Canadian 3D Beyond TV

There’s more to 3D than television. And right now, there are several Canadian 3D technology stocks exploring the possibilities of the technology in the medical and mining fields, for instance. While most of the companies profiled below are still at the earlier stages of their journey, there is a least one company, Computer Modeling Group, that has already commercialized the potential of 3D. Computer Modeling Group (TSX:CMG), a company out of Calgary, has seen it shares rise to $18 from just above $3 in 2006, with their revenue more than doubling since then. We take a look at Canadian companies exploring 3D Beyond TV, who are looking to follow in CMG’s footsteps.

1. Computer Modeling Group (TSX:CMG)

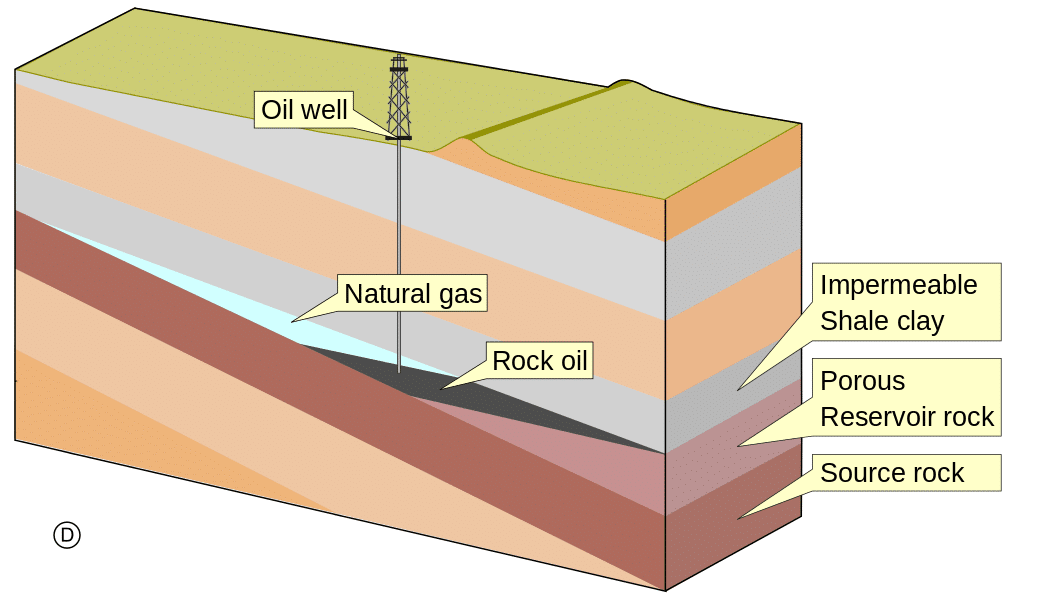

Calgary’s Computer Modeling Group is a tech success story in a town known for oil. Not that there isn’t an oil connection. Dividend paying CMG designs software makes that helps oil and gas companies examine their wells in 3D. CMG’s “Results Stereo 3D Visualization” which is a partnership with a company called StereoGraphics creates 3Dmodels of complex oil reservoirs. CMG says several major oil companies have installed visualization rooms to view oil and gas reservoirs in stereoscopic 3D. CMG has doubled its revenue, from $23.7 million in 2007 to over $45 million in FY 2010.

2. Vuzix (TSXV:VZX):

Vuzix is one of those companies that resembles an old comic book’s version of the future come to life. The Company makes high resolution eyeware that connects to a portable device to create a big screen experience. Vuzix has had some tough times, but it has a steady revenue stream from the sale of products such as thermal night vision goggles to the military. Vuzix describes their WRAP 920AR as “the world’s first consumer video eyewear with 67-inch displays as seen from 10-feet …that can be viewed in 3D stereoscopic video on the Wrap eyewear displays”. Vuzix IPO’d on the TSXV in January of this year and shares were in a slow steady decline, before bouncing back ever so slightly of late.

3. Zecotek Photonics (TSXV:ZMS)

3D without the glasses. Zecotek’s 3D2D Display, developed out of The University of British Columbia, may be a game changer. Though the days of watching a 3D movie without 3D glasses is coming, Zecotek’s immediately addressable markets likely aren’t related to James Cameron. When you walk up to a Zecotek image you can angle your head to the side and actually see behind images. This is called an occlusion effect. One area this could have an immediate effect on is airports, Zecotek’s technology could help improve baggage scanners and air traffic control systems.

4. Intermap (TSX:IMP)

2010 hasn’t been kind to Intermap. In August, the company’s Q2 showed some heavy losses of over 10 million, which was actually an improvement over the $11 million they had lost in Q1. This caused the company to begin a restructure that included the resignation of Brian Bullock as CEO, and the subsequent resignation of CFO Brian Musfeldt in September. Shares of Intermap began the year over $2 and early in March things looked promising, as the company signed a deal with Garmin to provide accurate 3-D elevation data for the United States and Western Europe derived from its NextMap countrywide digital map database. Intermap’s losses are staggering, but they speak in part to the large scope of what the company is trying to accomplish; building unprecedented national databases, called NEXTMap, which has provided 3D digital elevation models of all of Western Europe and the United States. The NEXTMap data library contains more than 12 million km2 of high-resolution elevation data and images to meet the demanding needs of a wide range of geospatial applications.

5. iSee3d (TSXV:ICT)

Vancouver’s isee3D’s hopes rest on a patented single-lens, single-camera 3-D technology. The Company sees their most immediately addressable market as the medical field, such as robotically-assisted minimally invasive surgery, which allows a surgeon to work through very small incisions. The Company recently signed a license agreement with Massachusetts based Hamilton Thorne, a provider of advanced laser systems and instruments for in vitro cell applications. Hamilton Thorne will combine commercial microscopes with its advanced laser imaging systems. Shares of isee3d hit a high of $1.33 early this year, but have struggled since, closing at $.41 on September 27th.

Leave a Reply

You must be logged in to post a comment.

Share

Share Tweet

Tweet Share

Share

Comment