In a market hemmed in by interest rates its’s hard to find the sweet spot.

Seems we are firmly in the proverbial “stock pickers market”. In other words, throwing a dart a board works sometimes, but not right now.

But some of Canada’s best analysts thinks are stocks you should be looking at to free yourself of minor expectations. Here are two of them.

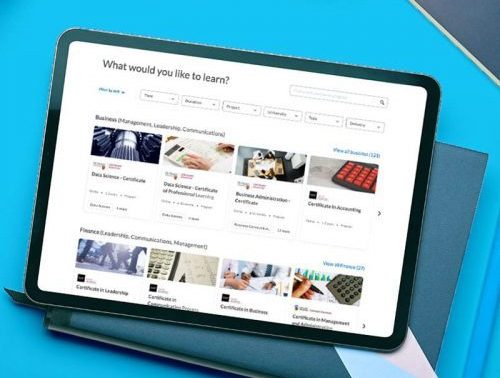

D2L

Following second quarter results, Eight Capital analyst Christian Sgro has maintained his “Buy” rating on D2L (D2L Stock Quote, Chart, News, Analysts, Financials TSX:DTOL).

On September 6, D2L reported its Q2, 2024 results. The company posted an Adjusted EBITDA loss of $500,000 on revenue of $44.5-million a topline that was up eight per cent from the same period last year.

The analyst summarized the quarter

“D2L reiterated its full-year guidance with the July report,” the analyst wrote. “FQ2 profitability came in behind the Street with the operationally active July quarter (conference and M&A), but more important to us is the growth and demand trajectory which appear to be improving. The company reaffirmed its mid-term targets, with profitability benefiting from COS optimization and scale. With respect to the demand environment, we like upbeat commentary around the core higher ed market and D2L’s evolving go-to-market and platform innovation. The reaffirmed guidance supports our positive view, centered around a sticky revenue base, product-market fit, and a path to strong cash flow profitability.”

In a research update to clients September 9, Sgro maintained his “Buy” rating and one-year price target of $11.00 on D2L. The stock closed September 8 at $9.00.

ATS Corp

Stifel analyst Justin Keywood remains bullish on ATS Corp (ATS Corp Stock Quote, Chart, News, Analysts, Financials TSX, NYSE: ATS).

Keywood, who recently attended the company’s annual investor day, said the event showed off the depth of its management.

“We were pleased to attend ATS’ inaugural U.S. investor day held in New York City, following the May NYSE listing and IPO,” the analyst said. “ATS’ leaders presented segments of the business, including Life Sciences, Industrial Automation, Food & Beverage, After-Sales Services and Process Automation (PA)/Digital, along with key executives providing overviews and insight. Hologic Inc. (NASDAQ:HOLX), as a marquee ATS customer, also participated in a fireside chat and spoke to the high quality and reliability at ATS, strong service and quick time to market, critical attributes within Life Sciences. The customer also highlighted using solutions across recently acquired ATS companies (Biodot/SP Industries), demonstrating cross-selling synergies, along with mentioning 16 automation lines executed on for one particular product area, implying high repeat orders. Overall, we were impressed with the level of management depth and see the business as continuing to scale well with higher margins and an assumed greater trading multiple ahead.”

In a research update to clients September 6, Keywood maintained his “Buy” rating and one-year price target of (C) $75.00 on ATS, which closed September 6 at $60.75.

Share

Share Tweet

Tweet Share

Share

Comment