The year 2000 was a remarkable and tumultuous period for Initial Public Offerings (IPOs), largely due to the dot-com boom. This era was marked by a surge in internet-based companies going public, driven by the widespread excitement and optimism about the potential of the internet and technology sector. Many investors, lured by the prospect of high returns, poured money into these startups, often overlooking traditional metrics like profitability or sustainable business models. What happened the next year? See the top IPOs of 2001, here.

The stock valuations of these internet companies skyrocketed, often reaching astronomical levels shortly after their IPOs. This frenzy was partly fueled by media hype and a general sense of not wanting to miss out on what was seen as a once-in-a-lifetime investment opportunity. This period saw some of the most hyped and initially successful public offerings, with stocks sometimes doubling or tripling in value on their first day of trading.

However, this enthusiasm was not grounded in economic reality. Many of these companies were burning through cash rapidly with no clear path to profitability. The situation was further exacerbated by speculative trading and sometimes questionable business practices.

This bubble in technology stocks eventually burst, leading to the infamous market correction that started in March 2000. The NASDAQ Composite, heavily laden with technology stocks, experienced a significant decline, wiping out billions of dollars in market value. The aftermath of this collapse was severe, with many of these once high-flying internet companies going out of business or seeing their valuations plummet to a fraction of their peak levels.

The 2000 IPO year, thus, stands as a cautionary tale about the risks of speculative bubbles and the importance of fundamental analysis in stock investing. It was a year of extraordinary highs followed by dramatic lows, deeply affecting investors, the tech industry, and broader financial markets.

California Pizza Kitchen IPO

California Pizza Kitchen (CPK), known for its innovative and non-traditional pizzas, made its debut on the stock market in August 2000. The company, founded by Larry Flax and Rick Rosenfield in 1985, had grown substantially by the time of its IPO, showcasing a new approach to pizza with unique and global flavors.

Their decision to go public came at a challenging time in the stock market, particularly following the burst of the dot-com bubble earlier that year. Despite these market conditions, CPK’s IPO was met with a fair amount of interest, as the company had established a solid reputation and a strong brand identity in the casual dining sector.

In its IPO, CPK priced its shares at $15 each, a rate that reflected both the company’s growth potential and the cautious investor sentiment prevailing in the market at that time. The funds raised were aimed at further expanding their restaurant locations, as well as strengthening their operational base.

CPK’s journey post-IPO had its ups and downs. While they managed to expand and grow their business, the company, like many in the restaurant industry, faced challenges including fluctuating consumer trends and the impact of economic cycles. Over the years, CPK underwent several changes in ownership and financial restructuring, reflecting the dynamic and often challenging nature of the restaurant business.

The story of California Pizza Kitchen’s IPO is thus a blend of entrepreneurial success and the complexities inherent in scaling a unique dining concept in a volatile market. It highlights the challenges businesses face in balancing growth aspirations with market realities, particularly in industries as competitive and consumer-sensitive as casual dining.

Energizer IPO

Energizer Holdings, widely recognized for its batteries and personal care products, embarked on its journey as a publicly traded company somewhat differently than many other businesses. Originally, Energizer was a part of Ralston Purina, a large American pet food company. In April 2000, Ralston Purina decided to spin off Energizer, marking its transition into a standalone public entity. This strategic move was aimed at allowing both Ralston Purina and Energizer to focus more effectively on their respective core businesses.

Unlike a traditional initial public offering (IPO), where shares are sold to raise capital, Energizer’s entry into the public market was through a spinoff. In this process, shares of Energizer Holdings were distributed to the existing shareholders of Ralston Purina. This meant that instead of buying new shares, Ralston Purina’s shareholders received shares of Energizer in proportion to their existing holdings.

The timing of Energizer’s spinoff was interesting, coming as it did at the turn of the millennium and amidst a volatile stock market environment, especially after the burst of the dot-com bubble. However, being a company with established products and a strong brand identity, Energizer’s market debut was viewed differently from the technology and internet-focused IPOs that characterized the period.

