Strong company, pricy stock.

That’s the takeaway from National Bank Financials’ Adam Shine and his coverage initiation of Hammond Power Solutions (Hammond Power Solutions Stock Quote, Chart, News, Analysts, Financial TSX:HPS.A).

As reported by the Globe and Mail April 10, Shine launched coverage of HPS.A with a “Sector Perform” rating and a price target $164.00.

The analyst offered an overview of where Hammond is and why it has caught the eye of more investors of late.

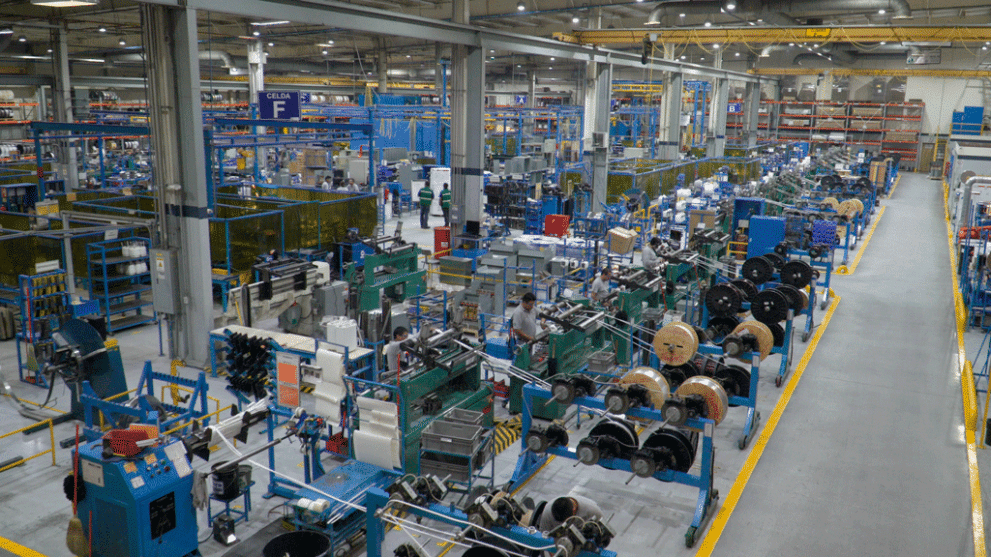

““Hammond Power Solutions (HPS) has a manufacturing presence across the North America, and India and a dominant share of the dry-type transformer market in North America (approximately $3-billion fragmented market),” Merer wrote. “Revenues grew 87 per cent over the last two years along with demand for its products and the market should continue to grow at more than 10 per cent per year. Growth is coming from residential, commercial, industrial and transportation markets and supported by sectoral tailwinds from re-shoring, electrification and rising data center demand. The company is also expanding its offerings in related power quality products.”

That’s all good for the company, but for investors the stock has a 52-week low of $35.85 and is currently trading near its 52-week high of $157.90. This “rapid” rise is the reason for the cautious rating.

“With revenue growth of 27 per cent year-over-year in 2023, EBITDA margins were up y/y to 17 per cent from 12 per cent, driving a 68-per-cent year-over-year increase in EBITDA,” the analyst noted. “HPS achieved $5.33 EPS in 2023, a two-year increase of 313 per cent. The stock has responded, up more than 1000 per cent over the last two years. HPS is in a good position to grow, as it has a strong balance sheet, strong FCF and a small dividend. HPS achieved a 26-per-cent ROIC in 2023 and sees a rapid payback on organic growth. It could look for M&A in associated product lines, like power quality products.”

Share

Share Tweet

Tweet Share

Share

Comment