Haywood report on Vancouver e-commerce companies is blueprint for IPO candidates

A recent report by Vancouver-based Haywood Securities analyst Pardeep Sangha, titled “A View Into Three of Vancouver’s Private E-Commerce Companies”, offers a detailed snapshot into three privately held companies, BuildDirect Technologies Inc., Cymax Group, and SHOES.COM, Inc., each of which are prime candidates for an IPO event in the near future.

This should come as good news in an otherwise sluggish environment for Canadian tech companies trying to make the leap to the TSX, setting aside last year’s Shopify IPO.

Sangha points out that while the Canadian e-commerce market in general remains less developed than the U.S., Canadians are expected to outpace Americans by 2019, driving commercial activity online to a nearly $50.0 billion market, up from approximately $29.6 billion in 2015.

The main thing that the three companies profiled in the Haywood report have in common is that they’re all e-commerce companies, albeit e-commerce companies working in three very different areas of retail, each of which has innovated a solution unique to their own challenges.

What they also have in common, along with every tech companies and business in general now, is that they have each figured out how to capitalize on data as a natural resource, or as Sangha puts it, “each firm has pivoted in its own way to go beyond e-retailing to become data-driven e-commerce platforms.”

Both BuildDirect and Cymax have solved the supply chain challenges needed to deliver large objects, heavy-weight home building materials in the case of BuildDirect and enormous home or office furnishings in the case of Cymax, directly to the consumer’s home, beating Amazon to that particularly lucrative punch.

SHOES.COM deals in footwear, apparel and fashion accessories.

What all three companies also have in common, other than calling Vancouver’s Lower Mainland home, is that they have all reported steep revenue growth in recent years, to the point that each of them are shaping up to be potential IPO candidates at some point over the next two years.

In July, BuildDirect reported 350% growth in its new Home Marketplace just three months after its launch.

Last September, SHOES.COM rolled out two-hour delivery in Vancouver and Toronto, following a stretch in which they reported 300% year-over-year revenue growth, to the point where they now generate over $300 million in gross annual revenue.

Interviewed by Cantech Letter last April, Cymax CEO Arash Fasihi said, “Nobody knows about us. We’re probably one of the largest tech companies in Canada that nobody’s heard of.”

Well, by this point, most Canadian investors have heard of Cymax.

Having brought reclusive PlentyOfFish founder Markus Frind out of retirement to lead a $25 million Series A financing round through his Frind Holdings in October 2015, Cymax now employs 220 people and reported revenues of $180 million in 2015, up from 85 employees and $100 million revenues in 2013.

“With many private companies and technology IPOs failing to meet their highly optimistic growth forecasts, investor focus is now shifting towards companies with more durable business plans, with an ability to control expenses and ultimately find a quicker path to profitability.” – Haywood Securities analyst Pardeep Sangha

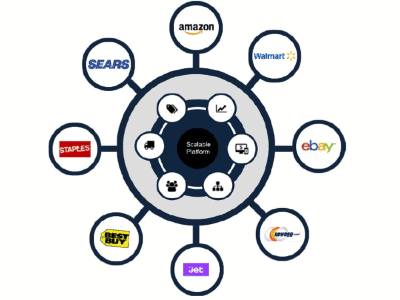

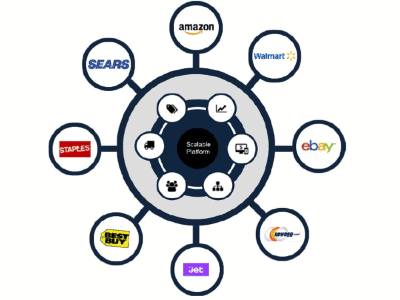

Sangha reports that Cymax generates 61% of its revenue through direct sales and 39% through indirect sales channels, for a blended gross margin of 21%.

“Cymax had intended to go public in 2016, but was similarly held back by the weak capital markets,” offers Sangha. “The Company launched several new initiatives over the past six months, including Constant Retail, with more projects planned for 2016. Similarly, we believe Cymax needs to gain traction with Constant Retail and continue delivering on its brand and growth strategy before testing the IPO waters again, which may take place sometime in 2017.”

With $230 million revenues in 2015, over 500 employees and a total of $45 million raised capital, SHOES.COM is competitive with American industry leaders like Zappos and DSW, not to mention Canadian heavyweights like Hudson’s Bay Company and Shop.ca.

Sangha reports that SHOES.COM is targeting $1 billion in net revenue within the next three years, “setting its sights on achieving over 30% annual organic growth, complemented with strategic acquisitions, by 2018.”

Referring to the company’s subsidiary online outlets, Sangha writes, “SHOEme.ca is expected to generate 88% organic revenue CAGR from $22M in 2015 to $137M in 2018, while OnlineSHOES.COM is expected to grow at 38% organic revenue CAGR plus acquisitions to achieve $417M in 2018 revenue, up from $208M in 2015.”

Sangha also notes that SHOES.COM has a long-term EBITDA margin goal of 10%.

Times in start-up land are difficult right now, despite Pollyana-ish reports to the contrary. Only 123 companies raised equity capital in Q1 2016, down from 153 for the same period in 2015.

Meanwhile, on the markets, listed companies raised a total of $235 million through IPO financings, down 80% year-over-year from $1.2 billion during the same period in 2015.

Noting that many investors had already begun focusing, in 2014 and 2015, more on top-line revenue growth as an important metric for evaluating private technology companies for funding, Sangha adds, “with many private companies and technology IPOs failing to meet their highly optimistic growth forecasts, investor focus is now shifting towards companies with more durable business plans, with an ability to control expenses and ultimately find a quicker path to profitability.”

Profiling these three e-commerce companies which are thriving with data-driven business models and fueled by organic growth and savvy financing, Haywood’s report is a fascinating read, not only to highlight three Vancouver area companies worth a look, but perhaps also as a blueprint for other companies struggling to emulate their success during difficult times.

Terry Dawes

Writer