Investors Visualize Success for MediPattern

To say it has been a bumpy road for MediPattern (TSXV:MKI) investors of late might be an understatement. The Toronto based company, which designs medical imaging software, went public in 2005 then soared to $1.64 in the first days of 2008 on the promise of a new medical imaging system for breast cancer detection.

But as 2008 turned to 2009 it was becoming clear that three little letters were going to drag down MediPattern and the momentum it had built in the space. Those letters were CPT, an acronym for Current Procedural Terminology, and they became the bane of both shareholders and management of the company.

CPT codes are numbers assigned to every task and service a medical practitioner may provide to a patient including medical, surgical and diagnostic services in the United States. They are then used by insurers to determine the amount of reimbursement that a practitioner will receive.

MediPattern originally attempted to use an existing CPT code for its breast ultrasound computer aided detection system: B-CAD™ but was met with criticism by the American College of Radiology Reimbursement Committee. With such strong opposition the company was forced to change strategies in 2008 in hopes of establishing a new CPT code for their flag-ship product. Since that time, MediPattern has been working with a reimbursement consultant, Healthcare iQ, but has yet to be successful in their attempt to establish a new CPT code for their breast ultrasound CAD system.

As shareholders of MediPattern have learned, the process of establishing a new CPT code is very lengthy and very complicated. And as this became increasingly clear, shares of of the company tumbled directly to near a dime, approximately where they have remained for almost two years. But on Thursday, MediPattern posted one of the largest one day gains in recent history of the of Toronto’s Venture Exchange, the stock ended up a whopping 366% as more than 2.6 million shares changed hands.

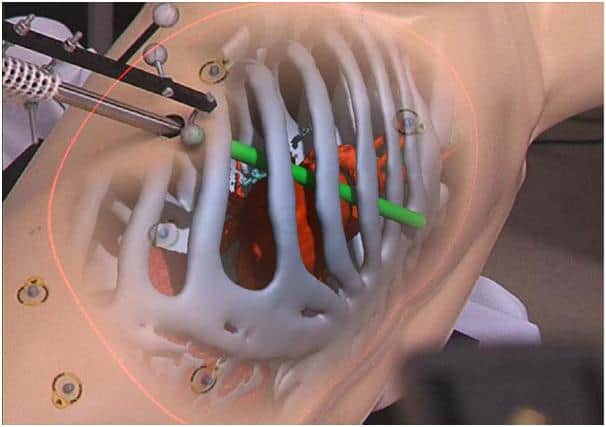

The reason? MediPattern received U.S. Food and Drug Administration (FDA) 510(k) clearance for its Visualize:Vascular™ product. Visualize:Vascular is a tool that can help a physician assess vascular disease using ultrasound imaging. With clearance from the FDA, Medipattern anticipates it will bring this new product to market in mid-2011 with help from its its clinical partner Navix Diagnostix, a cardiovascular diagnostic services provider in the United States.

Investors scooping up shares of MediPattern may be doing so because of a key differentiation between the breast ultrasound and vascular markets. The latter have existing and established CPT codes that, as reported by MediPattern in their Nov. 26th, 2010 MD&A, can be used for their new product Visualize: Vascular. MediPattern bulls may feel the company is now able to leverage the domain expertise it has built in what is now a rapidly recovering market. Research firm Frost & Sullivan says the medical imaging market will grow to $6.55 billion in 2012, as the market is “expected to bounce back from declining reimbursements and effects of the economic downturn…”

Disclosure: At publication date Cantech Editor Kirk Exner owned shares of MediPattern.

Nick Waddell

Founder of Cantech Letter

Cantech Letter founder and editor Nick Waddell has lived in five Canadian provinces and is proud of his country's often overlooked contributions to the world of science and technology. Waddell takes a regular shift on the Canadian media circuit, making appearances on CTV, CBC and BNN, and contributing to publications such as Canadian Business and Business Insider.