Two Bluechip Picks for October 2023

When the markets get really choppy, as they are now, people often talk about a flight to safety.

But what does that mean?

It means, for one, a history of delivering steady growth, expanding your customer base and delivering returns to shareholders.

At Cantech Letter we find the best of Canadian tech stocks through the people who know them better than anyone else, the equity analysts at Canada’s best investment banks.

Let’s dive into two bluechip picks from the experts.

OPENTEXT

The stock has been a strong performer in 2023, but National Bank Financial analyst Richard Tse says there is still money to be made on OpenText (OpenText Stock Quote, Chart, News, Analysts, Financials TSX:OTEX).

After a head-to-head meeting, Tse says he came away with confidence in his investment thesis.

“We had the opportunity to meet investors with OpenText Management (CEO and CTO Mark Barrenechea and EVP and CFO Madhu Ranganathan) today,” Tse wrote. “Over the course of our meetings, we learned (1) the Company continues to execute well on its integration of Micro Focus; (2) OpenText is moving back to an emphasis on organic growth; and (3) its organic emphasis appears to be underscored by its focused efforts in AI with opentext.ai, a strategic approach to advance how customers solve complex problems by applying Artificial Intelligence (AI) and Large Language Models (LLM) with their OpenText Information Management software. In the short term, the Company appears to be tracking to its outlook for the coming calendar Q3 (fiscal Q1). Further out, the Company is expecting to see an acceleration in organic cloud growth over the next 12-18 months. All in, what we heard remains consistent with our investment thesis, and from a valuation standpoint, 8.4x F24 EV/EBITDA looks compelling against the Company’s relative growth potential with de-levering being a further benefit to the equity holder.”

In a research update to clients September 6, Tse maintained his “Outperform” rating and one year price target of (US) $60.00 on OpenText, implying a return of 52.7 per cent at the time of publication.

LIGHTSPEED

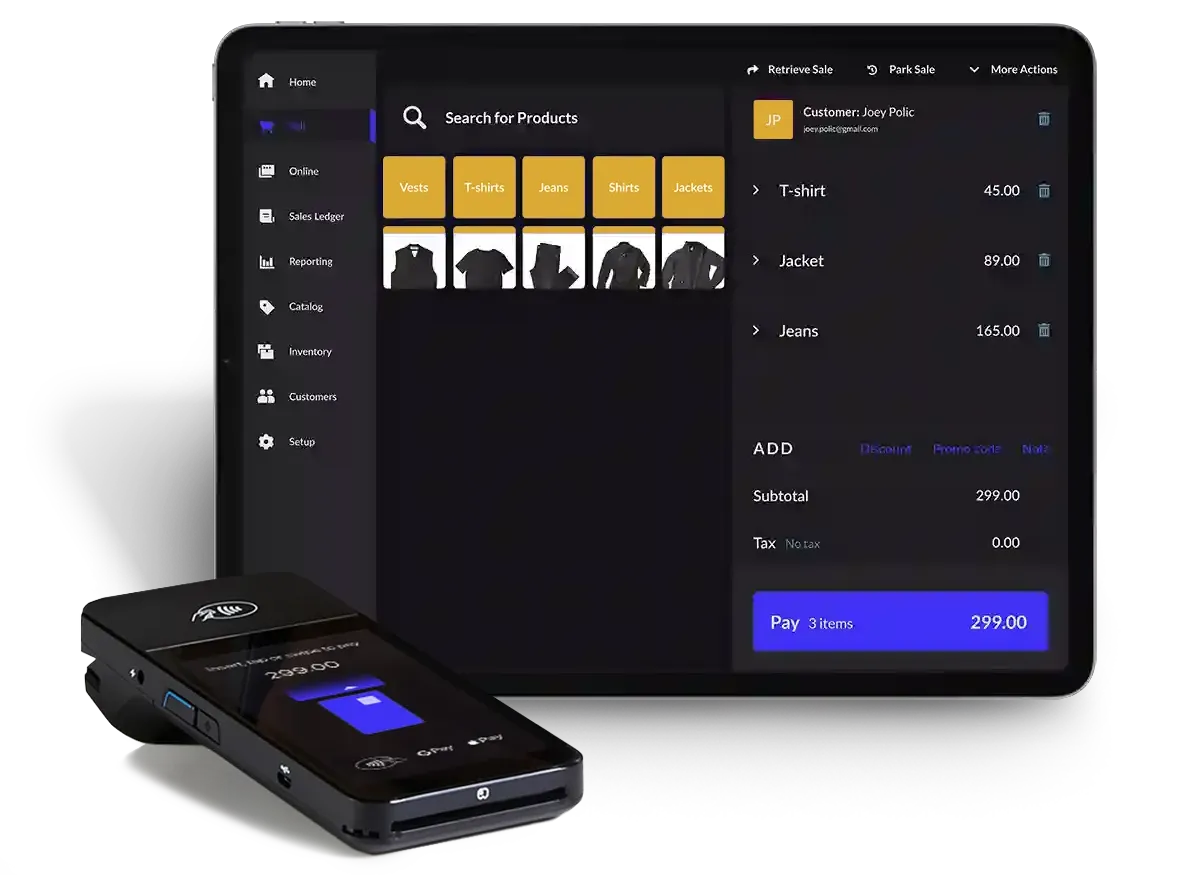

Following the company’s most recent quarterly results, Industrial Alliance Securities analyst Neehal Upadhyaya remains bullish on Lightspeed Commerce (Lightspeed Stock Quote, Chart, News, Analysts, Financial TSX:LSPD)

On August 3, LSPD reported its Q1, 2024 results. The company lost (US) $48.7-million on revenue of $209.1-million, a topline that was up 20 per cent over the same period last year.

The analyst characterized the quarter.

“Q1/F24 revenues came in at ~$209M, ahead of our estimate and consensus at ~$197M and ahead of guidance of $195-200M,” he said. “The beat was mainly due to higher-than-expected transactions-based revenue as payment penetration rates breached the 20% threshold reaching 21.8%. Adj. EBITDA came in at ~($7M), ahead of our estimate, consensus, and guidance of ~($10M). The beat was due to higher-than-expected revenues along with a significant decrease in OpEx, as spend across the board was below historical averages as a percentage of revenue. The beat in Adj. EBITDA was not larger simply due to lower margins recognized of 42%, which came in below both Q1/F23 at ~45% and last quarter at 47%. Had LSPD achieved margins closer to the midpoint between last year and last quarter, Adj. EBITDA would have been positive.”

In a research update to clients August 4, Upadhyaya maintained his “Buy” rating and one-year price target on LSPD, implying a return of 32 per cent at the time of publication.

Staff

Writer