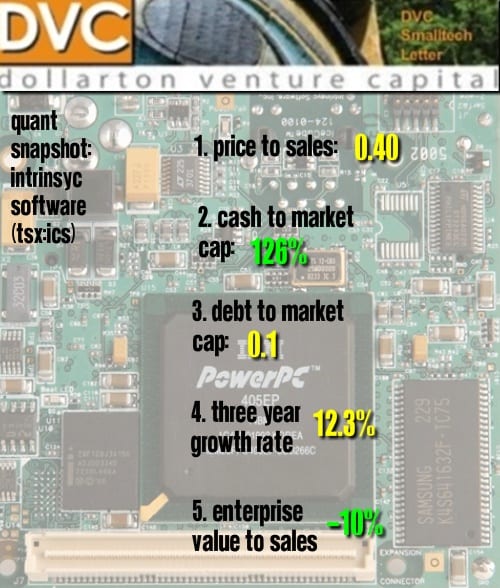

Quant Snapshot: Intrinsyc Software (TSX:ICS)

Underlying data:

1. Price to sales:0.40

As of Q4, 2008 Intrinsyc had 163,254,903 shares outstanding. The price

as of April 6, 2009 was $.06 This gave The Company a market

capitalization of $9,795,294. In the trailing four quarters sales

totaled $24.73 million.

2. Cash to market cap:126%

As of Q4, 2008 reported cash and short term investments was $12.39 million. Market cap as of April 6, 2009 was $9.79 million.

3. Debt to market cap:0.1%

The Company reported long term debt of $40,000 as of Q4, 2009.

4. Three year growth rate: 12.3%

Sales for fiscal 2005 were $17.5 million. Sales grew to $24.7 million in fiscal 2008.

5. Enterprise value to sales: -10%

The Company’s Enterprise Value as of Q1 2009 was $-2,554,706 million

using the formula (market cap + long term debt – cash and short term

investments). Sales for the trailing 4Q’s were $24.7 million

SuperUser

Writer