Post-spinoff, Energizer Holdings embarked on a path of expansion and diversification. They ventured beyond their traditional battery business to include various personal care products, such as razors and skin care items, broadening their market reach and product portfolio.

The story of Energizer’s transition into a public company through a spinoff illustrates an alternative route to entering the public market, different from a typical IPO. It’s a testament to how established companies can leverage their market presence and brand identity to navigate significant structural changes like becoming a publicly traded company.

Forcepoint IPO

Forcepoint, a company specializing in cybersecurity and data protection, has a unique journey regarding its public trading status. Unlike many companies that go public through an initial public offering (IPO), Forcepoint’s history is more intertwined with acquisitions and corporate restructuring.

Originally known as Websense, the company was publicly traded and well-known for its web filtering and security software. In 2015, Websense was acquired by Raytheon, a major American defense contractor, and merged with Raytheon’s own cybersecurity products. This merger marked the birth of Forcepoint.

As a result of this acquisition, Forcepoint became a privately held company under the Raytheon umbrella. This shift marked a significant transformation, pooling resources and expertise from both Websense and Raytheon’s cybersecurity divisions. The focus was on providing a range of security solutions, including cloud security, data protection, and insider threat solutions.

Instead of a traditional IPO journey, Forcepoint’s story is more about strategic acquisitions and the reshaping of its business within the realms of a larger corporate structure. This path reflects a common trend in the technology and cybersecurity sectors, where mergers and acquisitions are often key strategies for growth and expansion.

Throughout its existence under Raytheon and later developments, Forcepoint has continued to evolve, adapting to the rapidly changing cybersecurity landscape. This evolution is characterized by continuous innovation and the development of new products and services to address emerging threats and challenges in the digital world.

In summary, Forcepoint’s route to becoming a significant player in the cybersecurity market is not marked by an IPO, but rather through strategic acquisition and integration, showcasing a different facet of how companies in the tech sector can grow and establish their market presence.

Garmin IPO

Garmin, a company renowned for its GPS technology and wearable fitness trackers, made its debut on the stock market in an impressive manner. The company’s initial public offering (IPO) took place in December 2000, a time when the tech market was still reeling from the burst of the dot-com bubble. Despite the challenging market conditions, Garmin’s IPO stood out for several reasons.

Founded by Gary Burrell and Min Kao, Garmin had already established itself as a leader in the field of GPS technology, providing navigation solutions for automotive, aviation, marine, outdoor, and sports activities. Their products were known for their quality and innovation, appealing to both professional and consumer markets.

In its IPO, Garmin priced its shares at $14 each, a valuation that was considered reasonable and attractive, given the company’s solid financial performance and growth potential. The company raised around $122 million through its IPO, a substantial amount considering the cautious investor sentiment prevalent at that time.

Garmin’s successful IPO was a testament to its robust business model and the market’s confidence in its future prospects. Unlike many other tech companies that went public around the same time, Garmin was profitable, had a clear growth strategy, and a diverse range of products that were not just reliant on one sector or consumer trend.

Following its IPO, Garmin continued to innovate and expand its product line. The company adeptly navigated the shift from standalone GPS devices towards integrating its technology into a variety of platforms, including wearable tech. This adaptability and focus on research and development allowed Garmin to maintain a strong position in the market, even as consumer preferences and technology evolved.

Garmin’s journey from its IPO in 2000 showcases how a tech company with a strong foundation in product innovation, a clear market vision, and financial stability can successfully navigate public markets, even during turbulent times.

Hallmark Media IPO

Hallmark Media, widely recognized for its family-friendly entertainment content, notably through the Hallmark Channel, has a unique story in terms of its public trading status, primarily because it has predominantly remained a privately held entity. Hallmark Media is a subsidiary of Hallmark Cards, Inc., a privately owned American company known for its greeting cards, which was founded in 1910 by Joyce Clyde Hall.

Unlike many companies that either start as public entities or eventually go public through an IPO, Hallmark Media has largely operated under the umbrella of its parent company, Hallmark Cards. This private ownership has allowed the company to navigate its business strategy and content offerings in alignment with the broader goals and values of the Hallmark brand.

