Welcome to the first installment in our “Head to Head” series. In “Head to Head” we

use basic value metrics to compare a large Canadian tech stock to a small one in a

similar space. Clearly, there are caveats and

qualifiers necessary (growth, for instance is much more important to smaller stocks)

in such a comparison. Nonetheless, we think it’s a useful exercise to try and level

the playing field to see if David can take down Goliath. In the first matchup,

upstart OSI Geospatial (TSX:OSI) plays the role of David against the Goliath that is

MacDonald Dettwiler (TSX:MDA).

First,a little about the pugilists: Founded in 1977, Ottawa based OSI Geospatial

(OSI) develops and sells “command and control” technologies and navigation systems

for the defense and homeland security markets. In the past four quarters, to May

31st, 2009 OSI’s revenue was $26.4 million.

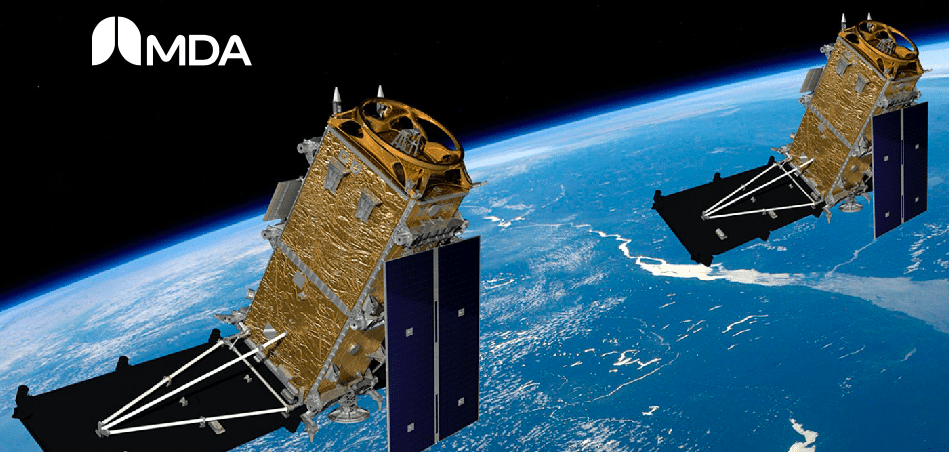

Richmond, BC based Macdonald Dettwiler and Associates (MDA) was founded in 1969. MDA

is a diverse provider of information solutions. One of the company’s key units

provides geospatial information systems for aerospace and defense industries. In the

trailing four quarters, to June 30th, 2009 MDA did $1.074 billion in revenue.

Let’s get started by seeing how these two from opposite ends of the weight class

fare in the most basic of tests, price to sales:

1. Price to sales:

OSI 0.30

MDA: 1.18

A big difference here; OSI’s market cap of 8.04 million (47.28 million shares

outstanding multiplied by the closing share price at September 18, 2009, which was

.17 cents) pales in comparison to its trailing revenues of 26.4 milion. This price

to sales ratio of 0.30 would put OSI in the top third of all DVC Smalltech profiled

companies. MacDonald Dettwiler, on the other hand has nearly doubled off its October

2008 lows of approximately $16 and now trades above one times sales again. MDA’s

market cap is now 1.27 billion (40.47 million shares multiplied by a closing share

price of $31.31 on September 18th, 2009)while its revenue in the trailing four

quarters was $1.07 billion.

2. Cash and Short term investments to market cap:

OSI: 6.3%

MDA: 2.97%:

When compared to their market caps, Neither OSI nor MacDonald Dettwiler could be

called cash rich. With just $510,000 in cash and short term investments as of May

31st, 2009 OSI has just 6.3% in the bank. But MDA falls even shorter. With just

37.68 million in the bank as of June 30th, 2009 MDA has just 2.97% of their market

cap at hand.

3. Debt to market cap:

OSI: Zero

MDA: 34.1%

OSI, like many of the DVC Smalltech Letter profiled stocks carried no long term debt

as of May 31st, 2009. MDA, on the other hand, might be described as “debt-laden”. On

June 30th, 2009 MDA reported just over $432 million in long term debt, or just over

34% of its market cap. Of course many would argue that MDA wouldn’t be a heavyweight

at all if it couldn’t access and manage a large debt load.

4. Trailing three year growth rate:

OSI: 35.5%

MDA: 12.6%

MDA has done a lot of growing since 1969 and, considering its size, that double

digit growth rate is impressive. MDA grew from just over $832 million in revenue in

2005 to $1.16 billion in 2008. In actual dollars, OSI’s growth is pocket change to

MDA, but a 35.5% annualized growth rate over three years is impressive regardless of

the size of the company. That number would place OSI in the top third of all DVC

Smalltech Letter profiled companies.

5. Enterprise Value to Sales:

OSI 28.5%

MDA 155%

Enterprise value is the really the metric that answers the question “How much love

does the market have for your company?”. Unfortunately for OSI at this time, as with

many small Canadian techs, the answer is “not much”. Here we compare each companies

Enterprise Value (The formula for calculating EV is Market Cap + debt – Cash and

short term investments). and express it as a percentage of their sales. The market

gives OSI an Enterprise value of just over $7.5 million, while sales from their

trailing four quarters were 26.4 million. OSI certainly has a lot of room to grow

into the public profile of MDA, whose EV clocks in at just over 1.6 billion, while

sales from the trailing 4Q’s totaled just $1.07 billion.

Leave a Reply

You must be logged in to post a comment.

Share

Share Tweet

Tweet Share

Share

Comment