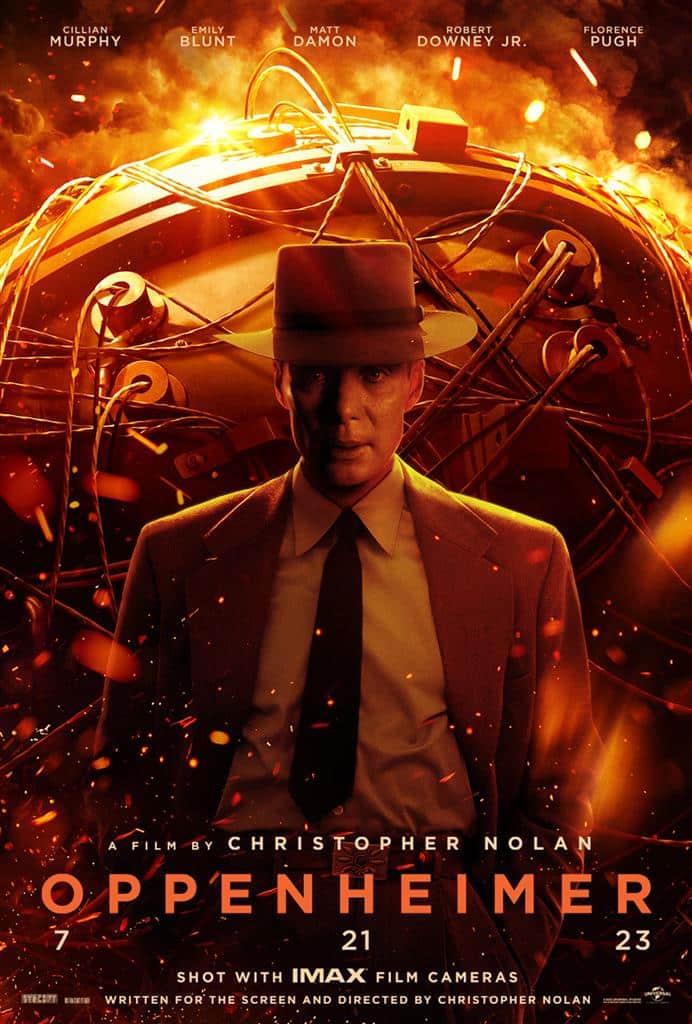

Buoyed by the movie Oppenheimer, IMAX (IMAX Stock Quote, Chart, News, Analysts, Financials NYSE:IMAX) had a good third quarter, and as a result Roth MKM analyst Eric Handler remains bullish on the stock.

The analyst says the big picture trend remains positive for IMAX.

“IMAX’s 3Q GBO far exceeded all projections paced by Oppenheimer. We are raising our 3Q estimates as a result, although our full year estimates are largely unchanged due to a lower 4Q box office forecast. Regardless, it is good to see IMAX continue to expand its box office market share, grow its global footprint, and increase its exposure to local language movies.”

In a research update to clients October 17, Handler maintained his “Buy” rating and one-year price target of $26.00 on IMAX.

The analyst believes IMAX will post EBITDA of $126.0-million on revenue of $393.7-million in fiscal 2023. He expects those numbers will improve to EBITDA of $133.2-million on a topline of $412.8-million the following year.

The analyst also weighed in with his fourth quarter outlook.

“We are lowering our revenue and adjusted EBITDA to $109mn (+11%) and $35mn (+26%), respectively, from $117mn and $39mn,” he wrote. “This revision reflects a decreased GBO forecast of $240mn (-4%) compared to our prior $282mn view. Two key drivers have impacted our view towards the quarter, including: (1) the pushed out release date for Dune 2 to March 15, 2024; and (2) a lackluster Chinese National Day Festival which saw IMAXgross a relatively modest $12mn with no major breakout hits which are likely to have legs, such as The Battle For Lake Changjin which amassed ~$32mn in 4Q21.”

Share

Share Tweet

Tweet Share

Share

Comment