Hallmark Media’s business focus has been centered around the Hallmark Channel, Hallmark Movies & Mysteries, and Hallmark Drama, all of which are known for their wholesome, family-oriented programming. This includes a wide array of television movies, series, and lifestyle programming, particularly known for their holiday-themed movies that have garnered a dedicated viewer base.

The financial and operational details of Hallmark Media are not as publicly visible as those of publicly traded companies. The strategic decisions, including content creation, channel expansion, and partnerships, are guided by the larger objectives of Hallmark Cards, Inc. The company’s approach to its media business reflects the broader Hallmark brand ethos, which emphasizes family values, celebration, and emotional connection.

In the absence of a public offering or stock market listing, Hallmark Media’s market impact and business growth are reflected through its viewer ratings, brand loyalty, and cultural influence, particularly in the realm of family entertainment. The company’s decision to remain privately held under the larger Hallmark umbrella has allowed it to maintain a distinct brand identity and consistency in its content strategy, which is somewhat rare in the rapidly evolving media landscape.

IGN IPO

IGN Entertainment, a leading digital media company focused on video games and entertainment, has a unique history regarding its status as a public company. IGN, originally known as the Imagine Games Network, was formed in 1996 through a merger of several smaller video game websites.

In 2000, during the height of the dot-com bubble, IGN went public. This move was part of the broader trend of internet-based companies seeking to capitalize on the high investor interest in anything related to the online and tech sectors. Their IPO was met with considerable interest, reflective of the era’s enthusiasm for technology and internet investments.

However, the dot-com bubble burst shortly thereafter, significantly impacting numerous tech companies, including IGN. The subsequent market downturn saw many of these companies, which had reached incredibly high valuations, struggle to maintain their worth and business viability.

In the years following its IPO, IGN faced financial challenges. These were reflective not only of the broader market conditions but also of the difficulties inherent in monetizing online content, especially in a field as dynamic and competitive as video gaming and entertainment media.

In 2005, IGN was acquired by News Corporation, marking the end of its short-lived stint as a public company. Under News Corp, IGN operated alongside other media properties, benefitting from the larger conglomerate’s resources and audience reach. This acquisition was part of a broader trend of media consolidation, where smaller independent outlets were brought under the wings of larger media entities.

The story of IGN’s IPO and subsequent acquisition is a snapshot of a specific era in the tech and online media industry, characterized by rapid growth, high investor expectations, and significant market corrections. It also illustrates the challenges faced by digital media companies in establishing sustainable business models, particularly in the volatile context of the early 2000s internet landscape.

Intuitive Surgical IPO

Intuitive Surgical, a trailblazer in the field of robotic-assisted, minimally invasive surgery, has an IPO story that marks a significant milestone in the medical technology industry. The company is renowned for developing the da Vinci Surgical System, a groundbreaking platform that revolutionized surgery with enhanced precision, control, and flexibility.

Intuitive Surgical’s initial public offering took place in 2000, a period characterized by high interest in technology companies, albeit amid the aftermath of the dot-com bubble burst. Despite the challenging market environment, the IPO of Intuitive Surgical was met with considerable interest, mainly due to its innovative technology and the potential to transform surgical practices.

At the time of its IPO, Intuitive Surgical was not yet profitable, which was not uncommon for innovative tech companies. However, what set it apart was its unique value proposition in the medical field. The da Vinci system represented a significant leap in surgical technology, offering minimally invasive options for procedures that traditionally required open surgery.

The funds raised from the IPO were crucial for the company in scaling up its operations, expanding its technology’s reach, and continuing its extensive research and development. Following its public listing, Intuitive Surgical embarked on a journey of growth and expansion, continuously enhancing the da Vinci system, increasing its applications, and training surgeons worldwide in its use.

The success of Intuitive Surgical post-IPO highlights a few key points. First, it underscores the importance of innovation and technological advancement in the healthcare sector. Secondly, it demonstrates the market’s willingness to invest in companies with long-term growth potential, even if immediate profitability is not evident. Lastly, it shows the critical role of capital in scaling high-tech medical solutions.

