end of the tunnel or train?

A year that tested and proved the mettle of the company.

That’s the way Carmanah Technologies (TSX:CMH) management described 2010, in a press release announcing results from that fiscal year today. With it’s stock falling from a high of $.83 on August 24th to lows under $.50 in December, it was a year that tested the mettle of shareholders as well.

But is the fourth quarter of 2010 a solar powered light at the end of the tunnel or a train? Sales for the three months ended December 31, 2010 were $9.3 million, up 36.1% from $6.8 million for the same quarter in 2009. But the remnants of a restructuring that began in 2008 continued to haunt Carmanah into the fourth quarter of 2010. The Company lost $4.1 million in Q4, compared to a net loss of $900k in the same period of the prior year, mostly due to a $3.0 million non-cash charge.

CEO Ted Lattimore, however, was quick to point out that compared to the year previous, overall revenues grew for 2010 were up 7%, to $33.9 million. But 2009 was a year in which the company saw its revenue nearly halved, from $61.57 million in 2008.

Carmanah went public in 2001 and graduated to the TSX in 2005. By 2006 the company, which had matured into one that provided solar lights for a variety of industrial off the grid applications, including hazard lights and lights for airport runways, had grown to near $63 million in revenue. As 2008 turned to 2009, however, it was becoming clear that many of the product lines the company was engaged in, such as its roadway signage and distribution business, were not profitable and probably weren’t going to be.

In June of 2008 Carmanah began to slash staff; 37 people or 40% of the company’s staff were cut. While noting the move was particularly hard for employees, CEO Ted Lattimore told the Victoria Times Colonist that the company would not have to suffer through “baggage and suffocation of businesses that are losing money.” Though 2009 produced only half the revenue of the previous year , it also produced something else unfamiliar to its investors; a profit. 2010 hasn’t yet been the runaway success many had hope for, the days of bleeding cash appear to be over, as the company now has $5.7 million in the bank and no debt.

At press time shares of Carmanah were up nearly 4%, to $0.54

Check out Carmanah and 9 other Canadian stocks in our recent article “Canada’s 10 Most intriguing Cleantech Stocks“

Nick Waddell

Founder of Cantech Letter

Cantech Letter founder and editor Nick Waddell has lived in five Canadian provinces and is proud of his country's often overlooked contributions to the world of science and technology. Waddell takes a regular shift on the Canadian media circuit, making appearances on CTV, CBC and BNN, and contributing to publications such as Canadian Business and Business Insider.