2023 was the year the term “Magnificent Seven” was popularized. The term, which refers to a group of U.S. tech stocks that outperformed the market heavily in 2023, was everywhere.

But in 2024 that wealth will be spread more broadly, say analysts from RBC Dominion Securities. One segment of the market that stands to benefit the most is Canadian tech stocks, the firm says.

As reported by the Globe and Mail January 24, analysts Paul Treiber and Maxim Matushansky, says this small sub-sector of equities is cheap.

“Although valuation multiples of some stocks (like Shopify) materially increased in 2023, the vast majority of Canadian tech stocks continue to trade below historical averages,” the pair wrote. “On an equal weighted basis, the valuation multiples of our coverage universe are 8 per cent below the average valuation over the last 10 years. In comparison to the last 5 years, our coverage universe is trading 20 per cent below the valuation average. Compared to the last two years, our coverage universe is still 2 per cent below the average valuation over the last two years. It is only in the last year where the valuation of our coverage universe is now 10 per cent above the valuation average over the last year. Other than Shopify, valuations of most Canadian tech stocks remain compressed. Some stocks like Shopify and Celestica have experienced material valuation multiple expansion in 2023, which has resulted in the valuation multiples of the average stock in our coverage universe increasing 22 per cent in 2023. However, the valuation multiples of the median stock in our coverage universe rose just 4 per cent in 2023. Moreover, valuation multiples expanded for 13 of our 21 covered stocks in 2023, whereas 8 have experienced valuation multiple compression.”

Treiber and Matushansky identified four stocks they think will do well in 2024.

Constellation Software (Constellation Software Stock Quote, Chart, News, Analysts, Financials TSX:CSU) they say, is not the cheapest stock but is one that should continue to perform.

“While Constellation’s valuation multiple has increased, we believe the stock is likely to sustain a historically high valuation, as we see Constellation continuing to compound capital at high rates,” they wrote.

Shopify (Shopify Stock Quote, Chart, News, Analyst, Financials TSX:SHOP) is not on any value investors list of finds, yet the pair think it will have a strong year once again.

“We believe Shopify is likely to sustain a premium valuation, given solid growth, improved profitability, and strong product execution,” they said.

Open Text (Open Text Stock Quote, Chart, News, Analysts, Financials TSX:OTEX) has not done well of late, but Treiber and Matushansky think the trend will be reversed in 2024.

We believe OpenText’s valuation is likely to rise toward its historical average, as organic growth strengthens, leverage declines, and FCF increases. OpenText is trading at 8.8 times NTM [next 12-month] EV/EBITDA, below its pre-acquisition 3-year historical average of 12 times,” they wrote.

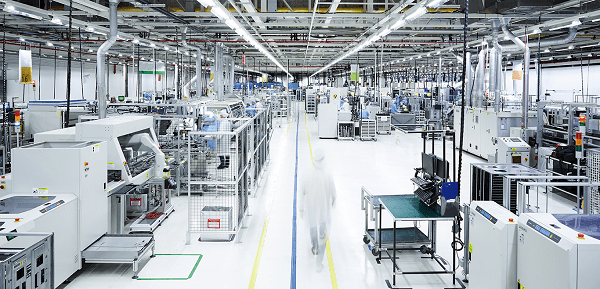

Lastly, Celestica (Celestica Stock Quote, Chart, News, Analysts, Financials TSX:CLS) is a stock the analysts like a lot.

“In our view, Celestica has the potential for continued outperformance in Q4 given recent positive customer and competitor commentary on AI-focused capex investments. While we believe there is downside risk in Celestica’s ATS segment guidance, there is likely upside potential in the CCS segment in Q4 and throughout FY24,” they said.”

Share

Share Tweet

Tweet Share

Share

Comment