Over the years, Intuitive Surgical has grown to become a leader in its field, with the da Vinci system becoming synonymous with robotic surgery. The company’s journey from its IPO to its status as a pioneering force in medical technology illustrates the impact and potential of innovative solutions in transforming healthcare practices.

Krispy Kreme IPO

Krispy Kreme, the iconic doughnut company known for its original glazed doughnuts, experienced a remarkable journey in the public markets. The company went public in April 2000, capitalizing on the strong brand recognition and popularity it had built since its founding in 1937.

The timing of Krispy Kreme’s initial public offering was particularly noteworthy. It came at a time when the market was still feeling the aftereffects of the dot-com bubble burst. However, unlike many tech companies struggling during this period, Krispy Kreme’s offering was met with great enthusiasm. The brand’s strong consumer appeal, characterized by a nearly cult-like following for its doughnuts, translated into significant investor interest.

Krispy Kreme’s IPO was a success, with shares initially priced at $21 and quickly soaring on the first day of trading. This positive response reflected not only the strength of the brand but also the market’s appetite for established companies with a tangible product and a clear business model, especially in a market environment skeptical of tech startups with inflated valuations and uncertain futures.

Following its IPO, Krispy Kreme experienced rapid expansion. The company embarked on an ambitious growth plan, opening numerous new stores across the United States. This expansion, however, came with challenges. The rapid growth led to market saturation, and the company faced various operational and financial difficulties.

By the mid-2000s, Krispy Kreme’s fortunes began to change. The company encountered several issues, including accounting scandals, management changes, and a shifting consumer focus towards healthier eating habits. These factors contributed to a significant decline in the company’s performance and stock price.

The story of Krispy Kreme’s IPO and subsequent years is a blend of initial triumph followed by significant challenges. It serves as a cautionary tale about the risks of rapid expansion and the importance of sustainable growth strategies. Despite these challenges, Krispy Kreme has remained a beloved brand, and its journey underscores the complexities of navigating the public market and the ever-changing consumer landscape.

LendingTree IPO

LendingTree, an online lending exchange that connects consumers with multiple lenders, banks, and credit partners, has a notable history regarding its journey in the public market. Founded in 1996 by Doug Lebda, LendingTree made a significant impact by revolutionizing the way consumers shop for loans, particularly mortgages.

The company went public in February 2000, right at the height of the dot-com boom, an era characterized by immense investor enthusiasm for internet-based businesses. LendingTree’s IPO came at a time when online commerce was rapidly evolving, and the concept of comparing lenders online was innovative and highly appealing.

In its initial public offering, LendingTree was able to capture the market’s interest due to its unique business model. Unlike traditional financial institutions, LendingTree empowered consumers by allowing them to compare various loan offers, providing a level of transparency and control that was previously unavailable in the traditional loan shopping process.

However, LendingTree’s journey in the public market wasn’t without challenges. The burst of the dot-com bubble in the early 2000s led to a tough market environment for many technology companies, and LendingTree was no exception. Despite these challenges, the company’s fundamental value proposition and its ability to adapt to changing market conditions allowed it to navigate through the turbulent period.

In 2003, LendingTree was acquired by IAC/InterActiveCorp, a move that took the company off the public market. However, this acquisition was a strategic fit, as IAC was building a portfolio of internet-based businesses and LendingTree benefitted from being part of a larger conglomerate.

Later, in 2008, LendingTree spun off from IAC along with several other businesses, and it started trading again as a separate entity under the name Tree.com. This marked a new phase for LendingTree, giving it a renewed opportunity to grow and evolve independently.

Throughout its history, LendingTree has exemplified the potential of online business models and the impact of internet technology on traditional industries like lending and personal finance. Its journey through an IPO, acquisition, and later a spin-off, reflects the dynamic nature of the tech business landscape, particularly in the realm of financial services.

Marvell Technology IPO

Marvell Technology Group, a prominent player in the semiconductor industry, has had an interesting journey in the public markets. Known for its development of complex integrated circuits, primarily for data storage, communications, and consumer electronics markets, Marvell went public in June 2000.

