In a now famous 1959 speech, John F. Kennedy, many leading linguists believe, misinterpreted the meaning of the Chinese word for crisis. The word is composed of two characters, he said, “One represents danger, and the other represents opportunity”. But this is mere historical nitpicking. JFK’s point stands for Presidents, motivational speakers and, not least of all, for technology. The high-profile visit of uber-environmentalist Jim Cameron to Alberta’s oil sands last month brought home the point that the world is expecting the industry to change and adapt -to make opportunity from its real or perceived crisis. This month we profile Canadian technology stocks that are changing the world of oil and gas by applying world class technology solutions.

Calgary’s Computer Modelling Group (TSX:CMG) is an Alberta technology success story. In 1978, the company was a small Calgary based research facility. Today, CMG has five offices around the world, and is more likely to make a sale of its leading edge reservoir simulation software outside of Canada than here at home. Ken Dedeluk has been at the helm of Computer Modelling Group for more than a decade. We talked to him about attracting talent in Alberta, why the company decided to declare a dividend, and what the future holds for the groundbreaking company.

Nick Waddell: Ken, I want to thank you for taking the time to talk to Cantech

Letter readers about Computer Modelling Group. For our readers who

aren’t aware can you describe to us what, exactly, CMG’s reservoir

simulation modeling does and how it increases efficiencies for oil and

gas companies?

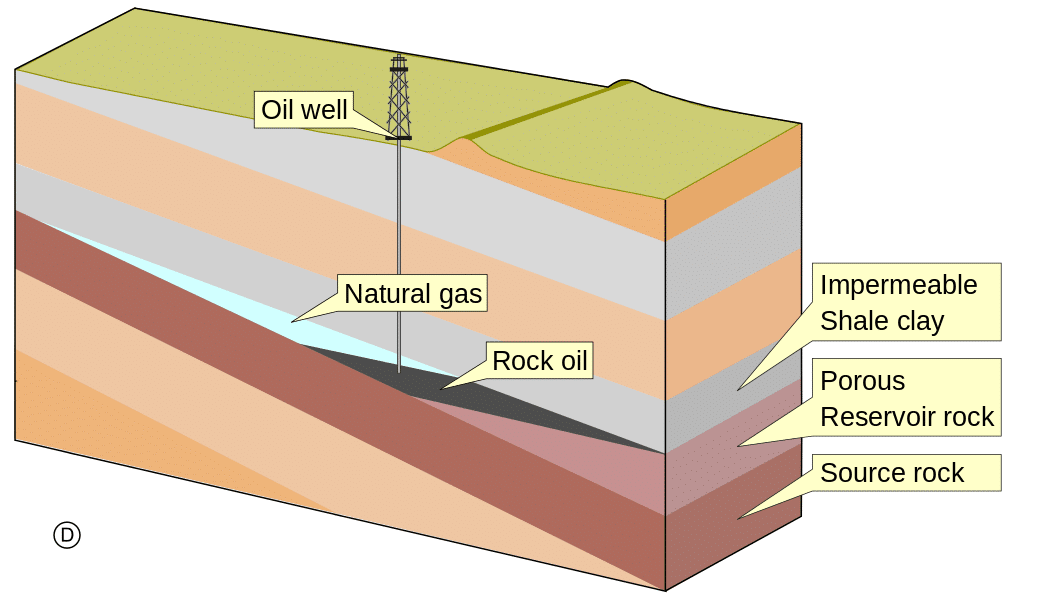

Ken Dedeluk: CMG is a company that specializes in developing software, that Oil and Gas companies use to maximize oil and natural gas production from a given reservoir. By modeling the static reservoir, and then applying alternative production strategies (dynamic modeling), we are able to predict the optimum production scenarios. We can also extend the life of many fields, by testing Enhanced Oil Recovery (EOR) techniques using the simulator. A few of the EOR techniques that we can simulate are CO2 injection, Steam Injection, Nitrogen Injection, Chemical Injection (Alkaline, Surfactants, and Polymers), and Air Injection.

NW: Before computer modeling of reservoirs became a reality, how did

oil and gas companies get a sense of what they had on their hands?

