Calling it a “gesture of coopetition”, a new deal between Shopify (Shopify Stock Quote, Chart, News, Analysts, Financials NYSE:SHOP) and Amazon likely involves a lot of give and take, but the development will likely be a positive for the Canadian tech giant, says National Bank Financial analyst Richard Tse.

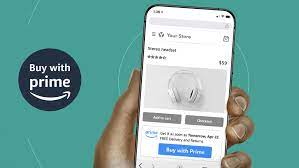

On August 30, Amazon (Amazon Stock Quote, Chart, News, Analysts, Financials NASDAQ:AMZN)

announced a new “Buy with Prime” app that will make it easy for Shopify merchants to integrate.

“We’ve been thrilled with the feedback merchants have shared about Buy with Prime, including the increased shopper conversion and new shopper acquisition,” said said Amazon vice president of Buy with Prime Peter Larsen. “The build of this app was a collaboration with Shopify, and we’re excited to help merchants not only grow their businesses, but also save time and resources—all while giving Prime members even more places to enjoy their shopping benefits.”

Tse says there was likely a lot of behind the scenes maneuvering involved in the arrangement.

“Buy with Prime on Shopify’s platform has been a point of contention given uncertain economics of such an arrangement,” Tse argued. “No doubt, those negotiations likely involved who would process the payments, data ownership, as well as Shopify assessing the impact it would have on its former SFN (its FBA competitor) segment. But with Shopify divesting its fulfillment business, it likely lifted the latter obstacle for this coopetition move where Shopify appears to be retaining the payments economics noted above while Amazon benefits from the fulfillment economics. More importantly, in terms of customer data, Shopify also underscored that its merchants will retain their customer data, something we believe had been a sticking point for merchants. Bottom line, we view this partnership as a positive for Shopify when it comes to enhancing its service offering to merchants by providing access to Amazon’s best in class fulfillment network as well as opening up a potential 168 mln U.S prime members to Shopify merchants. We see this move as extending Shopify’s moat against the competition.”

In a “Research Flash” update to clients on August 31, Tse maintained his “Outperform” rating and one-year price target of (US) $80.00 on Shopify.

“We continue to believe Shopify is in the early stages of a market that’s structurally changing,” the analyst concluded. “We believe Shopify remains a leading on and offline Commerce disruptor and that upside in the stock will come from a number of different incremental growth drivers such as: 1) International; 2) increased take rate with new services; 3) large enterprise (Shopify Plus & CCS); 4) POS for SMB retail; and now 5) B2B. We reiterate our Outperform rating and target price of US $80. That DCF-based target implies a valuation of 12.3x EV/Sales on F24E.”

Share

Share Tweet

Tweet Share

Share

Comment