The timing of Marvell’s initial public offering was significant. Coming in the wake of the dot-com bubble burst, the market was filled with skepticism towards tech companies. Despite this challenging environment, Marvell’s IPO managed to stand out, a testament to its solid business model and the essential nature of its products in the tech industry.

At the time of its IPO, Marvell was already recognized for its innovative technology and was well-positioned in the semiconductor industry, a sector critical for the rapidly expanding digital and electronics markets. The company’s success in going public was seen as a sign of investor confidence in its future growth prospects, driven by increasing demand for its high-performance semiconductor solutions.

In the years following its IPO, Marvell Technology continued to grow and evolve, adapting to the ever-changing landscape of the tech industry. The company expanded its product line and entered new markets, including those for mobile and wireless devices, further solidifying its position in the semiconductor sector.

One of the key strategies employed by Marvell in its post-IPO years was strategic acquisitions. These acquisitions allowed Marvell to diversify its product offerings and maintain a competitive edge in the dynamic tech industry. For instance, its acquisition of Cavium, Inc. in 2018 significantly expanded its portfolio in the data center and cloud computing spaces.

Marvell’s journey since its IPO in 2000 highlights the company’s resilience and adaptability in a highly competitive and rapidly evolving industry. It showcases how a tech company can leverage its core strengths, innovate continuously, and execute strategic growth plans to remain relevant and successful in the public markets.

Palm IPO

Palm, Inc., once a trailblazer in the field of personal digital assistants (PDAs), had a remarkable and storied journey in the public market. Founded in 1992, Palm gained prominence with its Palm Pilot PDAs, which were among the first to gain widespread popularity, offering users handheld computing capabilities, a novel concept at the time.

The company’s initial public offering (IPO) in March 2000 was one of the most anticipated and successful IPOs of that year, particularly notable given it occurred during a turbulent time in the stock market due to the bursting of the dot-com bubble. Palm’s IPO was not just successful but phenomenally so, with shares soaring on the first day of trading, reflecting the high investor confidence in Palm’s products and market potential.

Palm’s success during its IPO can be attributed to its clear leadership in the PDA market and its innovative technology. The Palm Pilot and its successors had become essential tools for many business professionals, and the brand was synonymous with mobile computing before the widespread adoption of smartphones.

However, the success story of Palm in the public market faced challenges as the technology landscape evolved. The early 2000s saw the rapid development of mobile phones and the eventual emergence of smartphones. Companies like Apple and BlackBerry began to dominate the mobile communication device market, offering more integrated and versatile devices.

Palm attempted to adapt to these changes, notably through the development of its own smartphone line and the Palm webOS mobile operating system. Despite these efforts, the company struggled to keep up with the competition and the rapidly changing technology.

The challenges Palm faced in a swiftly evolving market eventually led to its acquisition by Hewlett-Packard (HP) in 2010. This acquisition marked the end of Palm as an independent company and its journey in the public market. Under HP, the Palm brand and its technologies were initially used to develop new products, but these efforts were eventually phased out.

The story of Palm, Inc., from its groundbreaking entry into the handheld computing market to its IPO and eventual acquisition, illustrates the fast-paced nature of the tech industry. It serves as a compelling example of how technological innovation can revolutionize a market, yet also how quickly market leadership can change with the emergence of new technologies and competitors.

