Shopify (Shopify Stock Quote, News, Charts, Analysts, Financials TSX:SHOP) has broken through the symbolic $2,000 per share price barrier on the Toronto Stock Exchange, but the stock isn’t for everyone, says portfolio manager Norman Levine.

“It depends on what kind of investor you are,” said Levine, managing director at Portfolio Management Corp, speaking on BNN Bloomberg on Friday.

“If you’re a growth investor then Shopify is a Canadian stock that you want to own. We don’t have a lot of great, pure growth stocks in Canada and in technology stocks, so this is one you want,” he said.

“If you’re more of a value or ‘GARP’ (growth at a reasonable price) investor then Shopify gets more difficult to own. It’s hard to buy on a valuation basis because almost no matter how fast it’s growing the multiple is still way ahead of [that growth],” Levine said.

Shopify continues to defy the odds with its share price growth, returning in 2020 a huge 178 per cent, while so far this year the stock is up a further 38 per cent. SHOP climbed almost 23 per cent in the month of June alone, and that’s in a year which has been quite good but not exceptional for tech, especially for stocks of the growth variety. As a whole, the S&P/TSX Information Technology Index is up 21 per cent, while the tech-heavy NASDAQ in the US is up 17 per cent.

And while it’s true that SHOP has its significant swings, the stock has shown great resiliency over the years, taking hits of over ten per cent after events such as short reports and less-than-stellar quarters but bouncing back each time in relatively short order.

For a time, the knock against Shopify was that its customer base — the merchants who sell their products online via SHOP’s platform — featured a generous dollop of fly-by-night businesses whose ability to prop up Shopify’s success was, the theory went, bound to come to an end when all those jewelry-makers and custom fly-swatter entrepreneurs returned to their day jobs.

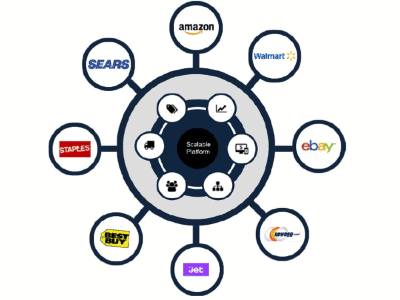

But that criticism no longer gets much airtime, with more and more established, brand name companies partnering with Shopify Plus and the growth in mom-and-pop stores signing up with Shopify showing little sign of letting up, especially with the surge in e-commerce over the past year and a half pulling more and more shoppers online.

Ahead of Shopify’s second quarter results due on Wednesday, Shopify is expected to crest the billion dollar mark in sales for the quarter, with analysts expecting Q2 revenue to hit $1.04 billion, which would represent a 46 per cent increase over the previous year. At the same time, the consensus call is for earnings to come in a shade lower than last year’s Q2 at $0.97 per share. (All figures in US dollars.)

Shopify last reported financials in late April where the company’s first quarter results featured a 110 per cent year-over-year ramp up in revenue to almost one billion dollars at $988.6 million. Merchant Solutions revenue grew at an even greater pace of 137 per cent to $668.0 million, led by strong growth in Gross Merchandise Volume, a measure of the total dollar value of orders through Shopify’s platform including apps and channels.

“Our singular focus is on making entrepreneurship easier, and making it easier for entrepreneurs to succeed,” said Shopify President Harley Finkelstein in a press release. “Merchant sales growth on our platform accelerated in the first quarter as merchants leveraged our modern commerce technology, which helps them compete in any retail environment and engage directly with their customers wherever they are.”

Levine says there’s no questioning SHOP’s status as a growth stock, yet the temptation is still there for even more risk averse investors to buy the stock.

“I have to admit that a number of my value-type competitors have bought Shopify, regardless, to try and juice their performance,” Levine said. “But we look at the risk-reward on it and say, is the potential risk of [an earnings miss] or of people deciding that the valuation is outrageous worth trying to keep up with an index leader? We’ve decided that it’s not.”

“We don’t own it for our clients. That doesn’t make it a bad company or stock. It just doesn’t fit our clients’ risk/reward profile,” he said.

Shopify made news this week with the announcement that its merchants could now sell non-fungible tokens (NFTs) to customers, with the NBA’s Chicago Bulls coming on as one of the first stores to sell the blockchain-based assets.

“If you’ve spent 1 minute on the internet this year, you’ve seen a lot about NFTs,” said Finkelstein on Twitter. “@Shopify we are making it easier for our merchants to sell NFTs directly through their stores.”

“Before Shopify offered this capability, merchants would have to sell through a third party marketplace aka less control of the sale and customer relationship. Once again we are putting the power back into the hands of merchants and meeting customers how and where they want to buy,” he said.

Leave a Reply

You must be logged in to post a comment.

Share

Share Tweet

Tweet Share

Share

Comment