After its Q2 results missed the mark, H.C. Wainwright analyst Mike Colonnese has downgraded HIVE Digital Technologies (HIVE Digital Technologies Stock Quote, Chart, News, Analysts, Financials Nasdaq:HIVE).

On November 13, HIBE reported its Q2, 2024 results. The company lost (US) $24.5-million on revenue of $22.8-million.

“Hive’s executive management team has skillfully navigated the recent bear market and are proud of achieving a gross operating margin of $4.6-million this quarter,” said CEO Aydin Kilic.”We produced 801 bitcoin this quarter, in a period where bitcoin mining difficulty increased 9 per cent quarter over quarter, reaching a then all-time high of 57T. Hive produced 834 bitcoin in the previous quarter; thus, our quarter-over-quarter bitcoin production represents only a 4-per-cent decrease despite a 9-per-cent increase in difficulty, the reason being that Hive’s operating hash rate increased substantially quarter over quarter.”

As reported by the Globe and Mail, the analyst on November 20 dropped his rating on the stock from “Buy” to “Neutral” and cut his price target from (US) $7.00 to $3.50. Colonnese explained the reasoning behind the move.

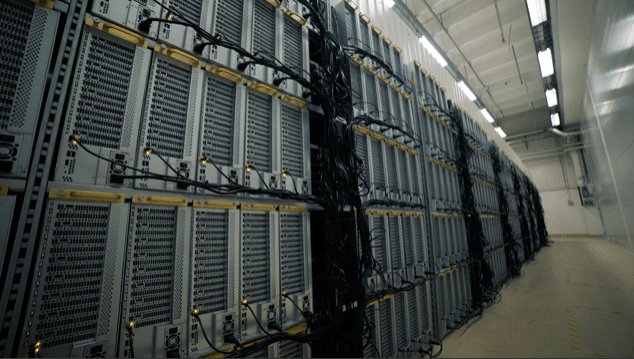

“Management postponed its calendar year-end 2023 hash rate guidance of 6 EH/s [exahashes per seconds] out one year to 2024 in its presentation,” he wrote. The delay in incremental hash rate deployment (beyond the 4.3 EH/s currently operating) could result in HIVE losing share leading up to the April 2024 halving event, as we see it, given the network hash rate continues to rise at a rapid pace. Meanwhile, HIVE’s direct production costs have risen considerably over the past three quarters and came in at $22,639 per BTC [bitcoin] mined in F2Q24, which represented a 21-per-cent quarter-over-quarter jump, largely driven by the abolishment of a reduced energy tax for data center operations in Sweden by the Swedish Parliament, which took effect in July. We estimate HIVE’s all-in cash cost to mine a coin in F2Q24 was over $27,000/BTC vs. an average BTC price of $28,000. HIVE’s high production costs and relatively low fleet efficiency (over 30 joules per terahash), could leave the company in a precarious position when the block reward miners receive is halved next April. As such, we believe it is prudent to move to the sidelines until we see greater revenue contribution from the high-performance computing (HPC) business, abating production costs, or higher BTC price levels.”

Share

Share Tweet

Tweet Share

Share

Comment