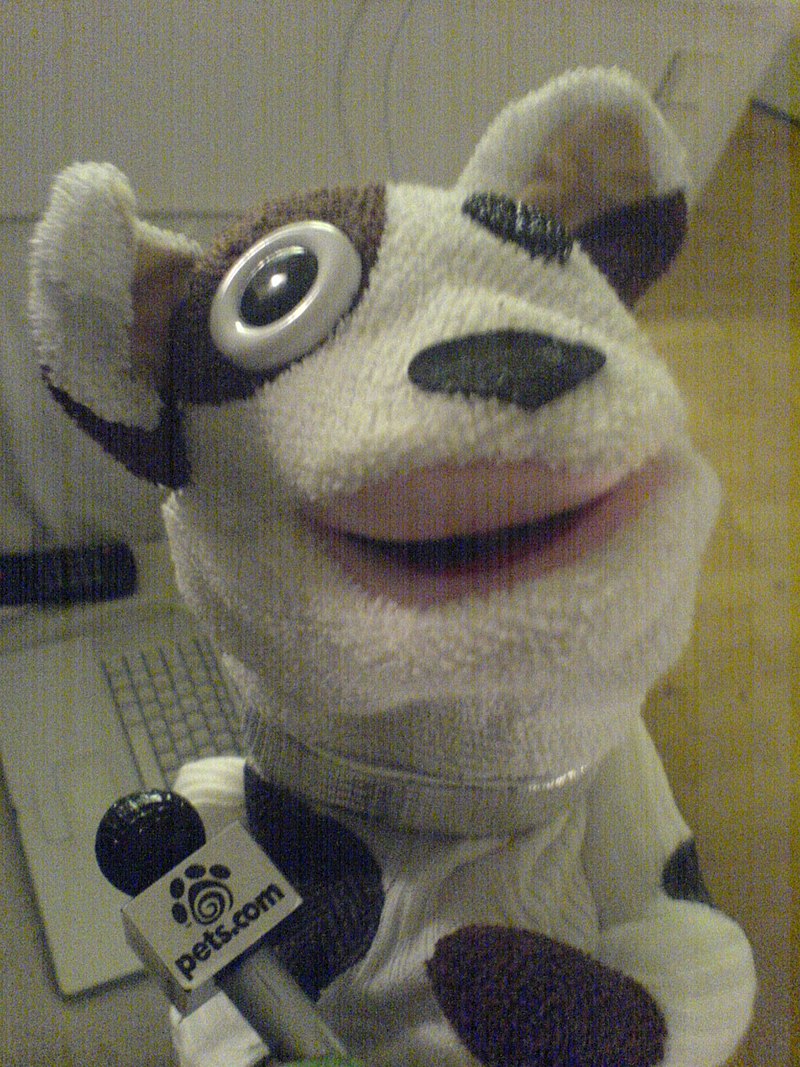

Pets.com IPO

Pets.com stands as one of the most notorious examples of the dot-com bubble’s excesses and failures. Founded in 1998, Pets.com was an online business that sold pet supplies, food, and accessories directly to consumers. The company gained rapid popularity and was emblematic of the internet boom of the late 1990s, characterized by its ambition to revolutionize traditional retail models through e-commerce.

Pets.com’s initial public offering (IPO) took place in February 2000, a time when investor enthusiasm for internet companies was at its peak. Despite the company being relatively young and having a short track record, the IPO was initially successful, attracting significant investor interest. This success was buoyed by the broader market excitement around online businesses and the belief that e-commerce was set to disrupt traditional retail.

The company was known for its aggressive marketing campaigns, including a memorable mascot, the Pets.com sock puppet, which quickly became a cultural icon. This high visibility contributed to the company’s hype and investor expectations.

However, the success of Pets.com’s IPO was short-lived. The company faced several fundamental challenges. First, its business model was flawed: the cost of logistics and shipping for bulky pet supplies like bags of pet food was high, and these costs couldn’t be passed on to price-sensitive online shoppers. Second, Pets.com struggled with competition, both from traditional brick-and-mortar pet stores and other emerging online competitors.

The bursting of the dot-com bubble exacerbated these problems. As investor sentiment shifted and the market began to recognize the unsustainability of many internet businesses, Pets.com’s stock price plummeted. The company, which was burning through cash rapidly without a clear path to profitability, found it increasingly difficult to secure additional funding.

By November 2000, less than a year after its IPO, Pets.com announced it was ceasing operations. The company’s rapid rise and fall became a symbol of the era’s speculative excesses in the tech sector and a cautionary tale about the dangers of overhyping and overvaluing unproven business models.

Pets.com’s story is now often referenced as a textbook example of the early 2000s dot-com bubble’s irrational exuberance and a reminder of the importance of solid, sustainable business fundamentals, especially in the volatile world of tech startups.

Rakuten IPO

Rakuten, a Japanese e-commerce and internet company, has a distinctive journey in the public markets, reflecting its evolution from a small startup to a global internet services giant. Founded in 1997 by Hiroshi Mikitani, Rakuten started as an online marketplace, and rapidly grew to become one of Japan’s largest e-commerce platforms, often likened to Amazon in its diversity and scale.