KD: Essentially, by using geological and geophysical information related to the reservoir combined with well information gathered during the initial drilling and production testing of these wells, an oil and gas company would estimate the amount of oil and gas in the reservoir and using recovery rates from analogous reservoirs estimate the recoverable amount of reserves that would be produced from the reservoir. Using this information (basically a static reservoir model) and the lessons learned in the development of similar reservoirs the company would come up with a development plan. Over time with additional production history, using decline analysis for example, the company could refine it estimate of remaining recoverable reserves and potentially modify its development plan.

With the use of reservoir simulation, companies can now take this static reservoir information and apply alternative production strategies to come up with the optimal development plan, more barrels for fewer dollars, as well as investigate the potential of EOR techniques to maximize recoverable reserves over the life of the reservoir.

With the use of simulation, companies no longer need to take a “wait and see” approach they can now employ a proactive “what could it be” approach.

NW: I read how larger oil and gas companies have set up stereoscopic

visualization rooms using your Results 3D project. It sounds like they

are committed to being up on the very latest technologies…

KD: Because simulators produce such a great volume of information that is critical in the assessment of a reservoir’s performance, the visualization rooms have been set up to view and evaluate large quantities of data using visualization and animation software. Think of it as reading an entire book in 20 seconds, and knowing what the entire story is. The old adage of “a picture is worth a 1000 words” is demonstrated using this 4D visualization software.

NW: Every company out there seems to be looking to become more green, or “reduce their carbon footprint” etc. Are there ways in which CMG’s Technology helps them do this?

KD: We are working on programs that simulate the storage of CO2 in old, abandoned reservoirs, and in many cases determine if there is extra producible oil as a result of the CO2 injected. CO2 can act as a solvent, to help mobilize oil that was left behind, when the reservoir was first produced. In addition, we have added features to our compositional simulator and allows us to predict the storage behavior of CO2 when it is injected into deep, saline aquifers, when it eventually reacts with the rock, creating carbonate minerals, thus storing the CO2 permanently underground. Many of our customers are looking at ways to capture, and to permanently store their CO2 emissions.

NW: Do you see evidence that technology developed for the oil and gas sector in Alberta being used other places in the world?

KD: Most definitely. Approximately 70% of our business in now international, and many techniques and processes that were first developed here in Alberta, have now been employed around the world.

NW: How do you find Canada, and Calgary in particular is in terms of attracting high level talent? Are you seeing any evidence that the “brain-drain” still exists?

KD: We have had the good fortune, to attract some of the finest researchers from around to world, into CMG’s R&D group.

NW: You recently have done a couple things to increase shareholder value. You increased your dividend and initiated a share buyback program. Did the board deliberate for a long time about these moves, or did it just seem like a natural fit?

KD: Both programs were natural evolutions of profitable companies that generate more cash, than they need to grow their business. It is also a prudent way to return to money to the shareholders, without squandering it on some hair brained scheme or idea, that is not in line with our fundamental business.

NW: Anecdotal evidence suggests to me that CMG is one of the most admired companies we cover. Adam Adamou of Caseridge Capital who is a frequent contributor to Cantech Letter has been a long term supporter of your company. He wrote in one of our early pieces that your stock was being ignored by analysts. How do you feel about this? Is CMG being ignored by analysts? Do you have any thoughts on why this might be the case?

KD: We have not had the need to raise money, and therefore the street has not paid much attention to us. Adam is an astute investor and analyst. He evaluated the ability for the business to generate growing profits, based on his gross margin multiple, and didn’t worry about the view “on the street”.

NW: What does the future hold for CMG?

KD: We have tremendous momentum in our market sector, and as long as we continue to “support, support, support” our customers, and continue to invest significantly in our R&D efforts, we should be rewarded with customer loyalty and continuous use of our products. We have spent 32 years getting to where we are today, and don’t plan on changing our true and tested formula for success. It is CMG’s tradition, to “Just do it right!”

Leave a Reply

You must be logged in to post a comment.

Share

Share Tweet

Tweet Share

Share

Comment