Firan Technology Group keeps “Buy” rating at Beacon

Firan Technology Group (Firan Technology Group Stock Quote, Chart, News, Analysts, Financials TSX:FTG) may not make headlines often, but the aerospace and defence electronics manufacturer continues to quietly build momentum in a sector where precision and reliability are everything, says one analyst.

In a May 1 note, Beacon Securities analyst Russell Stanley said several of Firan’s direct and end customers have recently reported earnings and updated their fiscal 2025 outlooks. Despite ongoing tariff uncertainty, most maintained their previous guidance and noted continued strong demand, an encouraging sign, he said.

His rating and target for Firan remain unchanged at “Buy” with a $12.00 price target.

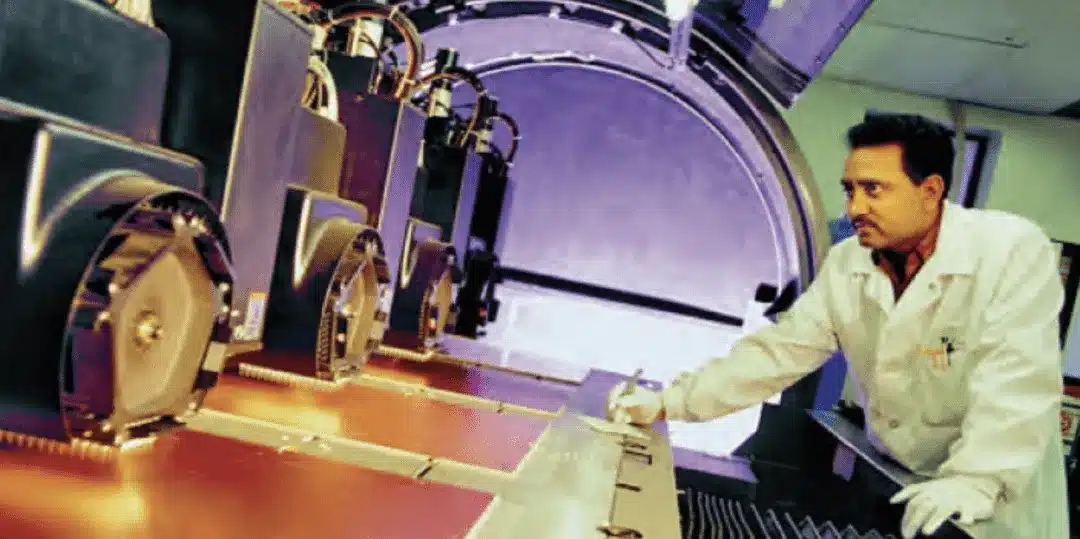

Firan Technology Group manufactures electronic products and subsystems for the aerospace and defence sectors, operating facilities in Canada, the United States and China. Its FTG Circuits division produces printed circuit boards, while FTG Aerospace specializes in illuminated cockpit panels, keyboards, bezels and related assemblies. Headquartered in Toronto, the company employs approximately 750 people.

Stanley thinks the company will post $32-million in Adjusted EBITDA on revenue of $194-million in fiscal 2025 and believes those numbers will improve to $212-million on revenue of $37-million in fiscal 2026.

Stanley said demand for commercial aircraft remains strong, with orders continuing to outpace deliveries.

“Yesterday, Airbus (AIR-Paris, Not Rated) reiterated its guidance for F2025 deliveries of 820 aircraft, with its current backlog (8,726 aircraft) still representing 10+ years of production based on this year’s production rate,” Stanley said. “Orders continue to outpace deliveries (280 gross orders/204 net vs. 136 delivered). A320 deliveries totalled 106 during the quarter (78% of the total), with AIR working to take monthly A320 production to 75 aircraft in 2027.

“Late last week, Boeing (BA-NYSE, Not Rated) similarly reported that orders continue to outpace deliveries (221 vs. 130), with its backlog of 5,600 planes also representing 10+ years of production based on consensus F2025 deliveries of 538 aircraft. Monthly production of the 737 (81% of Q1 deliveries) is now in the low 30s, with BA planning to reach the current FAA cap of 38/month within a few months. Assuming stable production, Boeing plans to request a lift in that cap to 42/month later this year.”

Stanley said Boeing’s defence unit scored a significant win, being selected by the U.S. Air Force to design and build the NGAD/F-47 aircraft, an achievement management called a “transformational accomplishment.”

“This order is not yet in Boeing’s backlog,” he said. “RTX (RTX-NYSE, Not Rated), the world’s largest aerospace and defence company, reiterated its F2025 guidance for revenue of $83-$84B (organic growth of 4-6%), adj EPS of $6.00-$6.15 per share, and CAPEX of $2.5-$2.7B.”

Significantly, that guidance does not factor in potential tariff impacts on raw material and component imports. During Boeing’s conference call last Tuesday, management said there hadn’t been significant changes in customer behaviour in April. Demand remains strong, and the company is “in an urgent mode in terms of increasing capacity across the board.”

“Notably, that guide does not include the evolving impact of tariffs,” Stanley said. “Though during its conference call, management noted that its strong Q1 sets up LMT to absorb currently known tariff headwinds as well as the loss of NGAD / F-47 program to BA. LMT management noted it plans to apply much of the technology developed for that 6th generation fighter to its 5th generation program (the F-35), adding to its marketability.”

-30-

Rod Weatherbie

Writer

Rod Weatherbie is a journalist based in Prince Edward Island. Since 2004, he has written extensively about the Canadian property and casualty insurance landscape. He was also a founder and contributing editor for a Toronto-based arts website and a PEI-based food magazine. His fiction and poetry have been featured in The Fiddlehead, The Antigonish Review, and Juniper.