Rakuten’s initial public offering (IPO) took place on the JASDAQ market in April 2000. The timing of the IPO was notable as it came amidst the turbulent aftermath of the dot-com bubble burst. However, Rakuten’s IPO managed to garner significant interest, showcasing investor confidence in the company’s business model and growth potential, even in a challenging market environment.

The success of Rakuten’s IPO can be attributed to several factors. First, the company had already established a strong presence in the Japanese e-commerce market with a unique business model that differed from typical e-commerce platforms. Instead of selling products directly, Rakuten provided a marketplace for smaller retailers and businesses to sell their products, thereby fostering a diverse and comprehensive online shopping experience.

Following its IPO, Rakuten continued to grow and expand its business significantly. The company diversified its offerings beyond e-commerce, venturing into various other internet services including fintech, digital content, and communications. This diversification strategy was aimed at embedding Rakuten into various aspects of daily life, mirroring the approach of other global tech giants.

One of Rakuten’s key strategies in its post-IPO years has been global expansion and strategic partnerships. The company has made several international acquisitions and partnerships, allowing it to extend its reach beyond Japan. Notable among these is the acquisition of Buy.com in the United States and PriceMinister in France, as well as significant investments in companies like Pinterest and Lyft.

Rakuten’s journey in the public market illustrates how an e-commerce company, originating from a non-Western market, can achieve global relevance and diversification. It underscores the importance of innovation, strategic expansion, and the ability to adapt to changing market dynamics in the internet and technology sectors. Rakuten’s continued success is a testament to its robust business model and its ability to evolve continuously in the fast-paced world of digital commerce.

Verizon Communications IPO

Verizon Communications, a major player in the telecommunications industry, has a significant history in the public market, marked by strategic moves and large-scale mergers that shaped its journey. Formed initially as Bell Atlantic Corporation, one of the Regional Bell Operating Companies, Verizon’s origins trace back to the breakup of AT&T’s monopoly in the 1980s.

The transformative moment for the company came in 2000, a period characterized by significant shifts and consolidation in the telecommunications industry. In that year, Bell Atlantic merged with GTE Corporation, leading to the creation of Verizon Communications. This merger was one of the largest in U.S. history at the time and signaled a major reorganization of the telecommunications landscape.

The formation of Verizon Communications through this merger was seen as a strategic consolidation of expertise and resources, combining Bell Atlantic’s strong presence in the Eastern United States with GTE’s nationwide coverage and diverse portfolio, which included everything from local exchanges to wireless and internet services. This merger was a response to the rapidly changing telecommunications sector, which was evolving with new technologies and an increasing demand for integrated services.

The newly formed Verizon started trading on the New York Stock Exchange in July 2000. The timing was notable, occurring amidst the burst of the dot-com bubble and a volatile stock market. Despite these challenges, Verizon’s debut was met with positive investor reception, reflecting confidence in the company’s potential to lead in a consolidating and evolving industry.

Post-merger, Verizon focused on expanding its wireless and broadband services, recognizing these areas as key drivers for future growth. One of the significant moves in this direction was the acquisition of a majority stake in Verizon Wireless from British telecom giant Vodafone in 2013. This acquisition made Verizon Wireless a wholly-owned subsidiary, bolstering Verizon’s position in the wireless market.

Throughout its history, Verizon Communications has been at the forefront of several industry-defining moments, including the rollout of 4G LTE and later 5G technologies. The company’s emphasis on network reliability, extensive coverage, and consistent investment in new technologies has kept it competitive in a fast-evolving industry.

Verizon’s journey in the public market, marked by strategic mergers, acquisitions, and a focus on innovation in telecommunications, underscores the dynamic nature of this industry. It reflects how large companies adapt and evolve in response to technological advancements and changing market demands. Verizon’s story is not just about growth, but also about navigating challenges and seizing opportunities in a rapidly changing technological landscape.

Share

Share Tweet

Tweet Share

Share

Comment