Signs of Life at Nuvo Research?

Milestone payments can be tricky business for publicly listed biotechs. One one hand, the cash creates a margin of safety for investors. On the other hand, the huge spike in revenue can create unreasonable expectations for a company’s balance sheet, especially one with a product that is trying to gain traction in the market.

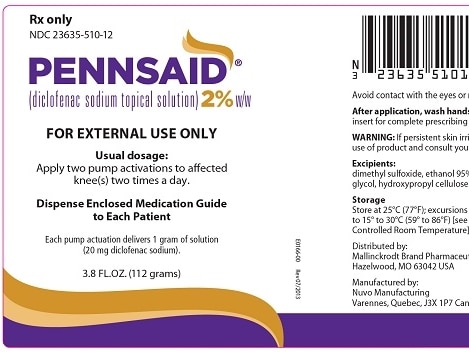

Shareholders of Mississauga’s Nuvo Research (TSX:NRI) have learned this the hard way. In 2009, Nuvo was buzzing on a $27.3 million payment from Covidien that was triggered by FDA approval of Pennsaid, an osteoarthritis pain-killing cream that is absorbed through the skin. The cash was received in the fourth quarter of 2009, and it made Nuvo’s year. The company ballooned from $10.52 million in annual revenue to $38.35 million.

Pennsaid only became available in the US market this past April, but the weight of expectations has already disappointed many shareholders in this short time frame. After rallying from under $.10 cents in late 2008, shares of Nuvo peaked at $.40 cents on July 24th, 2009. With $11.55 million in revenue in the first three quarters of 2010, the company has already bettered 2008, but the lack of a gigantic one time payment makes 2010 look like a disappointment to many shareholders. But is it?

In the just released Q3, Nuvo reported that Pennsaid sales were improving, Q3’s revenue increased 20 per cent to $3.9-million. The increase was primarily attributable to the U.S. launch of Pennsaid, which directly accounted for more than half of the total revenue. Nuvo also reported that, according to IMS data, 26,600 Pennsaid prescriptions were dispensed in the third quarter, which was an increase of 250% over Q2. Dan Chicoine, chairman and co-chief executive officer of Nuvo says the company is optimistic: “Weekly U.S. prescriptions for Pennsaid continued to increase week over week during the quarter” he noted “…and we are optimistic that this upward trend will continue.”

With its shares struggling, Nuvo shareholders can thank the Covidien milestone payment for one key aspect of the company’s health; the company still has $30.89 million in the bank, or nearly 45% of its entire market cap.

Nick Waddell

Founder of Cantech Letter

Cantech Letter founder and editor Nick Waddell has lived in five Canadian provinces and is proud of his country's often overlooked contributions to the world of science and technology. Waddell takes a regular shift on the Canadian media circuit, making appearances on CTV, CBC and BNN, and contributing to publications such as Canadian Business and Business Insider.